(Important) Looking Past The Near-Term Oil Glut, Where Are Prices Headed?

After the oil glut, what's next?

Our recent oil articles have been fixated on the incoming price weakness, and this “important” article is to illustrate what happens after the glut from now to H1 2026. In this article, we will discuss the following:

When does the oil market turn into a deficit again?

Where’s the supply growth after 2028?

HFIR US crude oil production model.

“Real” spare capacity from OPEC+.

Supercycle means super capex, how oilfield servicing stocks like the offshore space will benefit.

Current Fundamentals And When Does It Turn Into A Deficit?

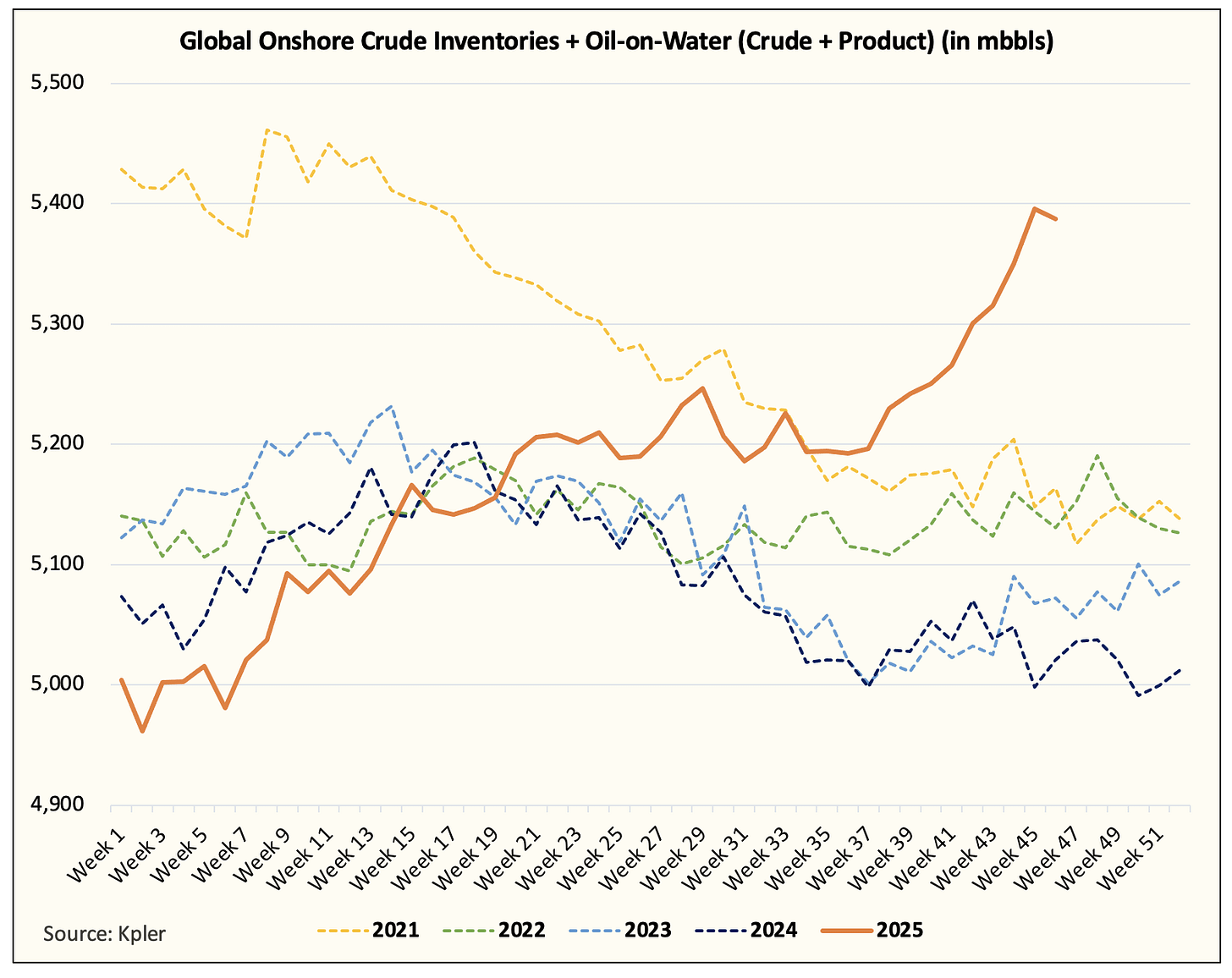

Implied oil market balances in Q4 are on track to be between ~2 to ~2.7 million b/d. This has pushed global onshore + oil-on-water to the second-highest level since COVID.

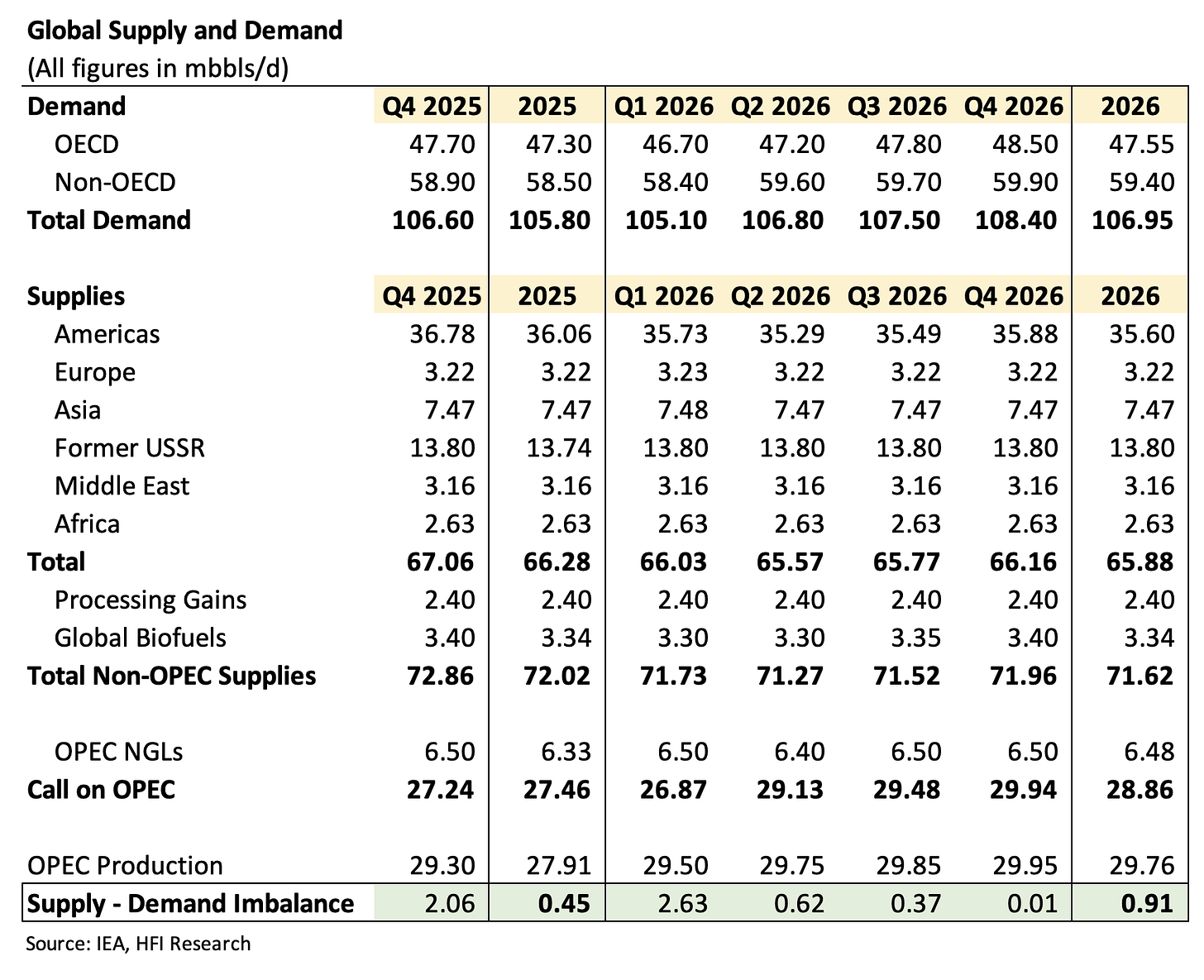

From a timing perspective, our global oil supply & demand pinpoint the turning point in oil market fundamentals in H2 2026.

The worst surplus is expected in Q1 2026 at +2.63 million b/d. We assume that US crude oil production falls due to lower oil prices with the eventual bottom in H2 2026. Depending on just how severe oil prices fall, our model will adjust for the timing.

In the meantime, between now to H2 2026, global oil inventories will build. The size and severity of the build is the primary reason for our cautious tone and the consensus’s expectation for lower oil prices.