If It Wasn't Obvious Before, It Should Be Obvious Now

The US crude oil production peak should be obvious to even the most casual observer of the energy market.

On Nov 8th, 2024, we published an article titled, The Peak In US Oil Production Is Here And Why You Need To Own Energy Stocks. In the piece, we specifically highlighted Exxon and Chevron as the key indicators.

Fast-forwarding to today, Chevron announced that it is on the cusp of a production plateau in the Permian, and it intends to maximize free cash flow going forward.

This was first telegraphed to investors late last year and Chevron appears to be following through. But for those that followed Chevron's development in the Permian closely, the plateau of ~1 million boe/d is shy of the previous target of ~1.2 million boe/d. The reasoning?

Inventory management...

This was obvious for anyone who followed Chevron's reserve report closely, where the crude oil segment was revised lower, while the NGL and natural gas segments were revised higher. The increasing gas-to-oil ratio was the first telltale sign that the Permian was starting to peak.

But even for the most casual observer of the energy market, the peak is becoming obvious.

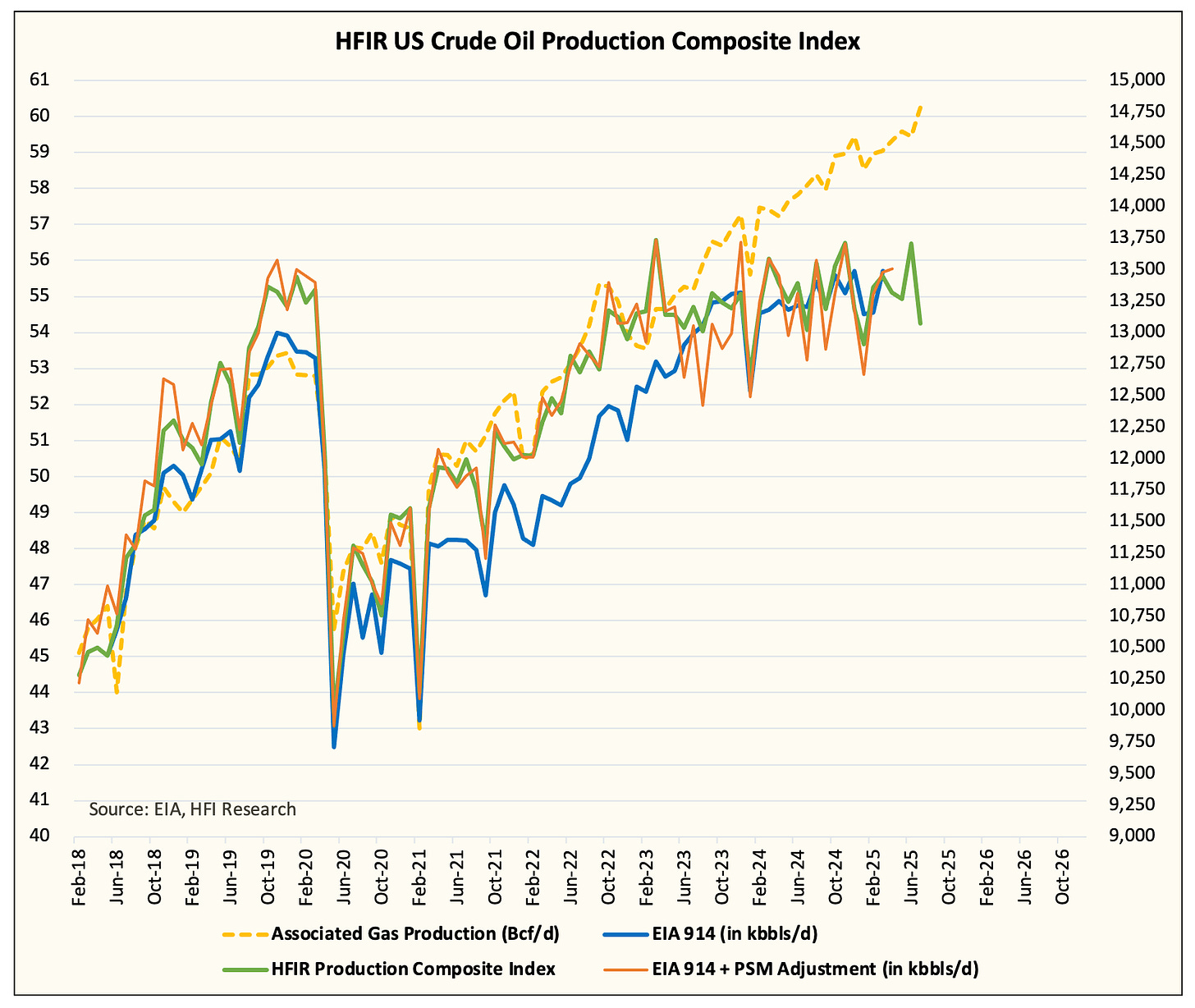

Despite many attempts at trying to ramp production above the 2019 peak, US shale has failed to produce any meaningful increase to the upside.

On the contrary, associated gas production (yellow line) appears to have no issues at all. The material increase in associated gas production vs our real-time US crude oil production tracker is yet another obvious signal that the peak in US shale is here.