Let's Be Real About The Oil Market

I am an oil bull, so I am going to be biased. That's human nature. But there are times we just need to be very realistic about the oil market. Following the OPEC+ meeting, many of us thought oil prices would be far higher. It's not, and while you can argue that the market is being emotional, the reality is that the physical oil market remains weak, and US oil balances are showing builds vs draws.

While the market can be irrational from time to time, it is suicidal to assume that it is always wrong. I am here to tell you that there is something clearly missing in our analysis of the oil market, at least in the short term. We do, however, stand firm on our belief that the Saudi voluntary cut serves as a put option for oil prices. That is the floor and I don't see us breaking that unless oil demand meaningfully surprises to the downside.

Let's be real...

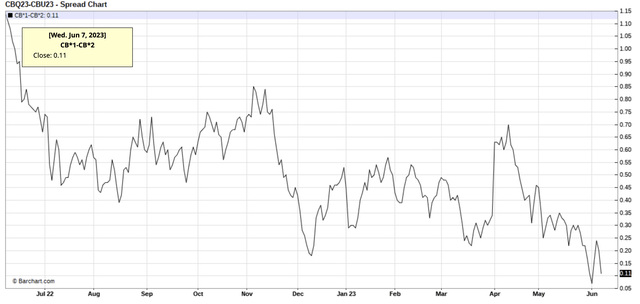

Despite the voluntary cut of an additional 1 million b/d for July and the unexpected official selling price increase from the Saudis, Brent timespreads continue to trade as if the physical market is oversupplied.

This is typically not a good sign. If you are a glass-half-full guy, however, you can argue that with the physical market being so weak and the Saudi voluntary cuts not hitting until July, physical timespreads have nowhere to go but up. Yes, that's a good way of looking at it, but I'm merely talking about the immediate reaction.

In addition, with the official selling price increase, the intention of the Saudis was to drive buyers to shore up physical crude from elsewhere. Clearly that's not the case as buying remains lackluster.