It's Just Not Drawing Fast Enough

Last week Tuesday, we published our WCTW titled, "Pause." In it, we explained why we thought the latest oil rally would pause for a bit. Refining margins have fallen resulting in flat prices to be capped, and with the latest EIA oil storage report, we are simply not drawing down storage fast enough.

On balance, things are slightly in the deficit. Total liquids saw a draw of 2.4 million bbls, but the 5-year average draw is closer to ~7 million bbls.

Year-to-date, we are ~17 million bbls below where we ended last year. That gives us an implied deficit of -0.3 million b/d. That's far better than the +400 to +700k b/d the consensus expected, but more is needed for oil prices to move materially higher.

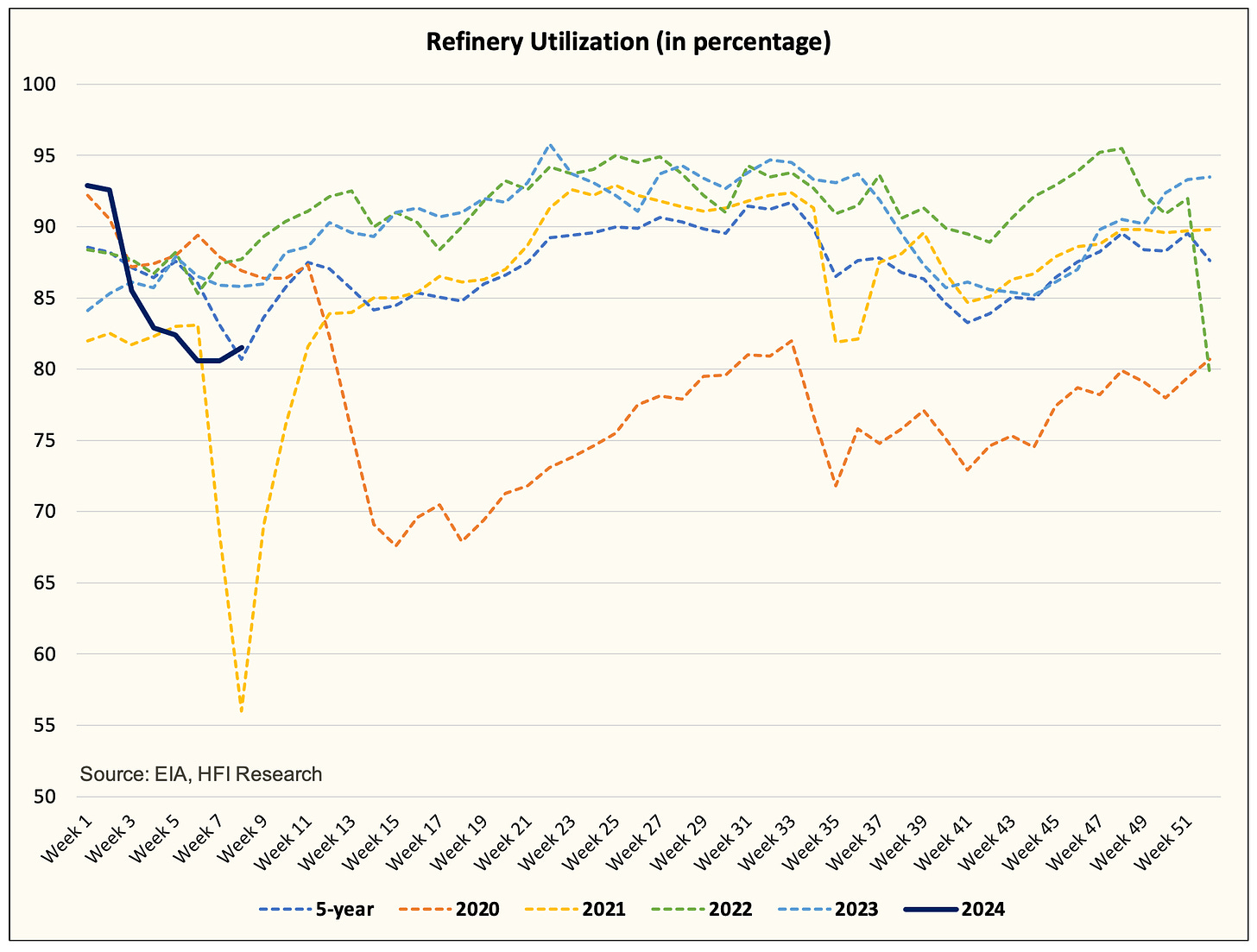

The reason for our cautious tone is that despite US refinery throughput coming in at one of the lowest levels in years, we are not seeing any material draws in product storage.

Product Storage

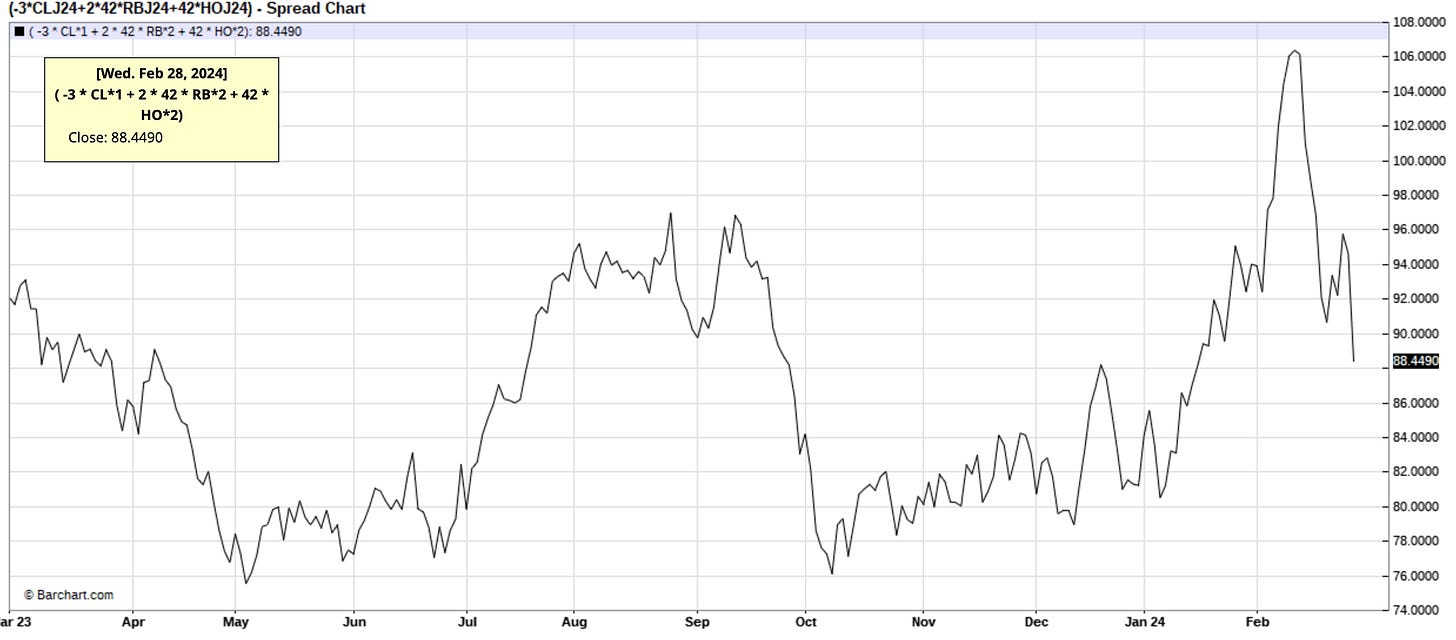

Given such low refinery throughput utilization, we would've expected product storage to be well below 2022 and 2023 levels. Yet, we remain above, which is surprising to say the least. This is why I think we are seeing weakness in the vanilla 3-2-1 crack spread:

And as we pointed out a week ago, the only way for crude prices to sustainably move higher is for refining margins to remain elevated. For now, the pause continues.