The end is here for Sable. There are a lot of things to cover here, so readers must bear with me.

Here’s a list of the topics that we will cover:

Pipeline route - what it looks like, what needs to happen, and what’s next?

Company guidance on FPSO and the reality of the valuation math.

The end.

I will start by saying that we are no longer long Sable Offshore. We exercised our put hedge positions last week at an average price of ~$15.8 per share.

Pipeline Route

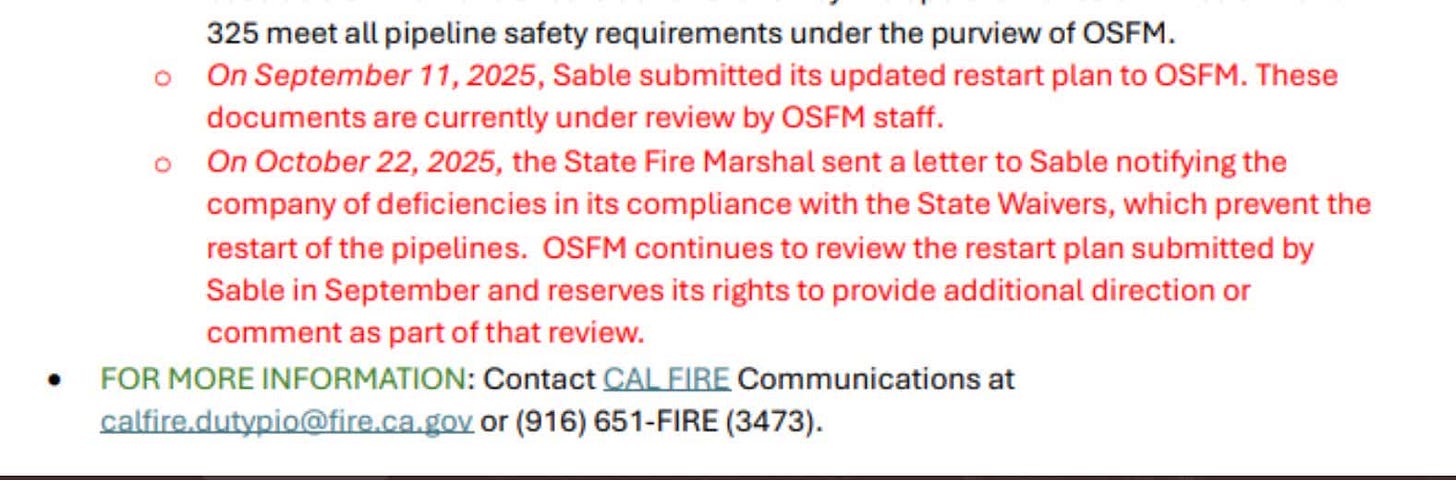

OSFM gave us the FOIA document today and simultaneously published the final restart plan on its website. In addition, it posted that it found “deficiencies” in its compliance with the State Waivers.

Source: OSFM

In a press release issued by Sable after the market close, it explained in its letter why the company believes it has complied with OSFM.

While I won’t go into the technical details of everything in the letter, company sources pinpointed that the anomaly repairs in the coastal section of the pipeline were not completed. The cease and desist order issued by the CCC prevented the company from finishing all the repairs, and while OSFM is pinpointing compliance with the State Waivers, it is clear that the CCC case was relevant to the OSFM restart.

As a result, in order for the pipeline route to be successful, the following needs to happen:

The appeals court needs to overturn Anderle’s ruling. Timeline unknown.

Simultaneously, Sable needs to win the lawsuit on SB 237 and how it doesn’t apply to its pipeline. Probability - low.

After the appeals court overturns Anderle’s ruling, the company will need to finish all of the anomaly repairs in the coastal section, resubmit the restart plan, and wait for approval.

If OSFM gives approval, the company will need to submit the final restart plan along with other permits to Judge Geck where it will have to wait 10 court days.

Probability-wise, the odds of all of this happening in favor of Sable are close to 0%.

The reason why the probability is so low is that if Sable doesn’t win the SB 237 lawsuit (whether the pipeline applies or not), it has a deadline on January 1, 2026. The appeals court process, using even the most asininely optimistic scenario, is in early December, and even then, you still need to finish the repairs. Once the repairs are done, you still have to wait for OSFM approval. And once that’s done, you need to survive Geck.

As a result, if Sable does not win the SB 237 case, the pipeline route is dead. The fact that the company is talking about using legal measures to sue OSFM tells you everything you need to know about where this is going.

Conclusion?

The pipeline route is dead. The OSFM rejection today guaranteed that outcome.

FPSO Math, It’s Worse Than You Think

I think it’s safe to say that Sable’s management team has done nothing but to mislead investors from the start.

The fact that the management team has said that the CCC case is not relevant to the OSFM approval was a lie.

The fact that all anomaly repairs are done (May 28k 8-K) was a lie.

To make matters worse, immediately following the CCC case ruling, Sable was brazen enough to state this:

The ruling would have no impact on the resumption of petroleum transportation through the Las Flores Pipeline System.

At the time, we noted how misleading the statements were because even in the rare event that OSFM approves, Judge Geck would never allow the restart. But the OSFM message today makes it more clear-cut. The company did not comply with the State Waivers, and the technical deficiencies are going to prevent a restart.

As a result, there won’t be any $10 billion takings claim. You can throw that scenario right out of the window.

On the FPSO front, I’ve been informed that the math is far worse than the management team has led investors to believe. The $100 million figure quoted is just retrofitting the platform; it does not include all of the cash burn, the purchase of the OS&T, and other costs associated with this.

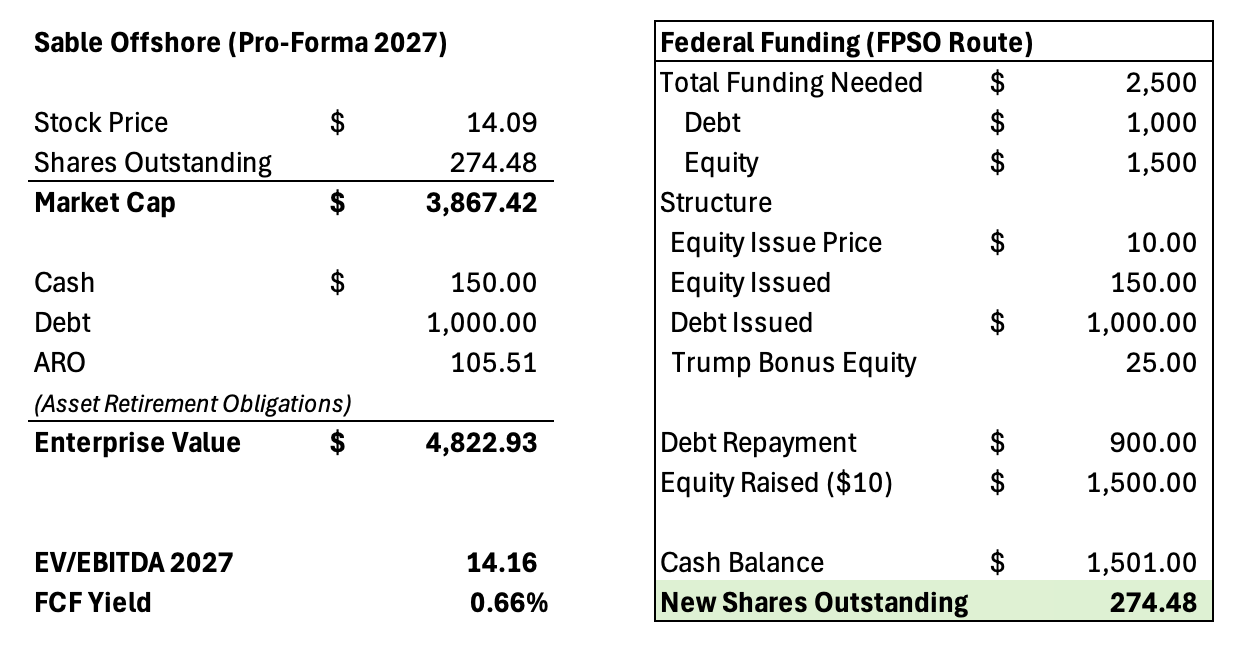

In aggregate, the figure that the company needs to raise in total is $2.5 billion.

Yes, $2.5 billion.

~$920 million to take out the Exxon debt.

~$500 million to purchase the OS&T.

~$500 million for plug and abandonment bonding support.

~$350 million for lease operating expense and G&A.

~$100 million for OS&T retrofitting capex.

~$130 million in interest expense (end of 2027) before restart.

And if you are asking, “Well, why can’t Sable just load up the balance sheet with debt and not dilute?”

Good question, it’s because it can’t afford that much debt on the balance sheet.

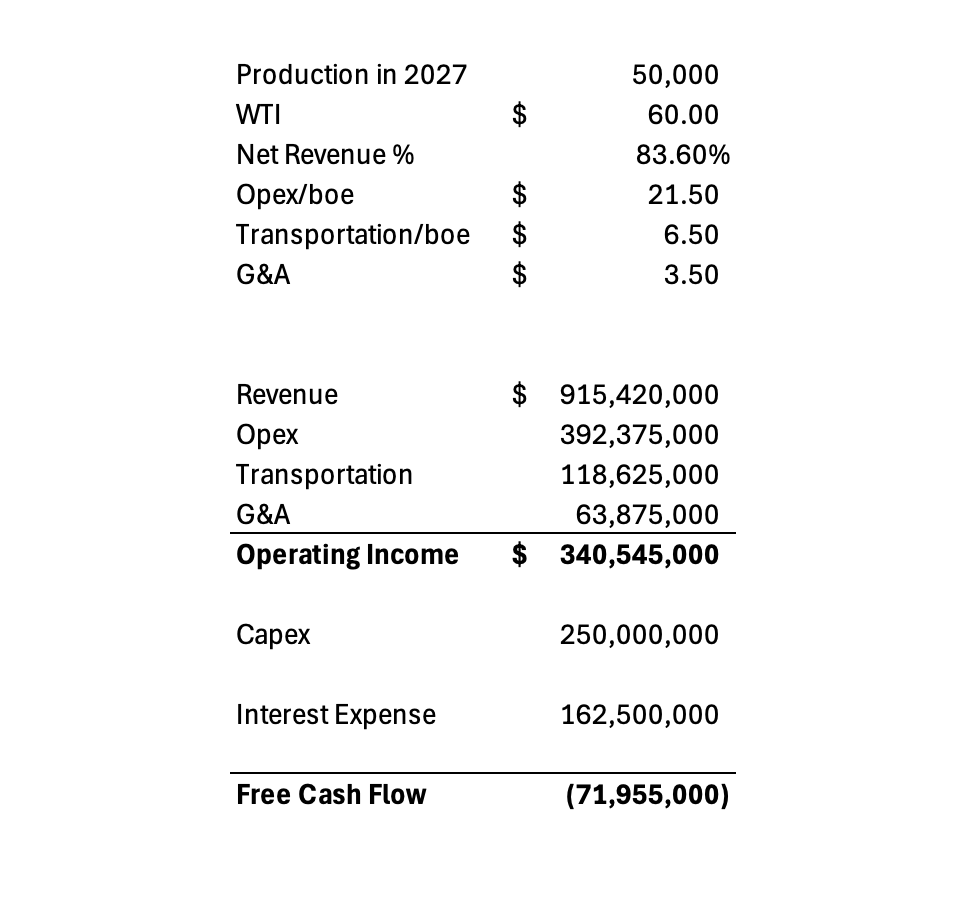

At $2.5 billion, the interest cost, assuming 6.5% (extremely generous assumption), is $162.5 million. At $60/bbl WTI, free cash flow would be negative ~$72 million. As a result, even with federal backing, there’s no precedent for such a large debt issuance.

So what’s the mix?

I assume that the Fed will backstop the debt and receive a ~10% stake in exchange for doing so. The debt will be some form of JPM credit facility with Fed backing.

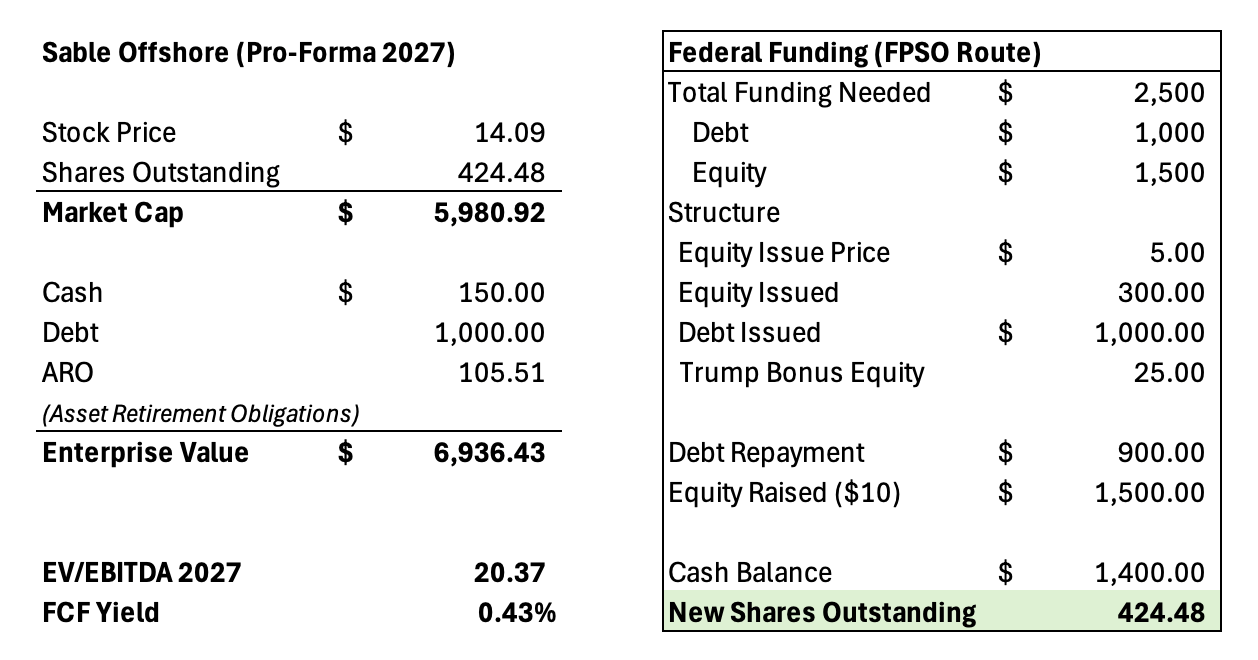

The company will have to raise a lot of equity and if we are being extremely generous and say they issue at $10/share, this will increase shares outstanding by ~150%. Including the Trump bonus equity of 25 million shares, total shares outstanding balloon to ~274.48 million shares.

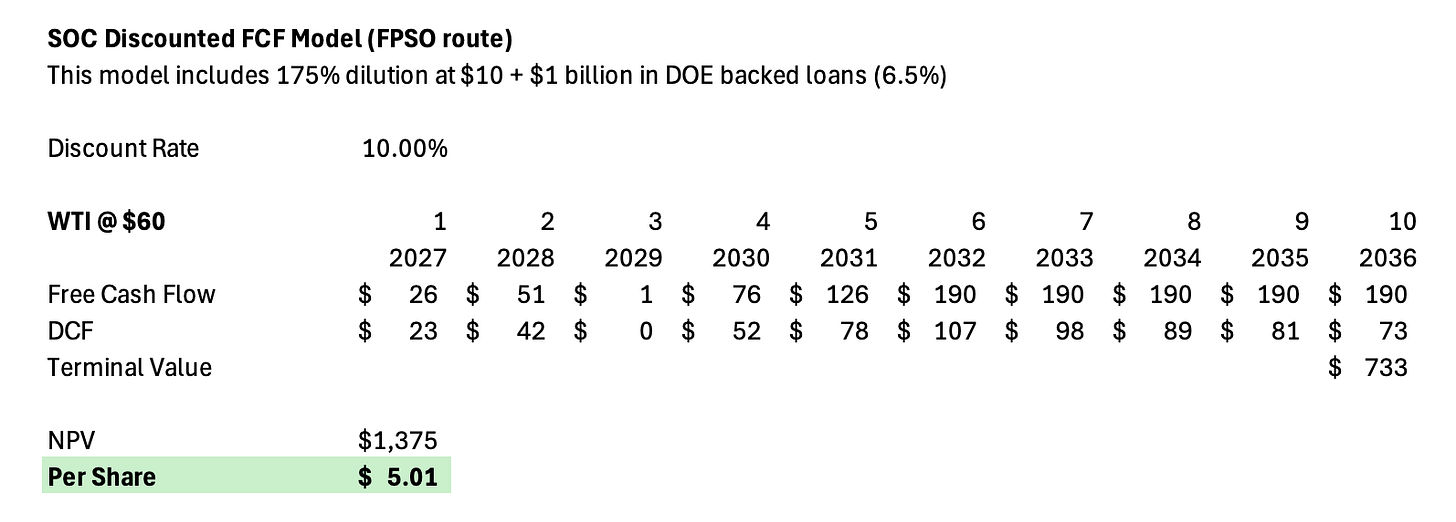

Using the company’s guidance on capex, the net present value per share at $60/bbl WTI is $5.01.

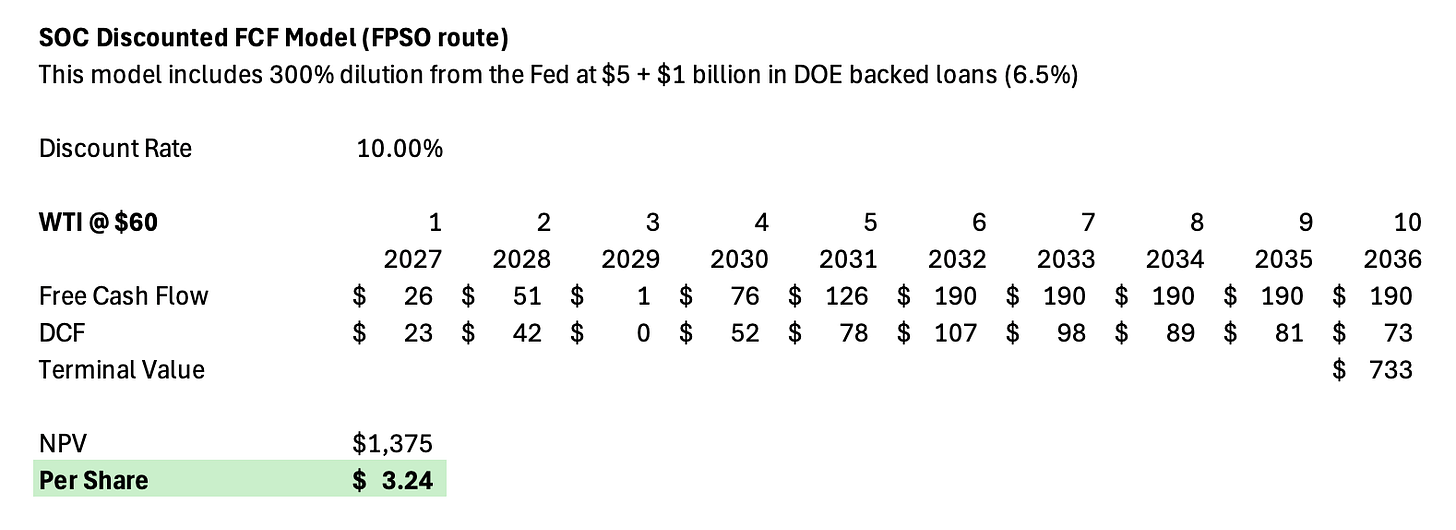

Now, if you assume a more draconian scenario where the market becomes aware that the management team has misled investors and the real cost is closer to $1.6 billion, the probability of an equity issuance at $10 is greatly diminished. Using a $5/share assumption, this is the math:

Structure

DCF

The NPV per share is $3.24.

As you can see, this is the primary reason why the company remains so steadfast on the pipeline route despite the FPSO being so apparent. It was because the “real” cost of going to the FPSO route was far greater than what people think.

The End

Fake it till you make it.

That’s the most generous way I will describe the Sable team. They don’t have a strategy. They are winging it. The Fed backing, the FPSO permit, and the JPM loan guarantee are all last-ditch efforts and not something well thought out in advance.

Why?

Because the company put all of its eggs in one basket, the pipeline, and that route is dead.

So even with the Fed backing route, it needs BOEM to approve the permit changes, which will take a few weeks. In the meantime, the company is running out of cash, and everyone who can read a financial statement knows that an equity raise is coming.

With the OSFM rejection news hitting the market, more and more investors will realize the pipeline route is officially dead, and FPSO is the only way forward.

The only thing keeping some market participants sane is the assumption that the FPSO route will only cost $100 million when the real cost is 15x that.

But it’s never what they tell you, it’s always what they don’t tell you. In this case, the lack of disclosure is going to do a lot of harm to investors.

As a result, my view is that Sable is about to enter into a reflexive death spiral. The perception that the FPSO route is not viable will push some investors to sell, which would push the stock price down and make that perception become reality. This would push more investors into believing that the FPSO pivot isn’t real, which will drive more downward pressure.

This will continue all the way into the equity raise vacuum. The only way out is the following scenarios:

Trump gets involved immediately - extremely unlikely as 1) Sable needs to obtain the permits and 2) loan terms need to be agreed upon.

Fed loan guarantee is disclosed.

Outside of direct Fed involvement, I don’t see how you can shake out of this death spiral. The stock will continue to move downward and making any possibility of financing extremely punitive. And since the market knows that the pipeline route is dead, it can force an inevitable outcome. Either the Fed gives away free money (unlikely), or the company has to heavily dilute.

I think the latter is the scenario that will take place, and by the time the Feds do get involved, I’m afraid the stock price will have suffered permanent damage.

And to make matters worse, the FPSO route is not even a guaranteed outcome. The air permit is the major gating mechanism, and according to sources inside the company, there would need to be law changes for the EPA to have the override ability on the local authorities. Otherwise, the only scenario where the air permit will be issued is if the EPA revokes Santa Barbara County from having the authority to issue the air permits, which is another lawsuit in the making.

In essence, the company’s 12-month timeline is also extremely unrealistic. It’s closer to 24-36 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOC PUTS either through stock ownership, options, or other derivatives.

I am long Nov 21 $13 strike puts.

So glad I got out early(ish)

What's happened since, and is it worth a punt at its now very low price..??

Would it be possible for Sable to still send the natural gas to the Las Flores Canyon processing facility? Sable's September 29 presentation indicates that there is a separate gas transmission line to the shore. My understanding is that the Las Flores Canyon facility processes the natural gas, uses it to generate electricity, which they could continue to do, and sells the balance to Southern California Gas Company. That would improve the numbers a bit at least.