Suncor Energy (SU:CA) shares have been flat since we last analyzed the name when it released first-quarter results. While Suncor’s market value may not have changed, we like its shares considerably more than we did three months ago.

Our enthusiasm stems from our conviction that Suncor’s operational and financial turnaround is sustainable. Second-quarter results revealed a changed company. Management is firmly in control of operations. Volumes are up while costs are down. The company’s integrated business model is generating above-average returns on capital. We expect all these improvements to last and to grow value for shareholders for years into the future.

A Standout Q2 Performance

In the second quarter, Suncor beat expectations on nearly every key metric. So far this year, its results have exceeded the high end of management’s guidance range in areas ranging from upstream production volumes to refinery throughput to refined product sales. It achieved this despite a heavy maintenance schedule that reduced volumes in its Base Upgrader, Syncrude facility, Montreal refinery, and Sarnia refinery. In aggregate, the turnarounds reduced quarterly production by approximately 60,000 bbl/d.

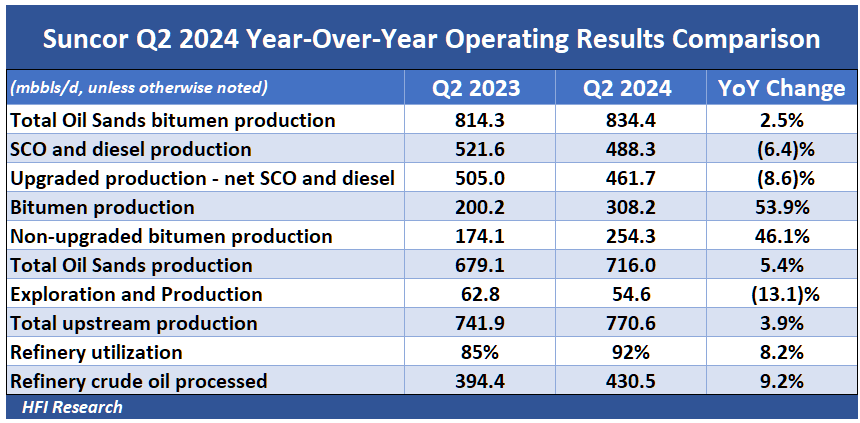

Even with these headwinds, results improved significantly, as illustrated in the quarter’s operating highlights below.

Of note is the 53.9% increase in bitumen production, which was partly attributable to Suncor’s November 2023 acquisition of the 31.2% ownership stake in its Fort Hills bitumen operation that it didn’t already own. Also, lower upgraded Syncrude production during the quarter was due to a decline in upgrader utilization, which was reduced to 86% versus 92% in the year-ago quarter due to planned turnarounds.

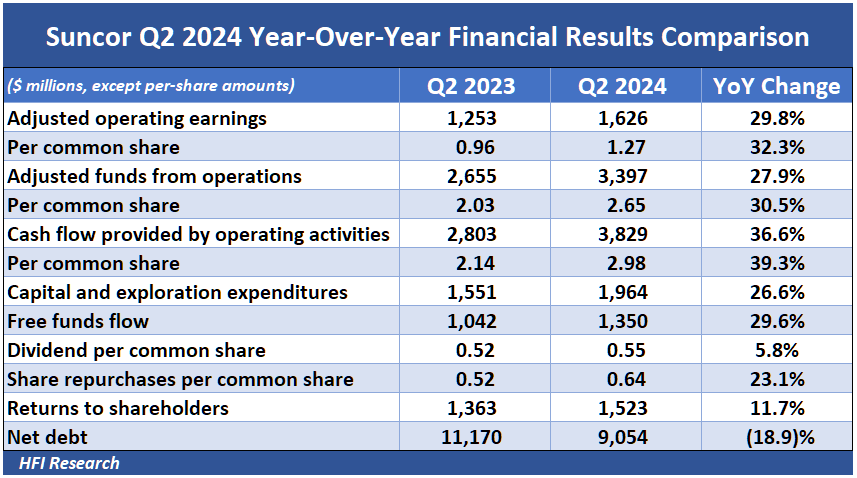

Suncor’s operational performance drove a spectacular financial performance during the quarter, as shown below.

In the second quarter, turnaround activity consumed $800 million of capex, reducing free cash flow by the same amount. Despite such a large cash flow headwind, the company managed to pay down long-term debt, repurchase shares, and pay a base dividend at levels consistent with previous quarters.