It's time for a comprehensive update on the natural gas bull thesis we first wrote up about in August 2024. Since then, and with the benefit of hindsight, the energy community is starting to build a consensus on the natural gas bull thesis. That wasn't the case when we first published our bullish view back in 2024, but we are happy to see the consensus come towards our view.

In this article, I will take a look at the following:

Short-term outlook: where are prices headed in the near-term, storage, and production.

Medium-term (2026).

Long-term (2026+).

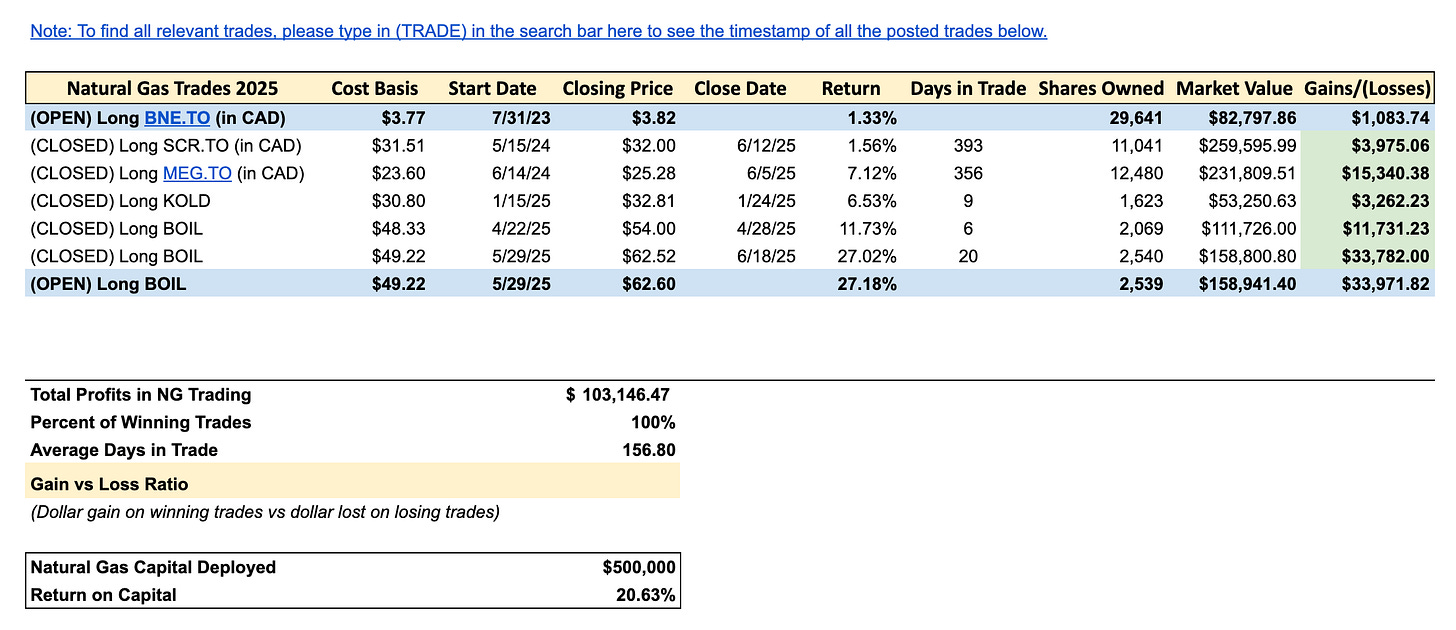

HFIR Natural Gas Portfolio Update.

Short-Term (1-3 months)

The natural gas market has managed to survive that temporary fundamental disconnect we wrote about a few weeks back. With the cooling demand season underway, the natural gas market should continue to tighten.

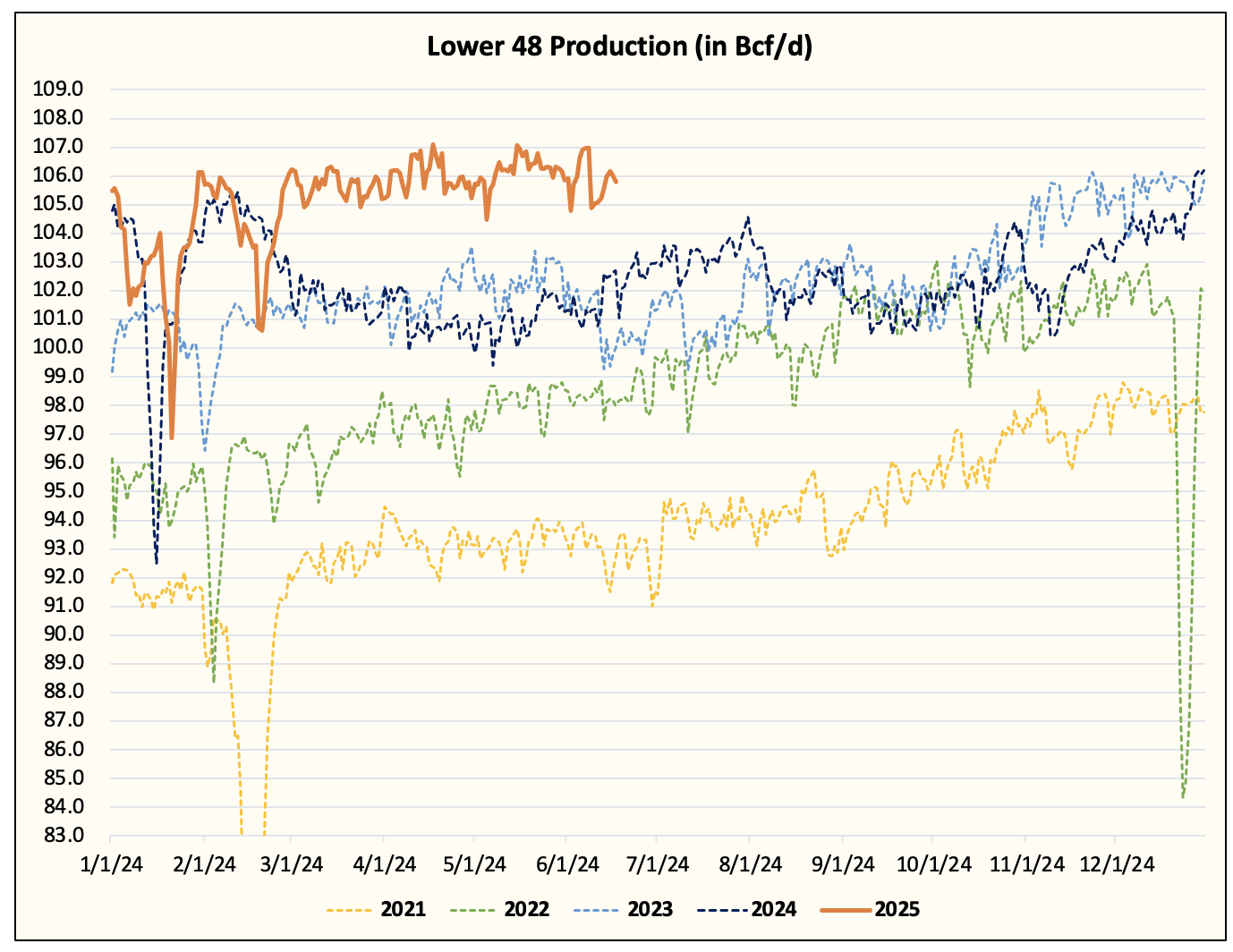

Following a surge to ~107 Bcf/d, Lower 48 gas production has tapered back a bit to ~106 Bcf/d. For this injection season, we now expect the average to be closer to ~106.5 Bcf/d, which will require warmer-than-normal weather to offset this production level. This is +1 Bcf/d from our previous forecast.

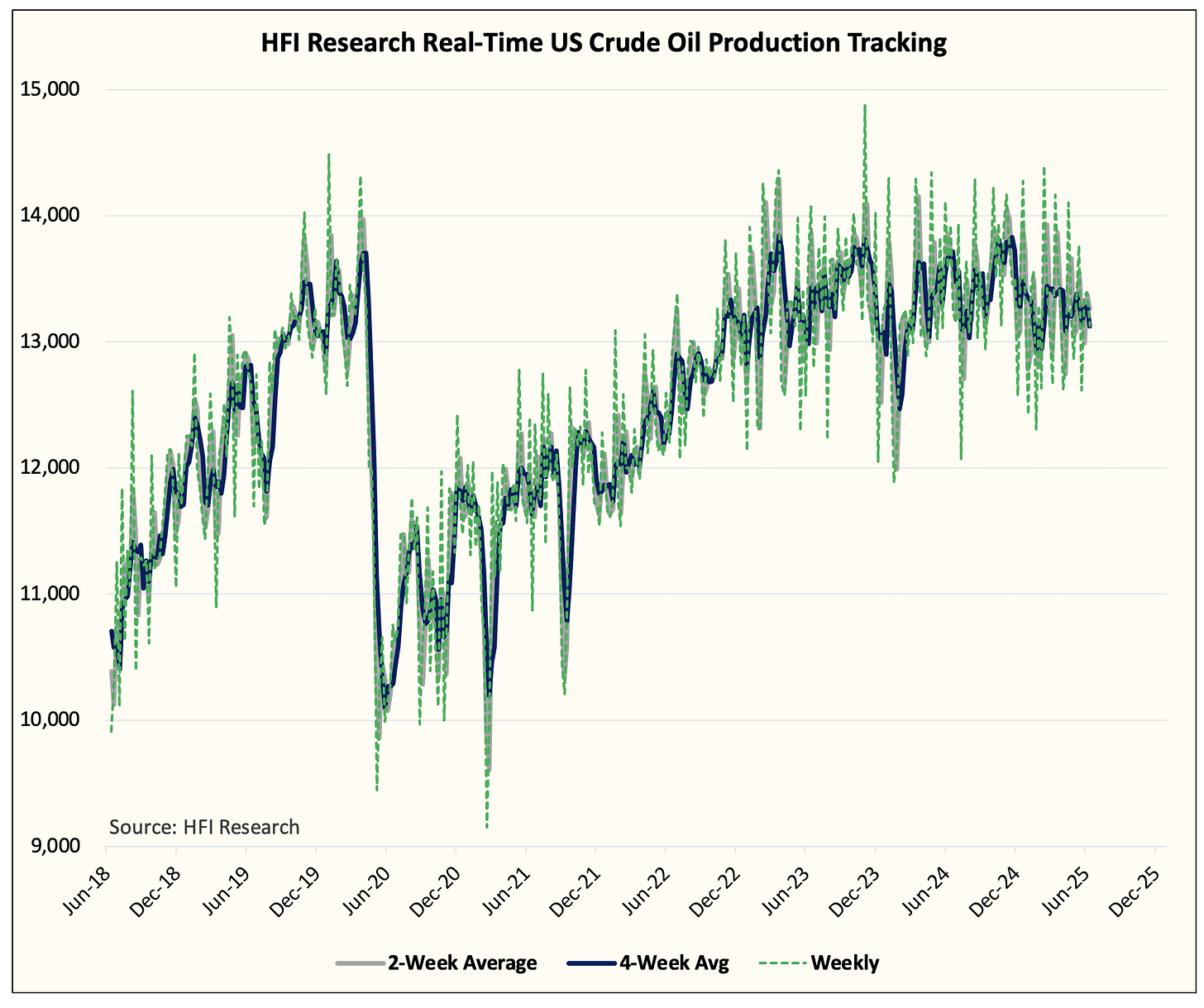

What's notable about the higher-than-expected production is that it comes at a time when our real-time US crude oil production remains weak. We estimate that US crude oil production is averaging ~12.9 million b/d today, which is ~500k b/d below the weekly EIA estimate.

The elevated associated natural gas production level implies that the oil-to-gas ratio is increasing. Unless we see WTI move meaningfully lower in the following weeks/months, we no longer expect associated gas production to disappoint to the downside.

By year-end, we are now on track to hit ~108.5 to ~109 Bcf/d. The increase will be driven by 1) higher Northeast gas production, 2) higher Haynesville production, and 3) higher Permian gas production.

As I will explain in the medium-term outlook section, this production level is in line with our expectations, but it will dampen the potential upside in 2026.

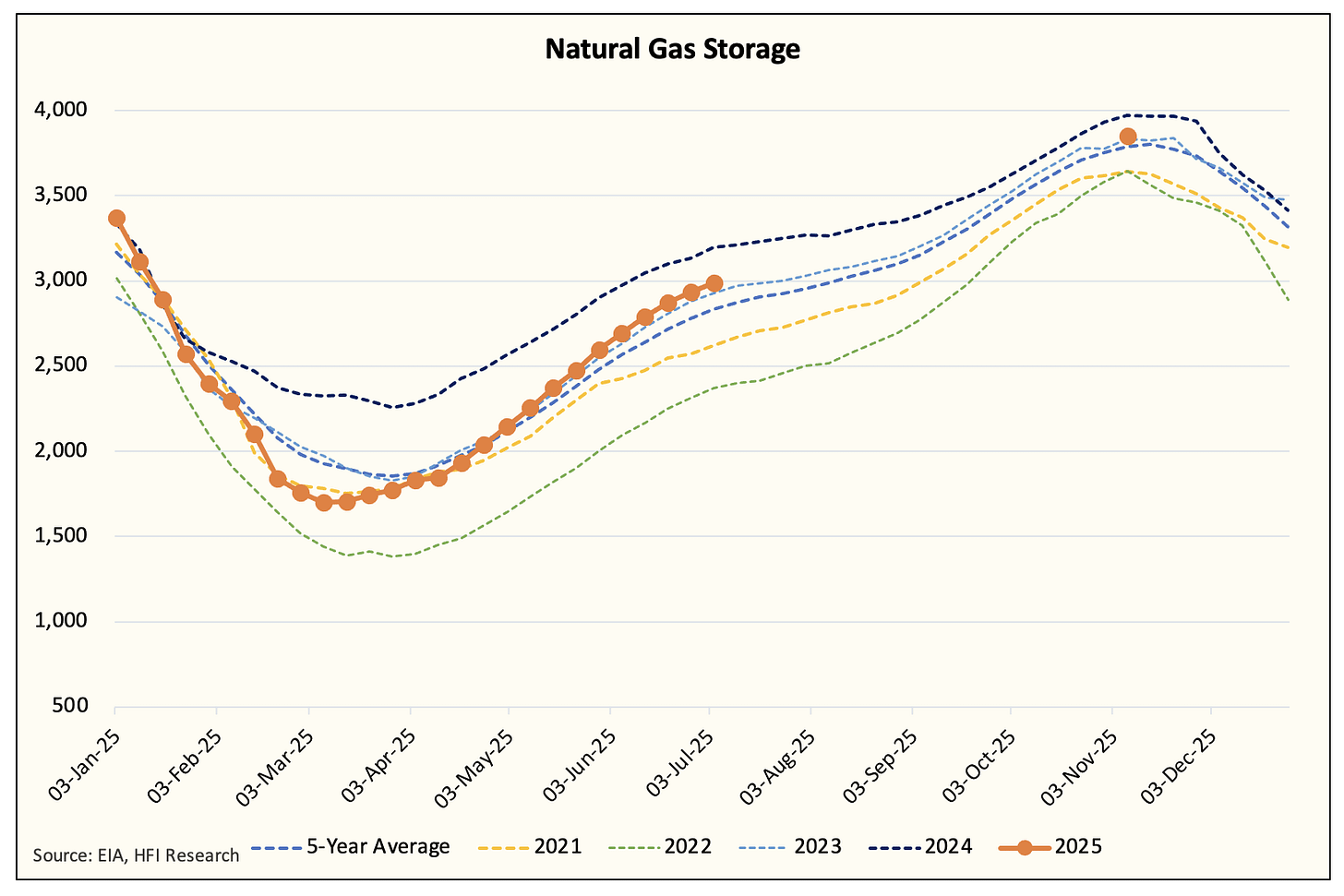

Looking at our near-term natural gas storage projection, we are still seeing ~3.85 Tcf for November. This is +100 Bcf vs the 5-year average.

Given where balances are today, the only way we move to a deficit vs the 5-year average is if July is a record hot month. Early weather model predictions show July to be a warmer-than-normal month, but the magnitude is uncertain for now. The weather development next month will play a crucial role in determining the fair value of natural gas in 2026.

Now if July weather turns out to be warmer-than-normal, we see upside in August contracts to $4.5 to $4.75/MMBtu. Only in the event of significantly warmer-than-normal weather will we see August contracts reach $5/MMBtu. By this point, readers should sell the remaining long BOIL position.

Note: Subscribers received a real-time trade alert today notifying them that we sold half of our BOIL long position that was initiated on May 29. We sold half of our position for a gain of ~27% and plan to hold the rest.

In essence, we expect the current rally in natural gas to continue. Net gas supplies y-o-y have compressed thanks to lower production and higher LNG demand. With power burn now taking the lion's share of the demand pie, natural gas bulls are back in control, and CTA positioning should move from being bearish to bullish. Once Henry Hub reaches our target, we will look to sell the rest of our BOIL long position.