(Important) This Is Going To Be Hard To Believe, But Energy Is Going To Outperform Tech In 2025

"Just lock this man up, he's crazy."

Oh man, here we go again. Wilson is going crazy. How can energy stocks possibly outperform tech when oil prices are expected to be rangebound in 2025?

Heck, how can energy stocks outperform tech when oil markets are going to see 1+ million b/d surpluses?

You must've lost your mind. What is the rationale behind this call?

Before you lose your mind because of the headline, I will just say this: what seems obvious in investing is never obvious.

Let's take a walk down memory lane back in late 2022. Tech was crashing and energy stocks were the best-performing sector for the year. HFI Portfolio returned +80.66%, and for most investors, inflation was going to last forever and the Fed would fail at fending off inflation. Tech stocks would continue to suffer and the supercycle was here.

But that clearly wasn't true. Despite it being the prevailing sentiment at the time and the consensus knew that the Fed would continue to increase interest rates, tech stocks bottomed, and energy stocks peaked.

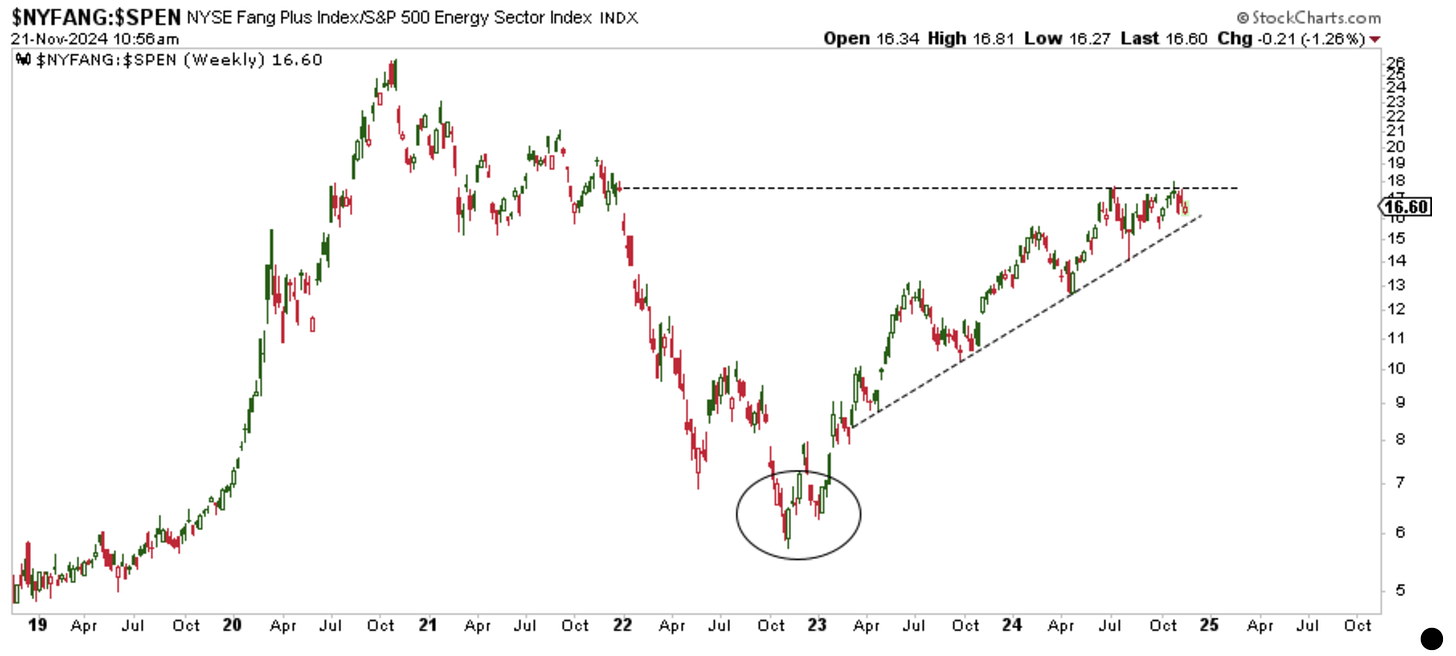

Now if you look at the chart above of the NYFANG index versus the S&P Energy Sector, you can see that the bottom happened just as everyone thought the tech sector was over. Since then, NYFANG has materially outperformed the energy sector.

But I think that's about to change. Similar to the extreme sentiment back in 2022, I'm seeing the same signs today. The thing that's giving me the most comfort is that despite very lackluster oil price action and sentiment since the start of the year, tech stocks have not meaningfully outperformed energy stocks.

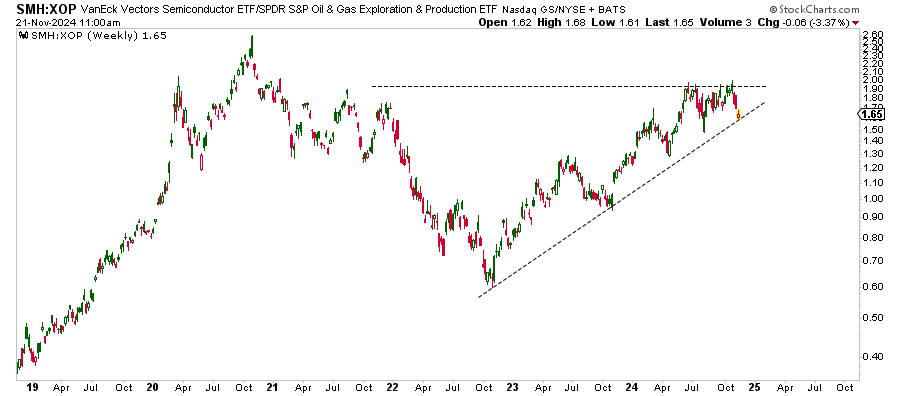

In fact, if you take the super popular semiconductor index and compare it to XOP, you see something very similar.

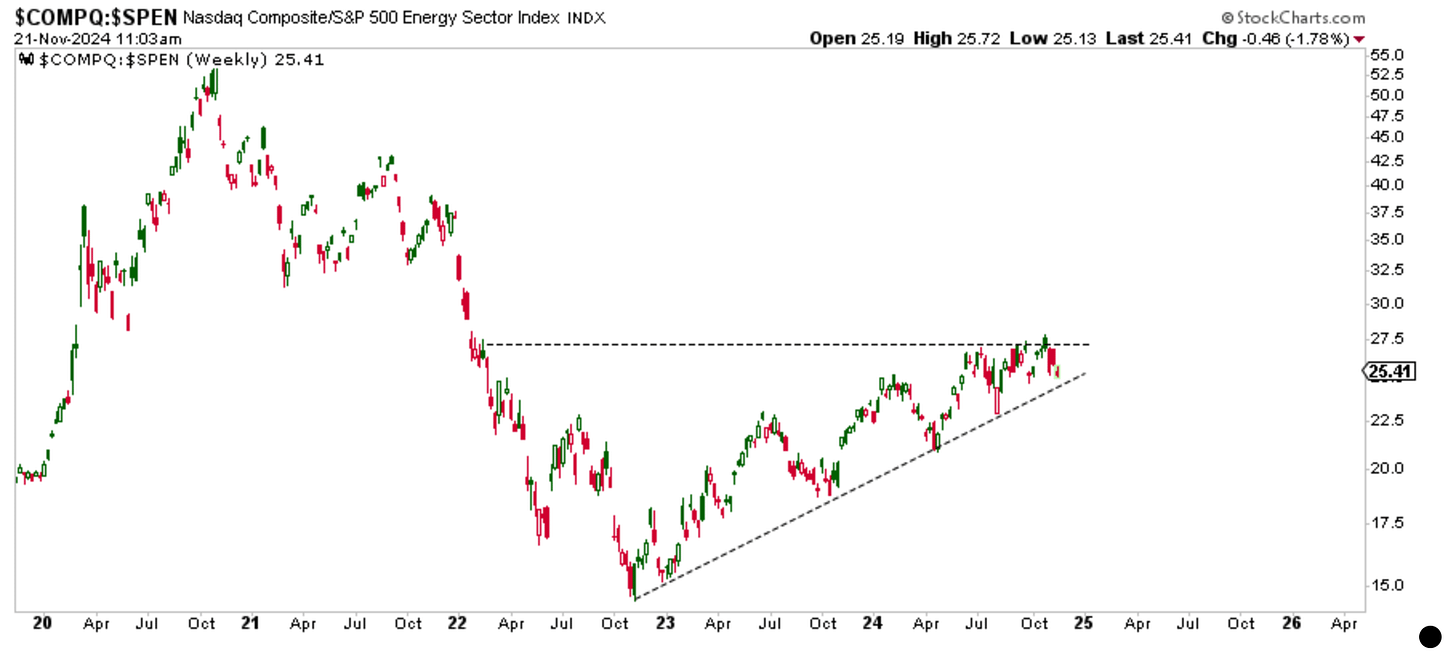

And in case you are wondering, the same pattern exists for Nasdaq vs Energy.

But aside from a few technical chart patterns, what's the fundamental rationale? Why would energy stocks move higher if oil prices are expected to be rangebound?