Is An OPEC+ Coordinated Cut Coming?

In the span of a month, the oil market went from very tight to loose in the blink of an eye. As expressed below by the Brent 1-2 timespread, the market suggests no tightness going forward.

So what is it exactly?

In our WCTW yesterday, we pointed out that the OPEC+ cut is not much of a cut. While the Saudis are doing all the heavy lifting, higher crude exports from Russia and Iran are offsetting. The end result is OPEC+ crude exports being flat y-o-y.

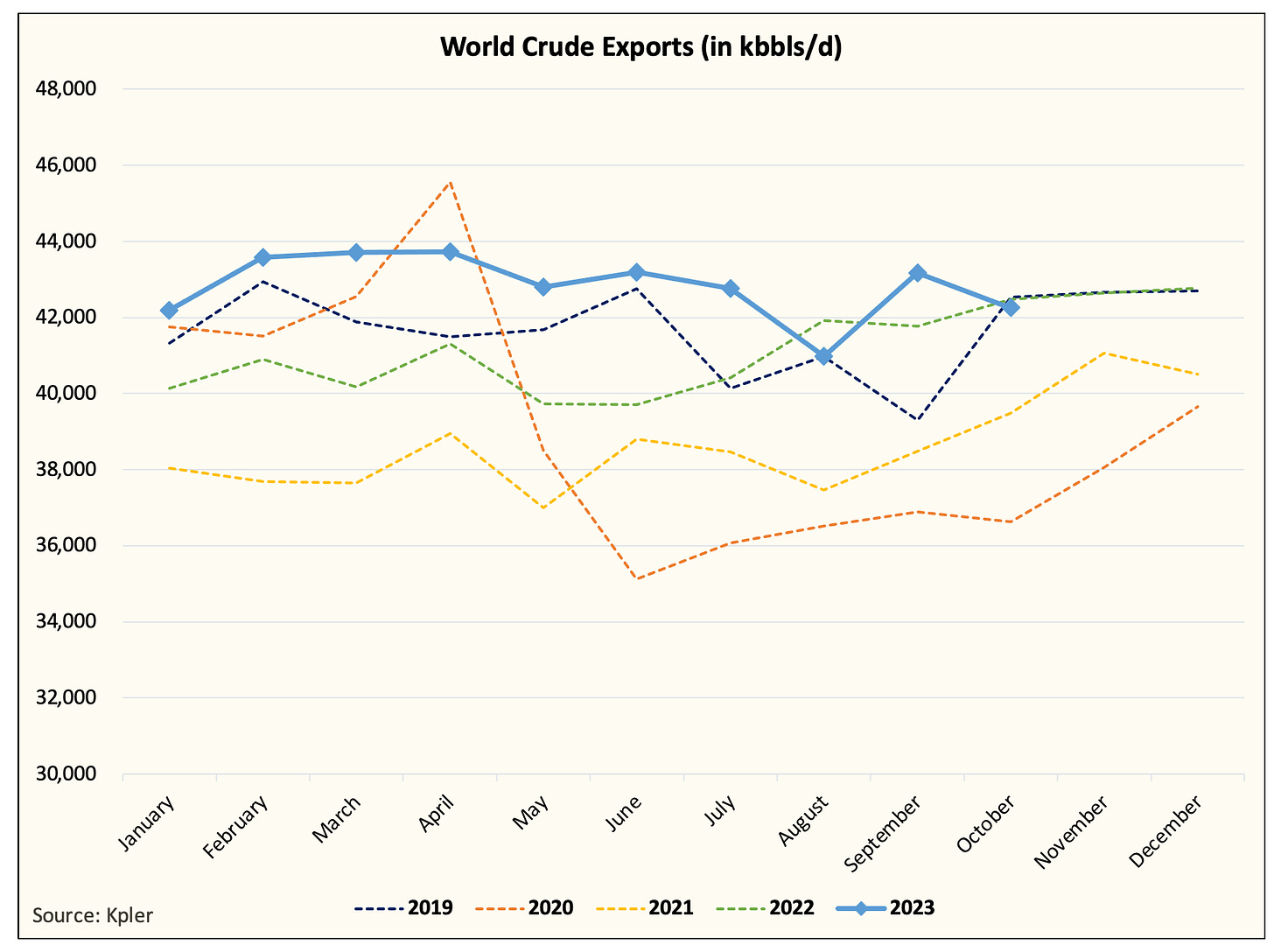

But higher supplies can't be the crux of the whole picture. Why? Global crude exports came in flat y-o-y.

Yes, total crude exports are higher y-o-y since the beginning of 2023, but if we are using October as the comparison point, we are now flat y-o-y.

Now I understand that crude exports won't explain the whole picture. Refined product exports, demand, and various other factors go into the overall picture. But if we are talking purely supplies here, it's not much higher y-o-y.

This means that the only reasonable conclusion one can come to is that demand is disappointing to the downside. Because let's face it. If demand was as stellar as Rystad's latest readings suggest, then we should see 1) higher refining margins and 2) higher backwardation. And we aren't seeing either of those things.

The reality is that demand is likely somewhere between really bad and just okay, and supplies have surprised to the upside (i.e. not as low as expected).

Because no matter how much I think this over, you can't assume strong demand and come away with the same conclusion. And I do have enough respect for the market to acknowledge the signals it gives me.