It Doesn't Look Good

Here we go again, sanctions have kept oil prices from falling further, but for how long?

The oil market is in a precarious spot. Russian sanctions risks have once again fueled the market into believing that the Trump administration is serious about choking off crude oil supplies.

Never mind the fact that since the Trump administration took office, Iranian crude exports have been near all-time highs.

What exactly will the US do this time around that will somehow choke off ~1 to ~1.5 million b/d of Russian crude exports?

The answer is nothing.

If you don’t know the history of oil sanctions, let me give you a brief overview:

In 2018, Trump sanctioned Iranian crude exports. But just before he was going to enforce the sanctions (October 2018), he backed off. He gave a 6-month extension. The result? Oil prices dropped $30/bbl.

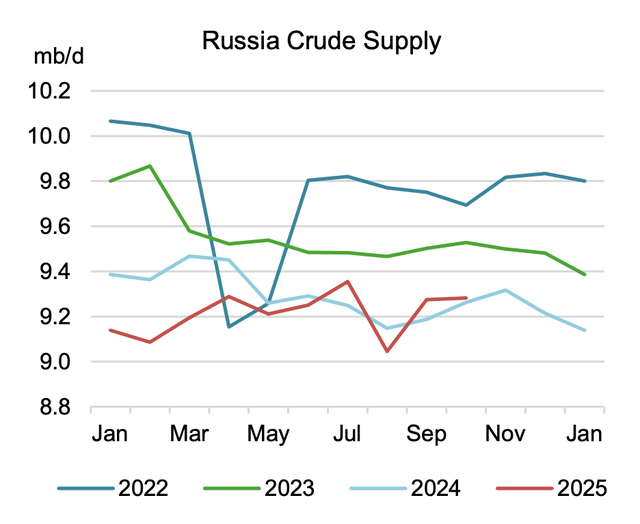

In 2022, Russia invaded Ukraine. The resulting economic sanctions announced led oil analysts and the IEA to believe that the sanctions would choke off Russian oil supplies. IEA, at the time, estimated that Russia could lose up to ~3 million b/d. Result? Crude supply declined by ~750k b/d since March 2022.

So will the incoming sanctions impact crude supplies? Probably not. And that’s where the issue is.

Q4 Oil Balances

There’s a bit of 2018 redux in today’s oil market. Thankfully, we don’t have the issue of elevated oil long positioning that we have to contend with. Unlike 2018, the massive speculator selling won’t be a theme this time around, but that doesn’t rule out the fact that money managers could go outright short.

Instead, I think the similarities are in the fact that the oil market has avoided a larger sell-off due to sanction-related risks.

We are seeing this manifest in higher oil-on-water (crude + products). Relative to historical standards, this is the second-highest oil-on-water reading since COVID.

Each subsequent peak in oil-on-water, except for March 2020, has resulted in a flat to down oil price environment.