By: Jon Costello

Tronox is a recovery play on the titanium dioxide market with added kickers from company-specific developments. I’ve followed the company’s ups and downs since 2012, and I believe this is a good time to initiate a long position.

Today, finds itself in one of its industry’s most protracted downturns. The downturn’s length is attributable to aggressive new Chinese competitors and tepid global demand. Tronox’s revenues have trended lower since 2021, tracking the downturn in the titanium dioxide market.

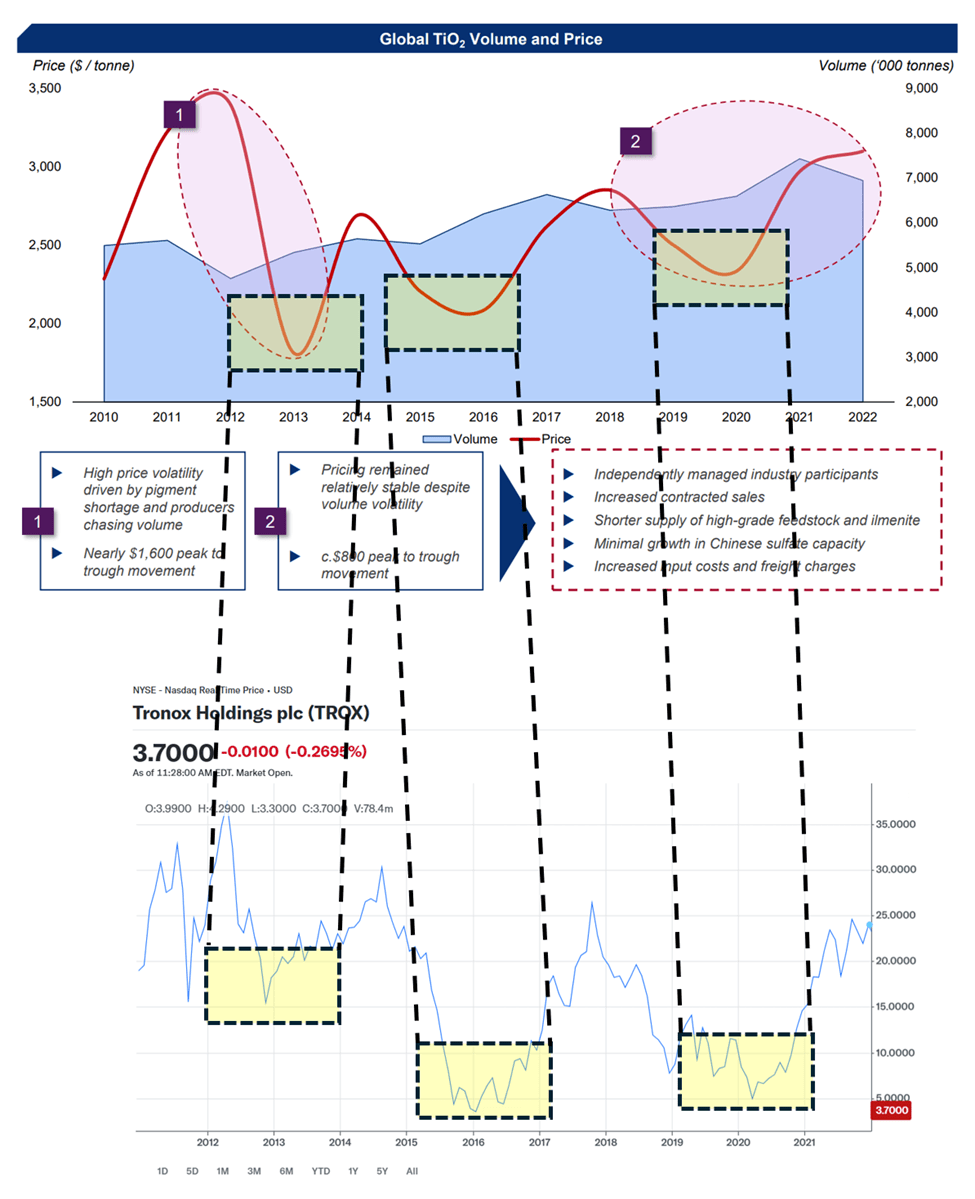

Historically, the company has exhibited some of the most extreme cyclical price swings of any company I know. The chart below illustrates how closely its share price follows the ups and downs of titanium dioxide prices. It depicts the market’s swings that occurred from 2010 to 2021.

Sources: Venator May 2023 Investor Presentation, Yahoo! Finance Oct. 28, 2025.

Today, I believe Tronox is in another cyclical trough. While the duration of the trough can’t be known with any degree of precision, improvements within the company are set to boost EBITDA and cash flow in 2026, which, in turn, should support its stock price. By the time the titanium dioxide market shows signs of a recovery, I expect Tronox shares to be bid far above their current price.