By: Wilson

I recently attended a dinner in Tokyo with a bunch of golfer friends. The main topic of discussion at the dinner table was about crypto and how Trump's recent presidential victory will usher in the golden age of crypto.

One by one, they started pitching their favorite shitcoin and which one will start performing the best. Some started showing intraday chart patterns illustrating what patterns they like to use when trading these shitcoins. One of them proclaimed that XRP will hit $8 and that it's not too late to get in. Another claimed that Dogecoin was going to hit $1 soon thanks to Elon's creation of DOGE.

It was the wild wild west again.

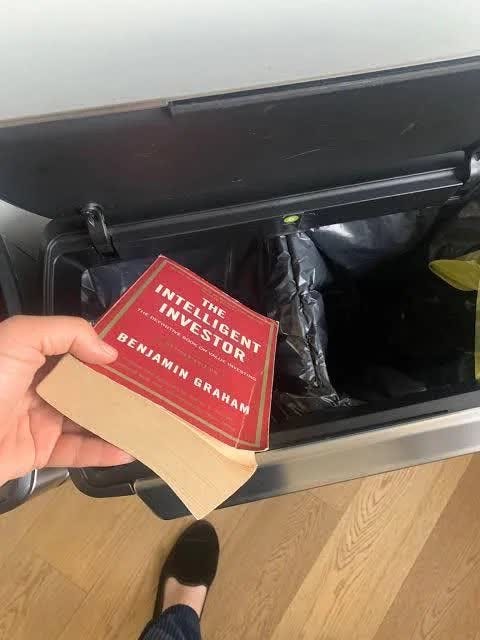

As I sit there listening to their amazing P&L run in the past 4 weeks, I can't help but remember this wonderful viral picture:

A sign of the times I suppose. No one gives a shit about value, and they definitely won't give a shit about energy investing.

Trying to Be Rational? Good Luck

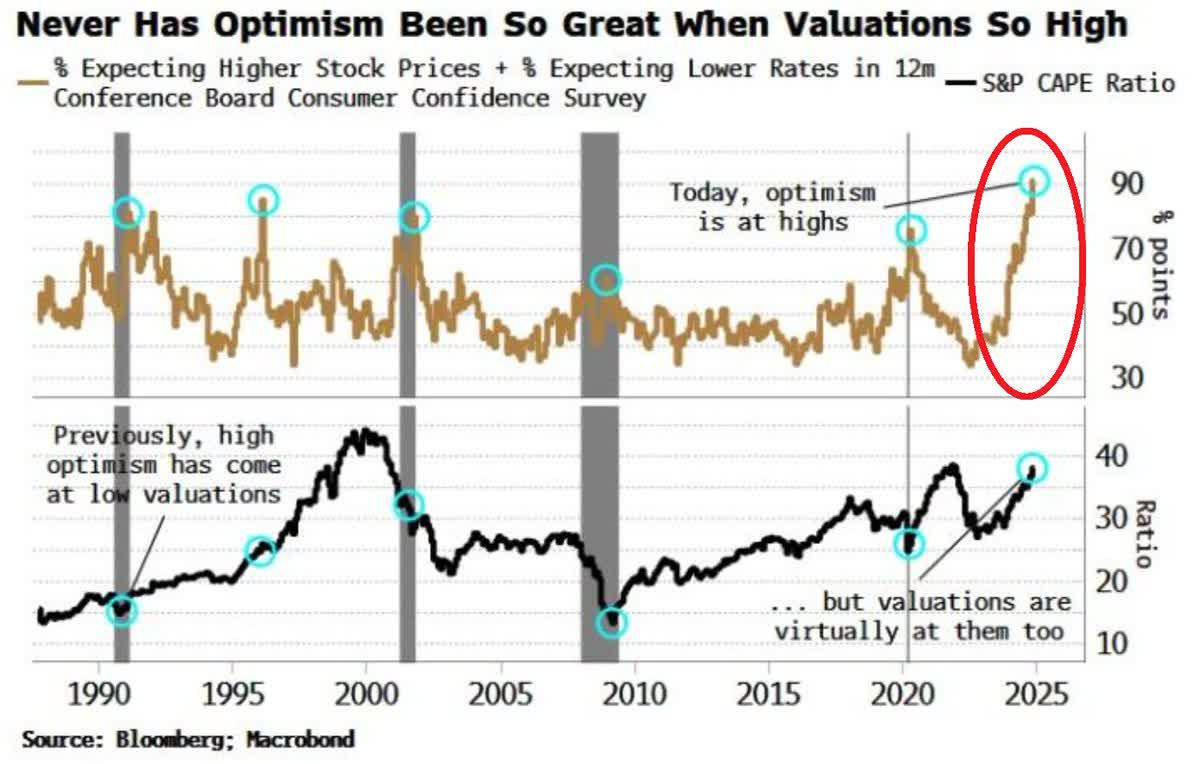

It's not easy being rational these days. I look on my X feed and all I see are people posting P&Ls and how they were right to have stuck through the 2022 bear market. Chest pounding and high fives are everywhere, all the while, investor euphoria is near an all-time high.

Source: Bloomberg, Macrobond

But it's not going to be easy calling the top in this either. While the S&P 500 trades at just a fraction of the P/E multiple it saw in 1999 (28.4x), strategists are calling for an even higher move.

P/E - 26x today

Source: Charlie Bilello

And if you go back and look at the P/E multiple from 1998 to 1999, it went from 27.8 to 28.4 on the back of a 16.7% increase in earnings. This pushed the S&P 500 up another 19.5%.

It's no wonder why strategists are all piling on the bull train expecting another move higher in stocks.

Source: Warren Pies

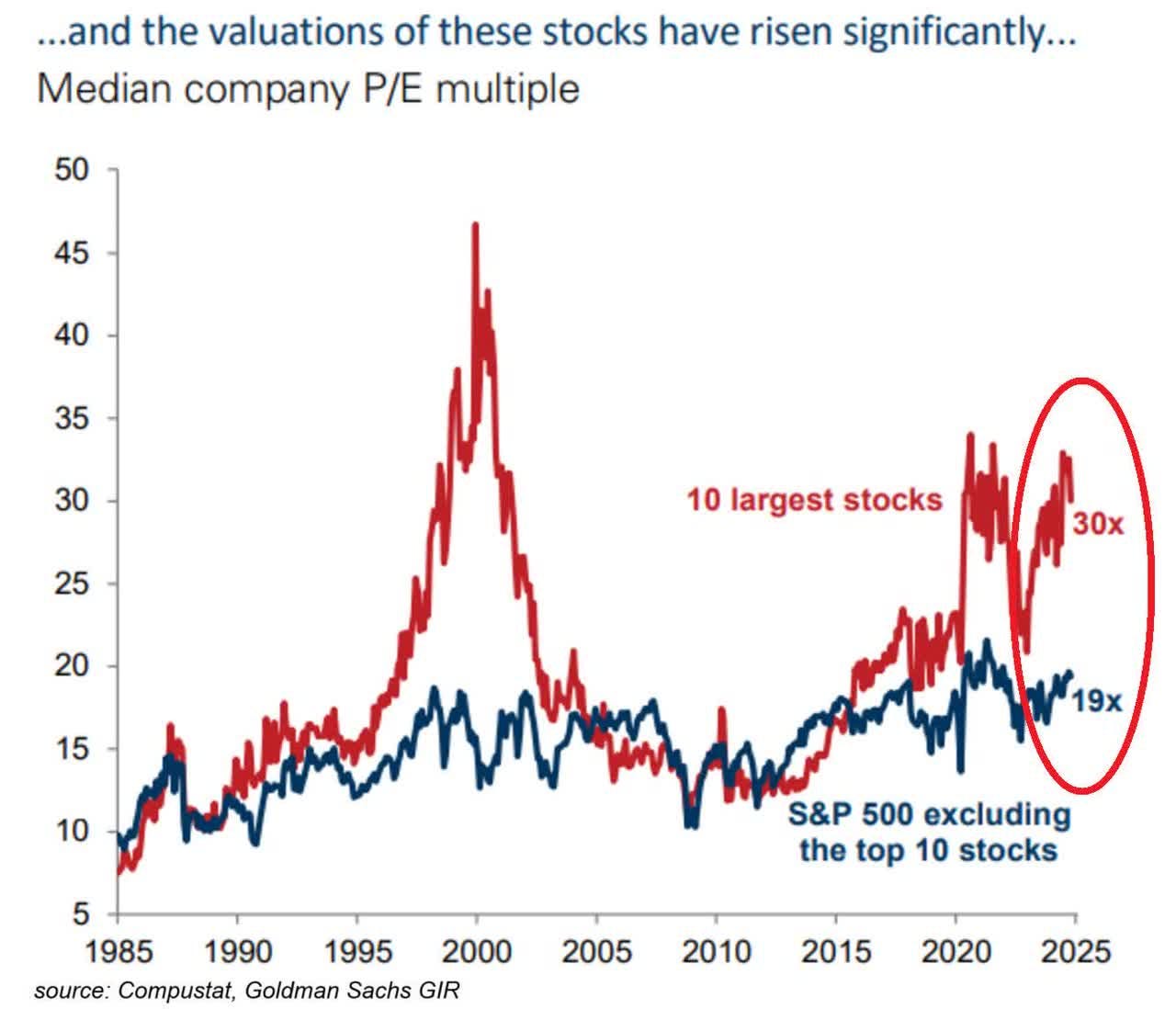

But this market is not your typical bull market, because the concentration is getting extreme.

For the market to rally further from here, either the S&P 490 will have to start moving disproportionally higher or most of the expansion will come from the top 10 largest stocks. Mag 7 will comprise most of that move and with valuations already elevated, another move up will only exacerbate the valuation disconnect.

And with everyone jumping on the bandwagon calling for another move higher, no one is going to give a shit about value investing. Let's face it. It's worked just 3 out of the last 10 years (2016, 2021, and 2022). Sadly, I don't think there are that many value investors left.

It's a dying breed, a sign of the times.

Extinct?

Market cycles can be undoubtedly cruel, but more so in the information age. With social media these days showing influencers capable of pumping new shitcoins to dump on their fellow followers without any worries over the regulatory backlash, it is a sign of the times that the old way of investing may be going extinct.

Or rather, people of this generation are not embracing what investing is in the truest sense. Perhaps guys who stick to the old ways will just go away with time, or perhaps, market cycles will play their cynical pivotal role and teach a new generation of investors what a euphoric bubble frenzy really is.

Time will tell. I don't have a crystal ball, but I can't help but ponder the consequences of the actions taken and the emotions of those who aren't partaking in this feverish frenzy. It's tough to stay rational because at times, it will feel that if you don't participate, you will go extinct.

But this is where the true definition of temperament comes in. Do you have the mental fortitude to stay inside your circle of competence and not do foolish things?

I guess this is where markets test the soul more than the brain.

But you should give a shit...

I'm here to tell you that you should give a shit. In the game we call life, the only thing that ultimately matters is the process we undertake. The process of how we do everything defines who we are. Perhaps people who are participating in the bubble frenzy have an extremely disciplined process, or perhaps they are just gamblers.

But what they do has no relevance to what you do. Rational investing, at its core, is keeping your mind even-keeled and not being impacted by exogenous factors. So long as you develop your circle of competence, and stay within that circle, things usually don't go wrong. It's when you start venturing into the unknown and speculate on things you have no right to speculate that the outcome usually punishes you.

My advice? Stay focused on the disciplined value approach. It might not feel like it's the right thing to do right now, but it will ultimately reward you in the long run. It always has.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

The meme photo was inadvertently created by @INArteCarloDoss

Great read.