There’s a lot to like about Parex Resources (PXT:CA) (OTCPK:PARXF). The company produces consistently good results. It possesses high-quality assets that have significant exploration upside. It’s likely to grow production over the coming years. Its balance sheet consistently boasts a net cash position. It also benefits from attractive product pricing.

So far, so good.

But here’s the rub: while PXT is domiciled in Canada, it operates in Colombia. We have experience investing in Colombia, namely in Gran Tierra (GTE:CA) before the 2020 downturn. The risks from operating in Colombia stem from two sources: shifting tax regimes and transportation disruptions, both of which pose clear and present danger to the company and its shareholders. Both of which also can surface with little warning.

Whether an investor chooses to buy PXT shares depends on their attitude toward the risks of doing business in Colombia’s oil and gas sector. If an investor can gain comfort with regard to the risks pertaining to asset seizures, tax regime changes, and the nation’s court system, PXT shares can be an attractive compliment to a North American-weighted energy portfolio.

PXT shares have been clobbered year-to-date on a relative basis. The shares are underperforming the broad Canadian energy index ETF (XEG) by 30.4% YTD.

As extreme as PXT’s underperformance has been, Colombia-related risks make the shares fairly valued at the moment. However, they could become attractive if they trade lower or if developments in Colombia take a positive turn for the company.

PXT’s Many Positives

PXT boasts a massive acreage position that spans some 5.2 million acres in Colombia. Granted, its leases involve greater risks and hurdles to development than PXT’s North American counterparts. Nevertheless, its land holdings possess significant value. The company considers its untapped exploration to be a cornerstone of its long-term investment prospects and intrinsic value, though any exploration upside isn’t reflected in PXT’s current stock price.

The company’s production averages more than 97% crude oil, one of the highest among North American-domiciled E&Ps. Even the highest-quality Canadian E&Ps have a production mix that includes at least 20% lower-value natural gas. PXT’s mix is highly attractive by comparison.

PXT’s financials are some of the strongest among Canadian E&Ps. It generates attractive cash margins. At $87.50 per barrel WTI, PXT’s corporate netback is $34 per boe.

The company operates with a conservative balance sheet. It maintains a large net cash position and has paid out all its free cash flow through dividends and share repurchases. PXT’s conservative balance sheet allows it to operate without hedges, so shareholders can fully participate in oil price upside.

PXT’s capital allocation over the past eight quarters is shown below.

PXT also generates a consistently high return on capital employed, which has averaged 35% over the past three years, including a high of 48% in 2022 and a low of 23% last year. Even the 2023 return on capital employed puts PXT near the top of its Canadian E&P peers. The high returns translate into robust long-term cash flow generation for shareholders.

The company receives Brent crude oil pricing and regional South American natural gas pricing, both of which trade at a premium to North American prices. The relatively high realized prices bolster PXT’s netback relative to its North American peers in a sustained manner.

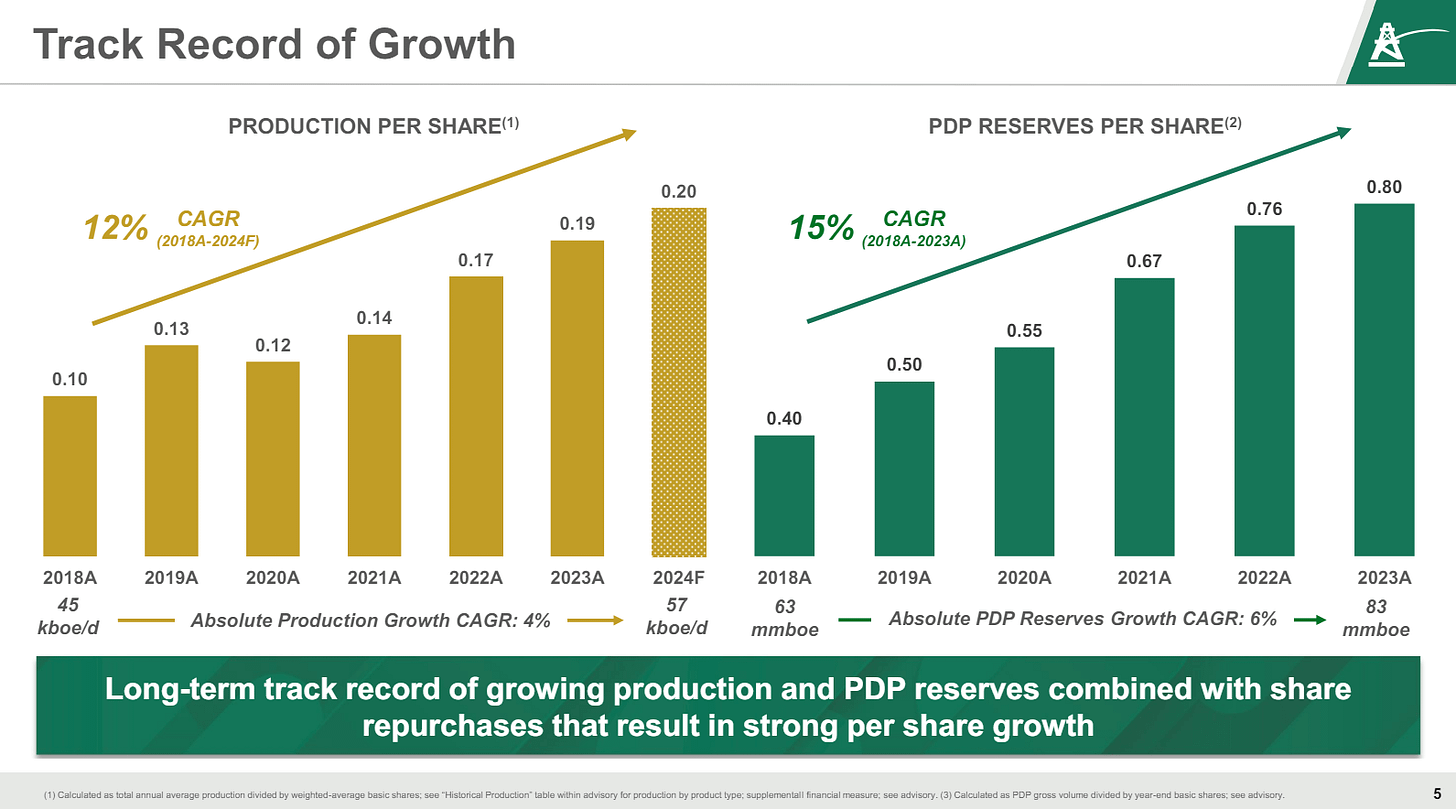

Management has a strong track record of achieving growth through exploration, as shown by the following chart from PXT’s investor presentation.

Source: Parex Resources February 2024 Investor Presentation.

Equally important for shareholders, management has successfully converted growth into increasing value per share. Through regular programmatic repurchases, PXT has reduced its shares outstanding by 36% since 2018, as shown in the chart below.

Source: Parex Resources February 2024 Investor Presentation.

This is exactly the kind of capital allocation E&P shareholders want to see when the company is growing production, when it possesses significant growth prospects, and when its shares trade below intrinsic value.

In 2024, we estimate that PXT will generate approximately $710 million of funds from operations at $87.50 per barrel WTI. It plans to spend $410 million of capex and pay out $115 million as a base dividend. We expect management to allocate the remaining $185 million to share repurchases. With PXT shares trading at $21.30, this sum represents 8.4% of PXT’s current enterprise value. This amount would be repurchased while investors who buy at current prices also enjoy a low-risk and stable 7% dividend yield.

Investors can use PXT shares to diversify their North American E&P exposure. The risks to North American oil and gas production may not be front-and-center for many domestic investors, but they’re significant when looking out over a period of years.

For oil, North American producers face the risk that WTI production growth crowds out heavier global crude oil grades. If WTI production grows until it reaches the maximum processing capacity for light-oil refiners, WTI’s discount to heavier grades could grow materially larger, which would hold the cash flow generated by North American E&Ps, as well as their share prices.

On the natural gas front, if the gas produced as a byproduct of crude oil production increases to levels that keep North America glutted with gas, continued low North American gas prices would wreak significant damage to E&P cash flow and share prices.

In a portfolio heavily weighted toward North American E&Ps, investors can escape these risks by holding PXT shares, which are not subject to these risks. In fact, producers of heavier oil grades like PXT would benefit in scenarios that are bearish for North American producers.