Saturn Oil & Gas (SOIL:CA) is the ultimate E&P battleground stock. The bulls point to big upside and the bears see steep downside risk.

Without a doubt, the shares are cheap based on the numbers alone. Saturn screens better than nearly all its peers based on price-to-reserve value and cash flow torque to commodity prices. The question is how likely that value is to be realized by shareholders.

In Saturn’s case, the negatives in the picture raise red flags that suggest the company is of lower quality than its numbers alone imply. The risk of the stock being a value trap makes it too hard for us to get comfortable owning the name, despite its statistical attractiveness.

Until the company can reduce debt, its shares will remain in the penalty box. Moreover, shareholders will be at constant risk of dilution and permanent capital loss. Since debt reduction is likely to take a number of years, these risks for shareholders are long-term in nature.

Saturn Overview

Saturn produces approximately 26,500 boe/d, which in the fourth quarter of 2023 was split 75% crude oil, 8% NGLs, and 17% natural gas. Its assets are located in Alberta and Saskatchewan, Canada.

Source: Saturn Oil & Gas website.

Last week, Saturn made a splash when it announced a new major acquisition from Crescent Point Energy (CPG). In the deal, Saturn paid $525 million for 13,000 boe/d of production in Saskatchewan comprised of 96% liquids.

The deal further polarized Saturn bulls and bears. The bears noted the deal came after management pledged to focus on paying down debt instead of expanding the company.

The bulls, by contrast, were gratified by the deal’s strategic rationale. For one, the acquired assets’ 96% liquids content is superior to Saturn’s existing production base, which produces 83% liquids. The acquired assets are also contiguous with Saturn’s existing asset base. And while the assets didn’t come cheap—at $40,385 per flowing barrel—their price tag reflects their oily nature and low royalty rates. The deal metrics are more attractive on an NPV10 basis, by which the deal came at an attractive 0.65-times PDP.

The deal also makes sense from a strategic standpoint, as it significantly increases Saturn’s scale in its core operating area. Management estimates a 20-year inventory life at the current development rate.

The most impressive feature of the acquisition wasn’t the assets, but the more lenient terms Saturn’s lenders offered to finance it. The new $625 million in financing replaces the company’s senior secured term loan that carried a 16% interest rate. It also reduces the need for hedging and involves no capital spending restrictions.

Saturn’s largest institutional shareholder, GMT Capital Corp., provided $100 million of equity financing for the deal at $2.35 per share, a discount of 11.3% to the pre-deal share price. The financing added 42.6 million shares to Saturn’s existing diluted share count of 180.2 million shares, representing 23.6% dilution. If the underwriters exercise their over-allotment option, dilution increases to 27.2%.

Given the stock's battleground status, it's worth comparing the positives and negatives to determine whether the shares are worth the risk.

Positive #1: A Cheap Stock

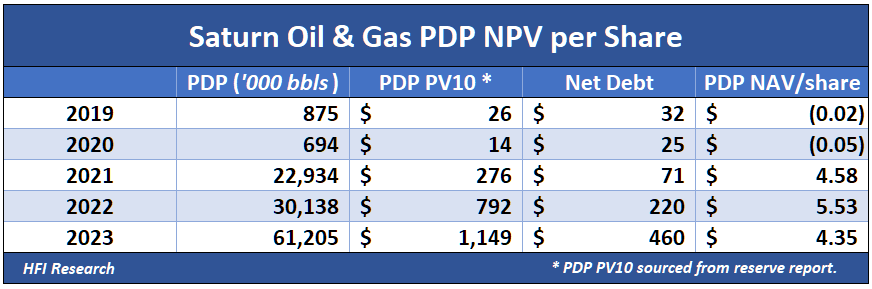

Saturn’s most obvious positive feature is its statistical cheapness. The shares trade at a steep discount from PDP reserve net asset value, a rough proxy for liquidation value.

At $87.50 per barrel WTI and $2.50 AECO, we estimate the present value of PDP discounted at 10% stands at $5.98 per share. Since most E&Ps trade around the NPV of their PDP, Saturn’s shares have implied appreciation potential of 139.2% from their current price of $2.50. The figure increases as the discount factor decreases, as shown in the table below.

If instead we use the figures presented in Saturn’s latest reserve report and financials, its PDP NAV is lower. These figures use significantly lower commodity prices. At a 10% discount rate, they imply PDP NPV per share is $4.35, for 74.0% upside. As debt gets paid down, PDP NPV will increase toward the $7.25 per share value that assumes no debt.

After a bought financing deal in February 2024—made before the latest acquisition—the share count increased to 180.3 million. The increased share count reduced PDP NAV per share from $4.35 to $3.82.

The latest deal appears to do little from a per-share perspective. Using pro forma figures provided by management, we estimate Saturn’s PDP net asset value per share will remain roughly flat at $4.45 per share after the deal closes.

Positive #2: Tremendous Cash Flow Generation Potential

Saturn sports an attractive corporate netback, which surges to more than $50 per barrel in the absence of hedges at higher commodity prices. The following table shows the quarterly and annual netbacks for the past two years.

Interest expense is high, most recently at $10.80 per boe in the fourth quarter of 2023. If the company actually manages to pay down debt, interest expense will decline, providing a powerful tailwind for an even higher netback.

Saturn’s cash flow torque to commodity prices is among the highest in our coverage universe. Its free cash flow yield becomes freakishly high at the current stock price as commodity prices increase.

Under our $87.50 per barrel WTI assumption and $2.25 AECO assumption, and inclusive of the hedges that were in place before the recent deal, we estimate Saturn shares trade at a 37.5% free cash flow yield. As hedges roll off, the yield increases, as shown in the above chart.

Due to the high free cash flow yield, the shares offer tremendous appreciation assuming they trade at a 12% free cash flow yield, as shown below.

If we discount Saturn’s free cash flow at 12% over the next ten years and use its financials before the recent deal, we estimate its shares are worth $7.82 at $87.50 per barrel WTI, and $2.25 AECO, implying 213% upside.

Positive #3: Production Growth

Saturn’s gross production growth rate is also among the highest in our coverage universe. However, management has prioritized growth to the point of exposing Saturn’s equity to a high risk of loss. Saturn’s quest for growth raises the risk that management goes a step too far with a future acquisition and causes permanent losses for its equity owners.

As good as Saturn’s gross production growth looks, the picture is considerably worse when adjusted for the company’s growing share count.

Despite Saturn’s impressive gross production growth, the recurring dilution attributable to its acquisitions’ equity financing has limited production growth per share.

Positive #4: Significant Institutional Ownership

Saturn’s last notable positive is the significant ownership stakes held by family offices. As of April 22, 2024, GMT Capital Corp. in Atlanta owned 26.7% of the shares, and the Libra Fund in New York owned 14.5% of the common shares.

Source: Saturn Oil & Gas Management Information Circular, April 25, 2024.

These are sophisticated family offices that presumably understand value. GMT has increased its stake significantly in 2024. One of its officers also sits on Saturn’s board of directors.