(Idea) Vermillion Energy

Note: Dollar references are to Canadian dollars unless specified otherwise.

Vermilion Energy (VET:CA) is a Canadian-domiciled E&P with operations in Canada, the U.S., Ireland, France, Germany, Croatia, and Australia.

Source: Vermilion Energy March 2024 Corporate Presentation.

Over the past few years, Vermilion has been undergoing a “high-grading” of its asset portfolio. The process has involved large acquisitions, non-core asset divestitures, and a reorienting of capex toward new growth areas.

Vermilion’s asset base includes the Montney in Canada, where it intends to grow production over the next few years, and emerging growth plays in Germany and Croatia.

Vermilion plans to focus most of its capex on developing its Montney position. To do so, it has stopped investing in its U.S. acreage, centered on the Powder River Basin play, and its Saskatchewan acreage. It also acquired 21.9% of outstanding common shares and warrants of Coelacanth Energy (CEI:CA). Coelacanth’s acreage lies in proximity to Vermilion’s own Montney acreage.

To facilitate expansion, Vermilion recently completed the construction of a plant that management expects will increase the company’s Montney production capacity by 20,000 boe/d. Longer-term, management intends to increase the company’s Montney production capacity by 28,000 boe/d, which it expects will support two decades of drilling in the play.

Favorable Price Realizations Drive Robust Free Cash Flow

Vermilion’s globally diversified asset base allows it to benefit from Brent crude oil pricing and global natural gas prices, which stand multiple times above those of North America, now in the midst of a natural gas glut. In 2023, Vermilion’s natural gas realizations averaged 300% of the AECO price realized by its Canadian E&P peers.

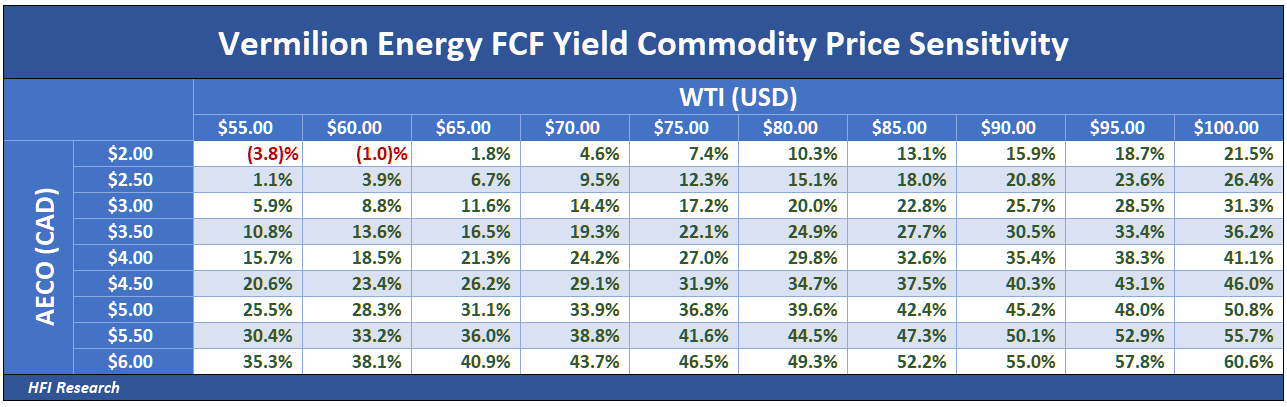

Vermilion’s favorable pricing results in wide cash flow margins, low breakeven oil and natural gas prices, and tremendous free cash flow torque to oil and gas prices. At its current stock price, we estimate it generates a 14% free cash flow yield, which is greater than most intermediate Canadian E&Ps.

Its cash flow surges as commodity prices increase. We estimate Vermilion shares at their current price of $15.40 would generate a 25.7% free cash flow yield at US$90 per barrel WTI and $3.00 AECO.

Assuming the shares trade at a 12% free cash flow yield, the free cash flow yield implies 113.8% appreciation upside from the current share price.

European natural gas prices have come off recently as the continent has managed to secure enough gas to fill its storage both this winter and last. But if cold weather returns, the continent may not be so lucky. Vermilion shares offer explosive growth in the event European natural gas prices return to the price levels seen in the first quarter of 2022 when Vermilion realized natural gas prices at 350% of AECO.

On the downside, we estimate the company can fully fund its 2024 capex budget—which includes significant growth capex—down to US$58 per barrel WTI assuming AECO trades at $2.00 per mcf.

Vermilion currently pays a $0.48 dividend, which generates a respectable yield of 3.12%. We estimate the dividend is covered by cash flow down to US$63 per barrel WTI with AECO at $2.25.

Pivoting from Debt Reduction to Repurchases

Vermilion has managed its debt well throughout its high-grading process. The slide below shows the changes in its net debt in its “High Debt” phase from 2018 to 2020, its “Debt Reduction” phase from 2021 to 2023, and where it stands today.

Source: Vermilion Energy Q4 2024 Earnings Conference Call Slide Presentation, March 7, 2024.

From a high of $2.0 billion in 2020, net debt has been brought down to $1.1 billion as of the end of 2023. Debt reduction over the past few quarters, as well as Vermilion’s other capital allocation decisions, is shown the table below.

Debt has been reduced to a comfortable 0.9-times funds flow from operations.

Debt reduction is set to continue. Going forward, Vermilion will allocate 50% of free cash flow after dividends to continued debt paydown. This year, we expect it to pay down another $200 million, bringing in comfortably below the high end of management’s long-term debt guidance range of $500 million to $1 billion.

The remaining 50% of free cash flow not allocated toward debt reduction will be allocated to shareholders. Management has indicated that most free cash flow will go toward share repurchases. At current commodity prices, as much as $200 million annually is available for share repurchases, equivalent to 7.7% of Vermilion’s market cap at its current stock price.