MEG Energy - Cash Flow Suffers In Q1 But Is Set To Improve In The Second Half

MEG Energy’s (OTCPK:MEGEF) first-quarter results were all about operating leverage. Commodity prices dictate the company’s revenues, but its large base of fixed costs remains flat, irrespective of commodity price swings. When realized commodity prices increase, free cash flow surges higher. But when they fall, free cash flow drops at a rapid rate.

In the first quarter, weak WTI and WCS oil prices drove MEG’s bitumen realizations significantly lower. First-quarter realizations fell by 16% from the previous quarter and 40% from the year-ago quarter.

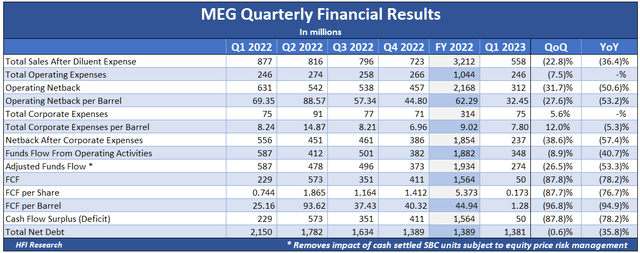

Lower realizations were met with relatively flat expenses. Operating expenses fell 7.5% quarter-over-quarter and were flat year-over-year. Similarly, corporate expenses declined by 5.6% quarter-over-quarter and were flat year-over-year. The sorry state of first-quarter netbacks and cash flows can be seen below.

MEG performed adequately from an operational perspective. Bitumen sales came to 106,840 bpd, slightly below capacity of 110,000 bpd. The strong production results were attributable to a declining steam-to-oil ratio. The steam-to-oil ratio was essentially flat from the previous quarter but down an impressive 7% from the year-ago quarter. The company attributed the improvement to optimized well spacing, enhanced completion designs, a well redevelopment program, and facility upgrades.

A Closer Look at MEG’s Q1 Netbacks and Cash Flows