Editor’s Note: Ideas from HFI Research is a separate paid subscription to HFI Research. Consider subscribing to Jon’s excellent work and following his energy income picks here.

By: Jon Costello

I’ve been exploring new investment ideas outside the energy sector and can report that it’s tough to find appealing bargains. The few candidates I’ve identified are in consumer-focused industries and certain industrial niches undergoing a cyclical downturn.

The difficulty in finding bargains in other sectors drove home how attractive the midstream sector is at the moment. Midstream equities offer low risk of loss, a high income yield, and appreciation prospects. If an economic downturn were to occur, their fundamentals will hold up well. Meanwhile, their yields will support their equity prices as interest rates fall. By contrast, the crop of currently bargain-priced consumer and industrial stocks will become much cheaper in a broader economic downturn.

Energy investors should take a serious look at midstream names. These equities can be bought for various purposes, but their main appeal at the moment is that they provide a way to sidestep the looming oil oversupply and significant price declines in other energy subsectors, as well as the stock market at large.

E&Ps Are Overpriced

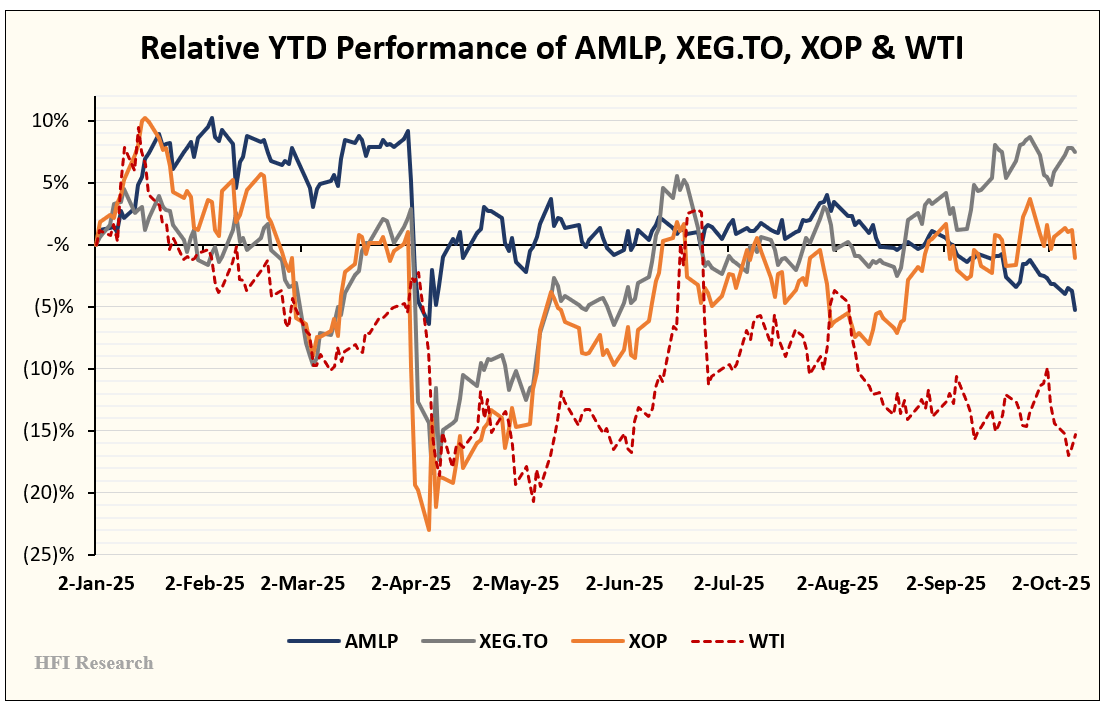

It is glaringly apparent that E&Ps are discounting higher oil prices. These stocks have run higher in the face of persistently lower oil prices for most of this year. Consider the remarkable divergence between E&Ps and WTI in the following chart, which plots year-to-date performance of oil and gas midstream (AMLP), Canadian E&Ps (XEG:CA) (XOP.TO), U.S. E&Ps (XOP), and WTI.

Year-to-date, the U.S. E&P index has declined by 1.0%, outpacing WTI by 14.3%. Midstream performed worse, dropping 5.2%, despite having limited exposure to commodity prices. Canadian E&P names have performed particularly well, outperforming WTI by 22.8%, as WCS has held up better than WTI due to improved egress in the WCSB and attractive pricing on Canada’s West Coast.

I estimate that E&Ps currently discount WTI in the low-to-mid $70s per barrel. Contrast the assumptions baked into these stock prices with current oil prices, which literally just fell below $60 per barrel as I write. Our oil price outlook calls for even lower prices over the next few months as the OPEC export surge arrives onshore and U.S. production continues to outperform in a global market that is already oversupplied relative to consumption.

The situation suggests that either E&P stocks will fall significantly lower from their current prices or that these stocks will go nowhere even if oil prices rise. What’s clear is that their long-term returns on offer from these stocks are far lower than they would be if their stocks reflected current commodity prices.

The situation further suggests that investors are looking through the commodity price weakness to better days ahead, when demand outstrips supply, sending oil prices higher. Or perhaps it’s merely a symptom of too much money chasing too few opportunities as concerns about inflation or “debasement” grow.

Whatever the cause, downside risk in E&P stocks is considerable if oil supply continues to exceed demand, inventories build for several quarters, and investors grow tired of supporting high E&P prices. If WTI remained in the $50s per barrel for a few months to shut off U.S. shale growth, many E&Ps would likely see their stocks fall by 20% or more. Given our expectation for an oversupply and lower prices, we’d rather wait for the pullback to happen than buy today.