(Idea) Whitecap Resources

Note: Dollar figures refer to Canadian dollars unless specified otherwise.

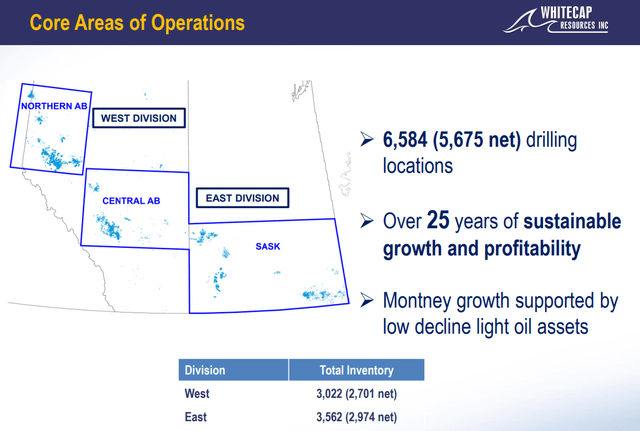

Whitecap Resources (WCP.CA) (OTCPK:SPGYF) is a Canadian light oil producer with operations located throughout Western Canada.

Source: WCP Investor Presentation, Oct. 2023.

Management’s strategy is to acquire low-risk acreage in established plays and use enhanced oil recovery to maximize production and reduce decline rates. The company considers the plays in which it operates to be among the most economical in North America, as shown below.

Source: WCP Investor Presentation, Oct. 2023.

Management estimates that WCP has more than 20 years of drilling locations at its current production rate. It forecasts total production of 165,000 boe/d in 2024, at which time we estimate its liquids/gas mix will be 65%/35%. The company’s long-term plan is to grow production by 3%-to-8% annually, growing to 200,000 boe/d by 2027. It would have to grow at a compound annual rate of 6.7% to achieve its objective from organic production growth alone.

Source: WCP Investor Presentation, Oct. 2023.

WCP has been a steady dividend payer since 2013. It currently sports a 7.5% forward dividend yield.

Recent Results Have Been Mixed

WCP reported Q3 production and cash flow results in line with consensus expectations. Full-year production guidance, however, came in slightly shy of expectations.

The biggest surprise in Q3 results came from management guiding to $250 million more capex than the market expected, with a total 2024 capex budget of $1.1 billion. A full $165 million of that amount was earmarked for infrastructure. The infrastructure expenditures are necessary to facilitate production growth in WCP’s Montney and Duvernay acreage. While the spending detracts from free cash flow, it reduces the longer-term costs, risks, and uncertainties stemming from third-party midstream operators. It is another example of management's conservative bent.

WCP has been a consistently good captial allocator. The company has used its free cash flow to pay down debt aggressively after making acquisitions that enhance its drilling inventory. Most recently, it paid down most of the debt taken on to fund its $1.7 billion acquisition of 32,000 boe/d XTO Energy Canada in August 2022. While WCP was paying down debt in 2022 and 2023, it boosted its production twice while also repurchasing shares. Its capital allocation over recent quarters is shown in the table below.

During the third quarter, the company achieved management’s $1.3 billion net debt target, at which point it increased its capital return to shareholders to 75% of free cash flow. The increased payout led to a 26% increase in WCP’s base dividend, to $0.73 per share annually. Management also stepped up repurchase activity, buying back 5.1 million shares in October. Debt stands at a conservative 0.6-times the last twelve months’ EBITDA.

One of the most notable features of WCP is management’s significant holdings of shares, which aligns its interests with those of public shareholders. CEO Grant Fagerheim, who has been in the post since 2009, owns 2.85 million shares that are currently valued at approximately $27.1 million. He is one of several insiders who have purchased 27,000 additional shares in the open market so far in the month of November.

WCP's recent results haven't all been positive. The main negative has been its increasing costs. Operating expenses per barrel have crept higher over the past several quarters, while capex increased due to infrastructure spending. Cash taxes are set to increase costs further now that the company has exhausted its tax pools. Its tax rate in 2024 will more than double from 2023.

Another negative is WCP’s increasing natural gas weighting in its production mix. Since the first quarter of 2022, when the company closed on its $206 million acquisition of relatively gassy TimberRock Energy, its natural gas production has grown faster than its liquids production. The increased gas content of total production has contributed to a decrease in netbacks per barrel. However, we don’t expect a long-term trend of higher gas growth relative to liquids. We were encouraged to hear management discuss its efforts to boost WCP’s liquids weighting in response to high oil prices in its third-quarter earnings conference call.