(Important) Our Top E&P Stock Picks For 2024

Note: The stock prices discussed in this article are in Canadian dollars and the WTI oil price is in U.S. dollars.

The energy sector is about to enter 2024 as the most beaten down, oversold, unloved, and under-owned sector in the stock market. While that’s bad news for 2023 E&P returns, it’s not so bad for the year-ahead outlook. We expect positive returns for the energy sector overall, with the picks discussed below being our favorite ways to play it.

Oil Market Considerations

Macro conditions will influence the outlook for E&Ps, so we’ll first review the important macro considerations to provide background for the reasoning behind our picks.

For 2024, the oil market supply and demand outlook is unusually binary. Since our market balances point to a 500,000 barrel per day supply deficit during the year, demand factors could either tip the balance into larger inventory draws or push the market into inventory builds.

Certain known bearish factors complicate matters. For instance, if the U.S. or China enters a recession, demand could weaken to the point at which Saudi Arabia can’t realistically support the market through production cuts. In that scenario, oil prices would have to do the job of balancing the market.

If WTI were to fall into the mid-$60s per barrel range or below and is sustained at those levels, North American E&Ps will run cash flow deficits. E&P stocks would get clobbered, with the more heavily indebted among them faring the worst.

I’m not an expert in forecasting the macro economy, but I’ll assign a 20% probability to this worst-case outcome.

In the event demand performs as consensus expects—increasing by around 1 million barrels per day (bpd)— OPEC+ cuts will support oil prices. We would expect WTI to average in the low-to-mid $80s per barrel, which would be supportive for E&Ps and their stocks. The more indebted companies would generate enough free cash flow to pay down debt, and several would reach their net debt targets. E&P stocks would perform very well in this environment, particularly given the depressed levels at which they entered the year.

I’ll assign a 60% probability to this consensus scenario.

The main known risk in this scenario is what the oil market outlook for 2025 will look like at year-end. Will the 1 million bpd of demand growth in 2024 be enough to support a bullish outlook for 2025? It’s too early to tell, but it could be bearish if the market begins to expect inventory builds in 2025. In any case, it’ll be an important consideration for how E&P stocks perform throughout 2024.

If, on the other hand, demand outperforms, we’re looking at WTI trading at $90 per barrel or above and 100%-plus returns for many Canadian E&P stocks. This scenario could occur if the Fed cuts as many expect and if the U.S. and China avoid recessions. It would entail an increase in demand of more than 1.5 million bpd. I’ll assign a 20% probability to this scenario.

Capital Flow Considerations

Another important macro factor for the year-ahead outlook for E&Ps pertains to capital flows. How large fund managers react to events as they unfold and how they approach E&Ps is anyone’s guess. But what’s clear at the moment is that money managers are reluctant to allocate to energy. Energy specialists have been all but eliminated from the field, leaving generalists to control the bulk of capital flows into E&P stocks. Generalists will want to see sustained higher prices. They’ll begin allocating to larger names. Only when they’re comfortable with those will they allocate to smaller names.

For this reason, we want to be positioned in companies that are big enough to benefit from the initial move into larger-cap names. This isn’t to say that small caps aren’t particularly attractive right now—perhaps even more so than large caps—but we’re only looking out a year, so capital flows will be more relevant to performance.

What will be interesting is the extent to which U.S. generalists recognize that U.S. shale growth is set to top out. At the moment, they’re back into the “shale is growing to the sky” camp, which is holding down both oil prices and E&P stocks.

We expect U.S. shale growth to top out in 2025 and plateau thereafter. If we’re right, investors should begin to get a whiff of this outcome in mid-to-late 2024. Assuming large generalist investors appreciate the ramifications of this development—namely, that global production growth will be harder to come by—they’re likely to seek out high-quality, long-lived assets in investor-friendly nations with at least a well-functioning legal system.

Canada is the natural choice here. Canadian production features all these desirable attributes, plus pockets of production growth. A slight drawback for U.S. investors is the 15% withholding tax on dividends, but many Canadian E&Ps are choosing to repurchase shares instead of increasing dividends. Moreover, large U.S. shareholders will be more likely to push them in the share repurchase direction, as well.

Energy investors should position themselves in Canadian E&Ps, whether they’re buying for 2024 or longer, and whether they buy our favorites or something else.

Now to our picks. We’ll make three: one with the greatest upside, one no-brainer, and one particularly safe money maker.

Biggest Upside: Baytex Energy

This one is easy. Baytex Energy (BTE) stock that checks all the boxes for the most upside in 2024. Let the company’s many naysayers complain about its assets, management, or whatever they choose; even they can’t deny that BTE’s cash flow has jaw-dropping torque to oil prices. An investor who is highly confident that the U.S. and China will avoid a recession—or who simply wants to bet on higher oil prices in 2024 for whatever reason—should go with BTE.

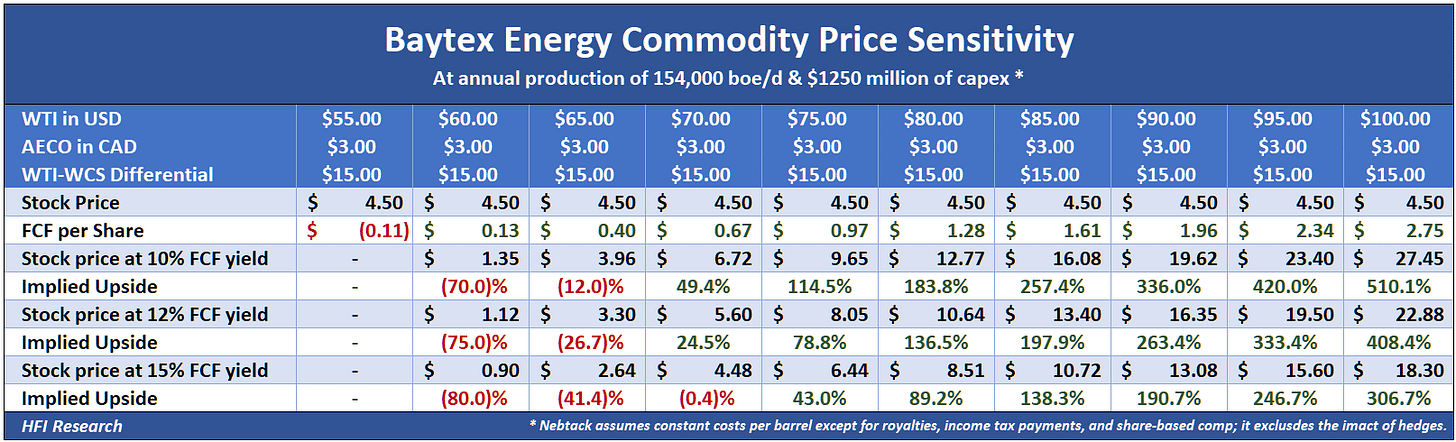

BTE’s cash flow torque is shown in the table below, which depicts free cash flow scenarios using the mid-point of management’s production and capex guidance ranges for 2024. Consider that at $90 per barrel WTI, its shares would increase to $16.29, for 263% upside, to trade at a 12% free cash flow yield. Return prospects get ridiculous above $100 per barrel WTI. On the flip side, free cash flow disappears with WTI slightly below $60.

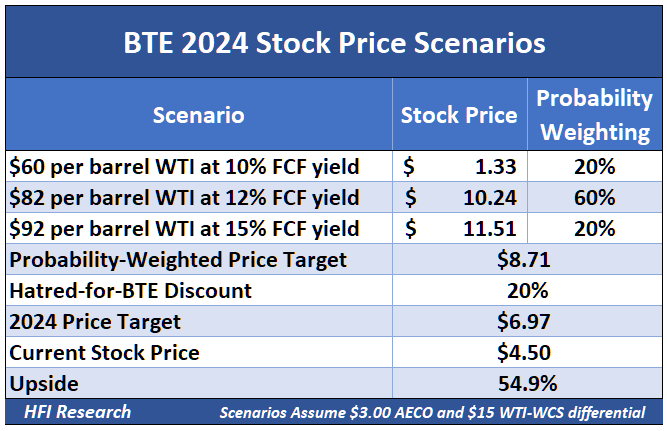

Assuming our three scenarios, in which we see a 20% probability of $60 per barrel WTI, a 60% probability of $82 per barrel WTI, and a 20% probability of $92 per barrel WTI, our 2024 price target for the shares is $8.71, as shown below.

Investor sentiment will be the wild card with BTE. If oil prices surge to the upside and investors are bullish, it’ll be the go-to name to profit from higher prices. Investors will flock to the name and push its price toward our $8.71 probability-weighted price target.

But in less bullish scenarios, BTE stock is likely to trade at a discount to its free cash flow generation potential. The stock has struggled to gain favor with investors since its Ranger acquisition. For this reason, we’re applying a “Hatred for BTE” discount to make our price target realistic, which we believe is reasonable, given how long it takes for sentiment to change and the fact that we’re forecasting a year ahead.

BTE also faces the challenge of having a shorter reserve life than most peers. Based on BTE’s 2022 reserve report and 2023 production, we estimate its proved and probable reserve life index at 11.7 years. While its stock has explosive torque to higher oil prices, it could continue to trade at a discount if WTI remains below $90 per barrel and management fails to replace produced reserves. We don’t expect it to do so in a material way through the drill bit in its Eagle Ford acreage, which accounts for 55% of BTE’s liquids production. Its Canadian acreage is clearly superior, but reserve developments remain to be seen.

That being said, if oil market developments remain bullish in 2024, while the company allocates free cash flow toward paying down debt and begins to discuss returning capital to shareholders in larger quantities, its shares would likely outperform.

Investors should be aware that BTE’s torque to oil prices cuts both ways: its cash flow decreases at a faster rate as oil prices fall. The company is heavily indebted, so as oil prices decline, investors grow concerned about its ability to meet its debt service obligations. BTE stock would be crushed in a severe oil market selloff.

However, it is likely to survive such a selloff if it occurred in 2024. BTE’s credit facilities are not borrowing base facilities, so they don’t require periodic reviews and redeterminations. We estimate that WTI would have to be sustained in the mid-$40s for the company to be at risk of violating its Senior Secured Debt to Bank EBITDA ratio covenant based on its September 30 senior secured debt balance. Its $1.6 billion of long-term notes mature in 2027 and 2023. In fact, BTE’s stock could offer a tremendous longer-term buying opportunity in a significant oil price selloff. But keeping to our 2024 time horizon, the stock would probably underperform, even from its current depressed levels.