If These Two Variables Pan Out, It's A Matter Of How High Oil Prices Can Go

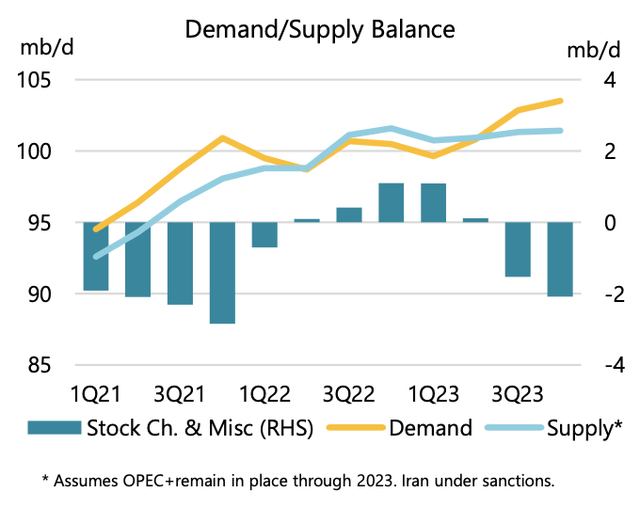

IEA released its latest oil market report today. And in it, this is the most important chart:

Source: IEA

According to IEA's data, Q4 oil market balances turned out to be net builds as the builds were primarily driven by non-OECD and oil-on-water.

Oil-On-Water and Floating Storage

For November, IEA noted that global observed oil inventories increased by ~79.1 million bbls. And since Q4 turned out to be builds as opposed to the draws we had expected, this alters the calculus for Q1 balances. From the high-frequency data points we collect, OECD inventories are expected to be down slightly in Q4, this was validated by the IEA data. But the builds in non-OECD and oil-on-water need to be accounted for. One thing to consider though is that oil-on-water has since normalized and fallen back into the normal range.

In essence, IEA expects oil market balances to remain in surplus in Q1 before tightening into year-end. The two main drivers will be Russia and China.