We recently initiated a short position in the shares of SM Energy (SM) at a price of $51.70. While we see nothing inherently wrong with the company or its management, the shares have gotten ahead of themselves, recently trading into the $50s versus our estimate of their value of $30.76 at fairly valued commodity prices. We view the shares as an attractive short down to $41.

SM Energy Background

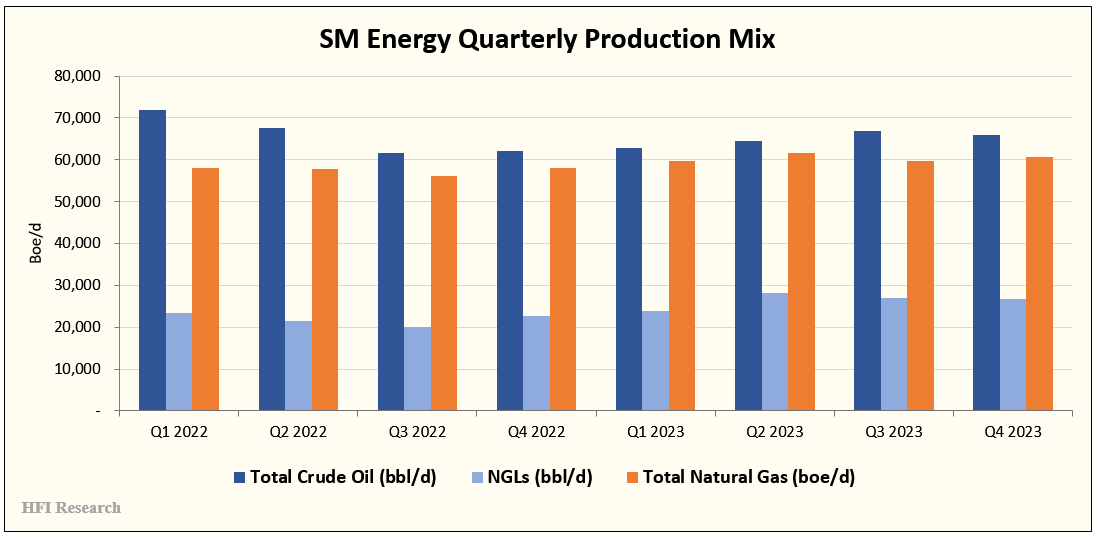

SM operates in the Eagle Ford and the Midland sub-basin of the Permian. In 2023, it produced 152,000 boe/d, split 43% oil, 17% NGLs, and 39% natural gas. The company has kept its production mix steady over the past eight quarters.

Management is guiding to a higher percentage of oil in future production after recent oil-weighted acquisitions. With natural gas currently sitting in negative territory, a higher oil cut will be a welcome development.

SM’s fortunes have improved dramatically in recent years. The improving trend of company fundamentals likely factor into the shares’ current overvaluation.

In the 2014 to 2017 timeframe, SM was a poster child for the over-levered, high risk shale E&Ps that outspent cash flow to grow production at all costs. It racked up debt and put its shareholders at risk.

The situation has since turned for the better. Beginning in 2018, SM steadily reduced leverage, bringing debt to reasonable levels, as shown below.

In 2022, SM used the cash flow generated from high commodity prices to pay down $585 million of debt and reduce leverage to slightly under 1-time cash flow, around where it stands today. With leverage having reached management’s target in 2023, the company has pivoted from debt paydown to increasing its distributions to shareholders.

In the fourth quarter of 2022, SM initiated a $0.15 per share quarterly dividend, which it recently increased to $0.18. At that rate, the shares currently trade at a 1.46% dividend yield.

After reducing leverage in 2022, the company also began to repurchase stock. In 2023, SM allocated $228.1 million of its $543.4 million of free cash flow to share repurchases. When combined with the $71.6 million of dividend payments that year, the company distributed 55.1% of free cash flow to shareholders. The past eight quarters of capital allocation are shown below.

Of the $299.7 million of cash flow that remained, it allocated $109.9 million to acquisitions.

Organic Growth Opportunities

SM prides itself on its technical expertise. In 2023, it acquired 29,700 acres in the Midland sub-basin of the Permian, for which it paid $90.6 million. Management disclosed the location of 20,000 of the acres—which included 1,250 boe/d of production that was 90% oil and signifiant undeveloped land—but it kept the remaining 9,700 acreage under wraps.

In its fourth-quarter earnings conference call, SM discolsed the location of the new acreage, which it believes will be more productive than understood in the market. If management is right, the acreage could generate years of attractive returns for shareholders.

Altogether, the newly acquired Midland Basin acreage increases SM’s existing inventory in the basin by 37%. Much of the acreage lies in proximity to SM’s existing Permian footprint, so it can be developed efficiently.

Source: SM Q4 2023 Earnings Conference Call, Feb. 21, 2024.

SM’s other source of organic growth is its Austin Chalk acreage in South Texas. Well results in the acreage have so far outperformed peers, which SM attributes to its technical team and well design.

These acquisitions enabled SM to increase its proved reserves in 2023 by 13% and replace 2023 production by 2.2-times. Since 2019, management has successfully grown proved developed reserves on a gross basis and a per-share basis, as shown below.

The company estimates that it has more than ten years of repeatable drilling inventory that can drive 3% to 4% annual production growth over the coming years. This is consistent with its proved developed reserve life index of 10.9 years at the end of 2023.