Valero Energy (VLO) is a premier crude oil refiner with operations concentrated in the U.S. It offers investors the prospect of gains from increasing dividends and share repurchases while also providing protection against the risk of surging refining margins that could arise amid refinery capacity shortages. Investors should consider VLO shares for their safe 2.6% dividend yield, dividend growth prospects, and share price appreciation from growing free cash flow and share repurchases.

Refining Margins: Higher for Longer

One of the most important energy market developments in recent years has been the sustained increase in global refining margins. Margins have remained consistently high relative to historical levels since 2022, and the outlook appears to be "higher for longer" until significant new capacity can enter the market.

From a high-level perspective, the increase in margins is attributable to widespread concerns about peak refined product demand. These concerns reduced the perceived need to spend massive sums on building new refineries. The fact of the matter is that building a new refinery is an extremely complex, multi-billion-dollar undertaking that takes five years on average to complete and more than a decade to pay off for investors. If a finance provider believes they may face severe losses owing to the refinery’s eventual obsolescence, they’ll either charge a steep cost for their capital or be reluctant to commit to such a risky project.

From the more granular perspective of the physical refined product market, the sustained rise in refinery margins has been caused by a combination of 4.5 million barrels per day (bpd) of global refining capacity reductions, bans on Russian refined product imports, Russian refinery outages, and a dearth of newly built refining capacity. These have kept a lid on refined product supply, boosting prices relative to crude oil and benefitting the refiners in the business of buying crude and selling refined products.

The resulting margin uplift has been unprecedented in recent decades in terms of longevity and scale. It encompasses all the major grades of crude oil used by refineries as feedstock. The long-term trend of higher average margins is clear when looking at data for refining margins achieved from different grades of crude oil, as shown below.

Source: Federal Reserve Bank of Dallas Energy Indicators, Nov. 2023.

The phenomenon can also be seen from the refined product side. Margins for gasoline and middle distillates, such as diesel and jet fuel, are shown below.

Source: EIA.

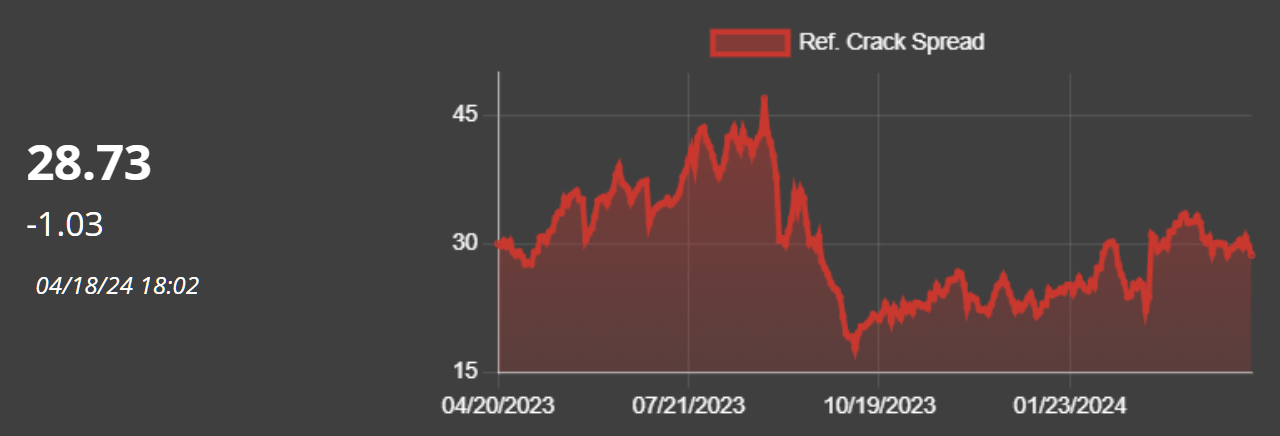

While it’s not possible to precisely estimate the supply outlook for each refined product, we can gauge whether the supply picture pertaining to the combined slate of refined products is constructive for overall refinery margins. The best macro variable for doing so is known as the “3:2:1 crack spread.” The “3:2:1” in the name reflects the fact that three barrels of crude oil translate roughly into two barrels of gasoline and one barrel of diesel. The metric is calculated by subtracting the price of three barrels of crude oil from the price of two barrels of gasoline plus one barrel of diesel, and then dividing by three to arrive at the value per barrel. The term “crack” refers to the refining process wherein long crude oil hydrocarbon molecules are “cracked” into smaller refined product hydrocarbon molecules, and “spread” refers to the difference between the crude oil price and wholesale refined product prices captured in the margin.

The 3:2:1 crack spread has been elevated on a sustained basis versus historical levels since 2022. It has remained strong throughout 2024 and currently trades at $28.73 per barrel.

Source: RBN Energy.

If margins remain elevated, global refiners could experience a prolonged stretch of record profitability.

A Bullish Outlook for the 3:2:1 Crack Spread

The outlook for margins hinges on the prospects for future refining capacity additions. Since refinery projects involve multi-year lead times, the near-term and medium-term capacity outlook can be ascertained with a fair degree of accuracy. The amount of capacity additions determine the amount of future supply, which can then be measured relative to demand in order to gauge the outlook for margins.

The current outlook for capacity additions implies a bullish long-term outlook for the 3:2:1 crack spread.

We defer to refining industry experts on the subject of capacity additions. One of the premier energy market consultancies, RBN Energy, sees a bullish setup for refining margins over the next few years. We’ve followed RBN for many years and believe their work to be top-notch. The firm’s Refined Fuels Analytics (RFA) group views the current outlook for refinery capacity additions as “the lowest since the RFA team has had since they began analyzing refining projects 15 years ago.” If global refined product demand continues to grow for many years as we expect, at an annual average rate of at least one million barrels per day, the lack of new refining capacity will keep margins—and refiner profitability—sustained at high levels into the future.

RFA estimates that two million barrels per day of new capacity came online in 2023—a multi-decade high—but that this capacity was not enough to offset the capacity being shuttered at the time.

RFA is particularly bearish on the prospects for the largest and highest-profile new projects, namely, Dos Bocas in Mexico, with 340,000 bpd of nameplate capacity, and Dangote in Nigeria, with 650,000 bpd of nameplate capacity. RFA expects both of these projects to experience operational challenges that push back the timing of reaching full capacity to 2026 at the earliest.

This year, RFA expects 1.1 million barrels per day of new refining capacity, with limited additions in subsequent years. Such a low level of capacity additions is hardly enough to meet long-term demand growth. It therefore bodes well for refining margins.