My Latest Thoughts On My Bullish Bets On Oil And Natural Gas

We are currently bullish on natural gas and oil.

We are long natural gas through BOIL. We issued the trade alert on Jan 15 to paid subscribers.

We are long crude oil through USO and UCO. We issued the USO trade alert on Jan 13. The UCO trade alert was issued on Jan 21.

In this article, I will give you my latest thoughts on both natural gas and oil.

Oil

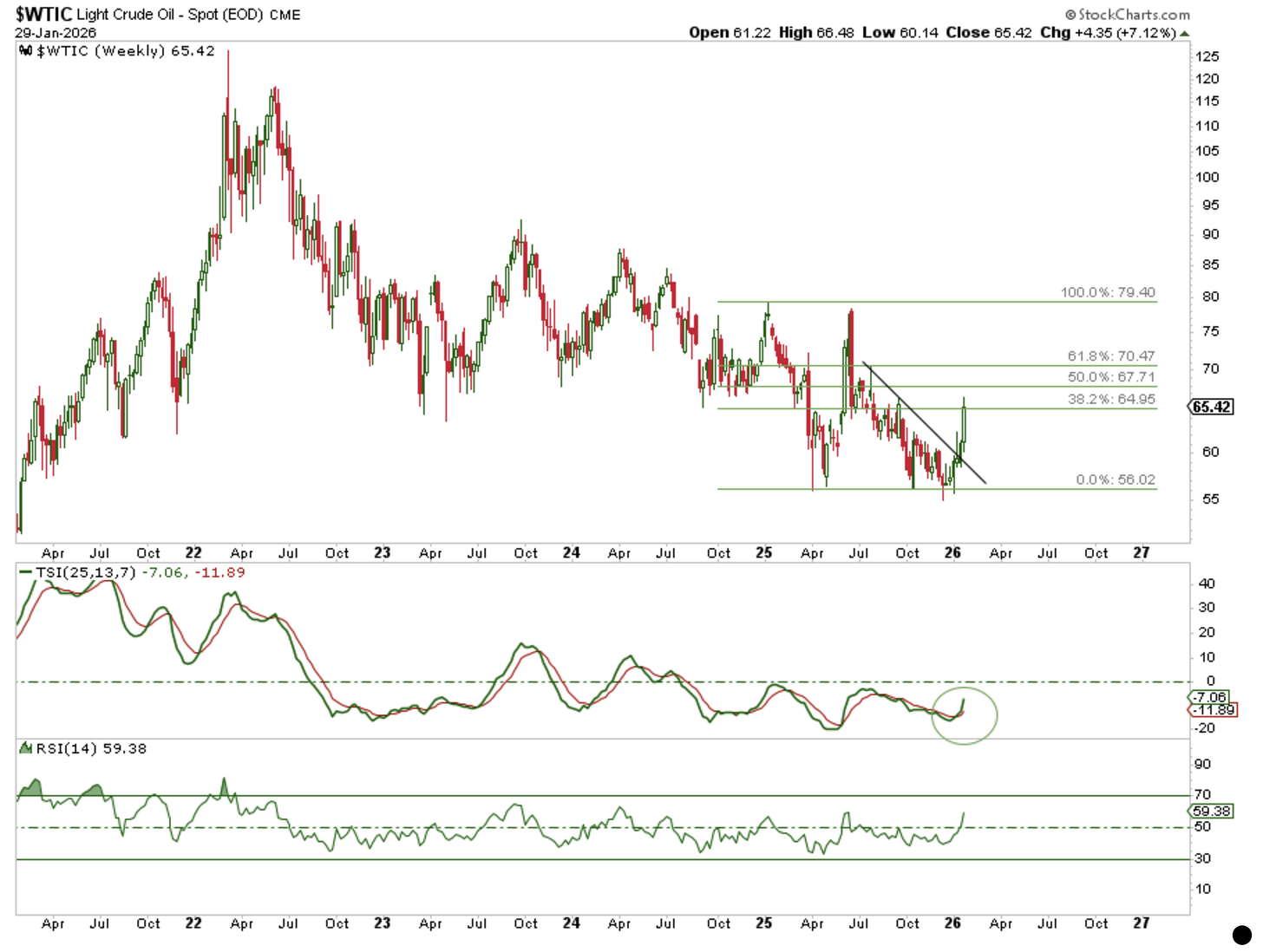

We were fortunate to have caught the oil market at an opportune time.

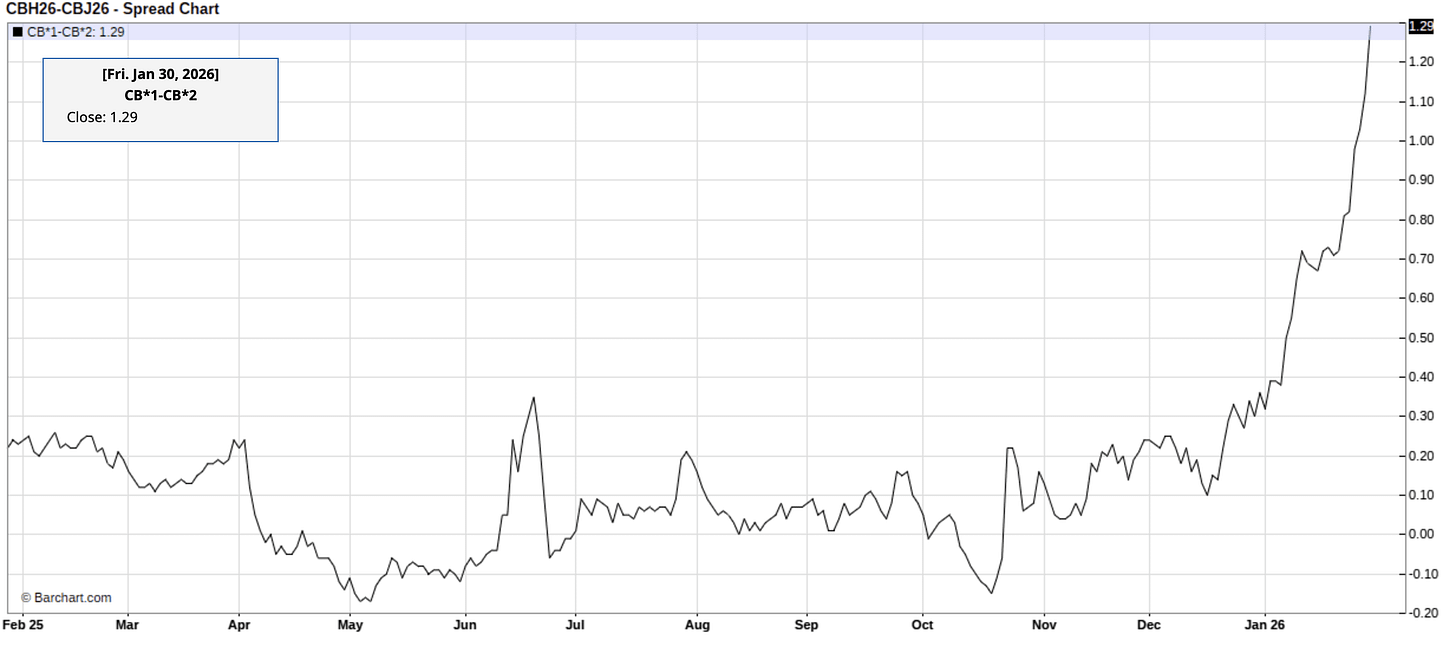

Implied oil balances to kick start 2026 were nowhere near the advertised 4+ million b/d. Crude timespreads remain backwardated and steepened as the year went along.

And with a bit of good fortune, colder-than-normal weather was projected after we went long USO.

But the market was apathetic initially to the colder-than-normal weather. Natural gas prices rallied steeply, but oil failed to gain any traction. This prompted us to initiate the UCO long trade.

Since then, WTI has rallied from ~$61/bbl to $65.42, and we think there’s upside to $70/bbl.

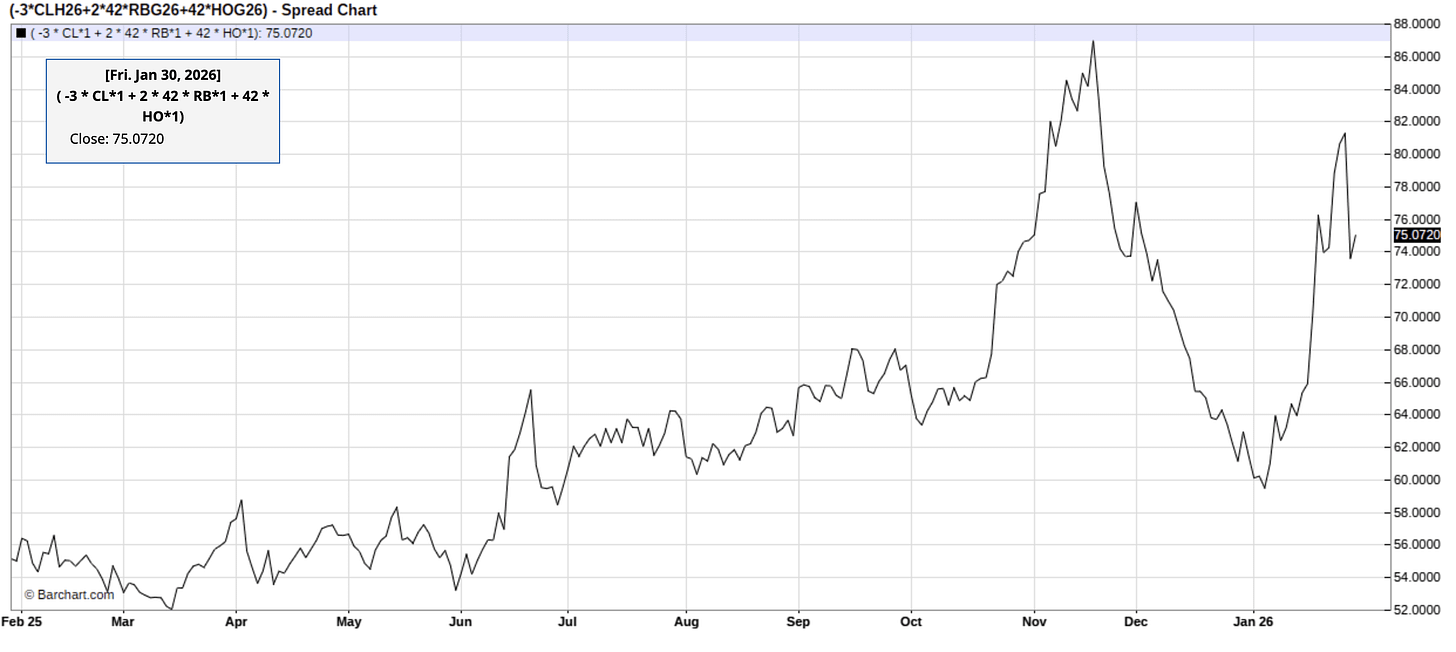

Fundamentally speaking, the colder-than-normal weather will boost heating-related demand, which should lower visible global oil inventories. Even if crude inventories build, product storage like distillate, NGL, and others will draw. The material decrease in refinery throughput will also keep crack spreads elevated for longer as some refineries opt to start the refinery turnarounds now.

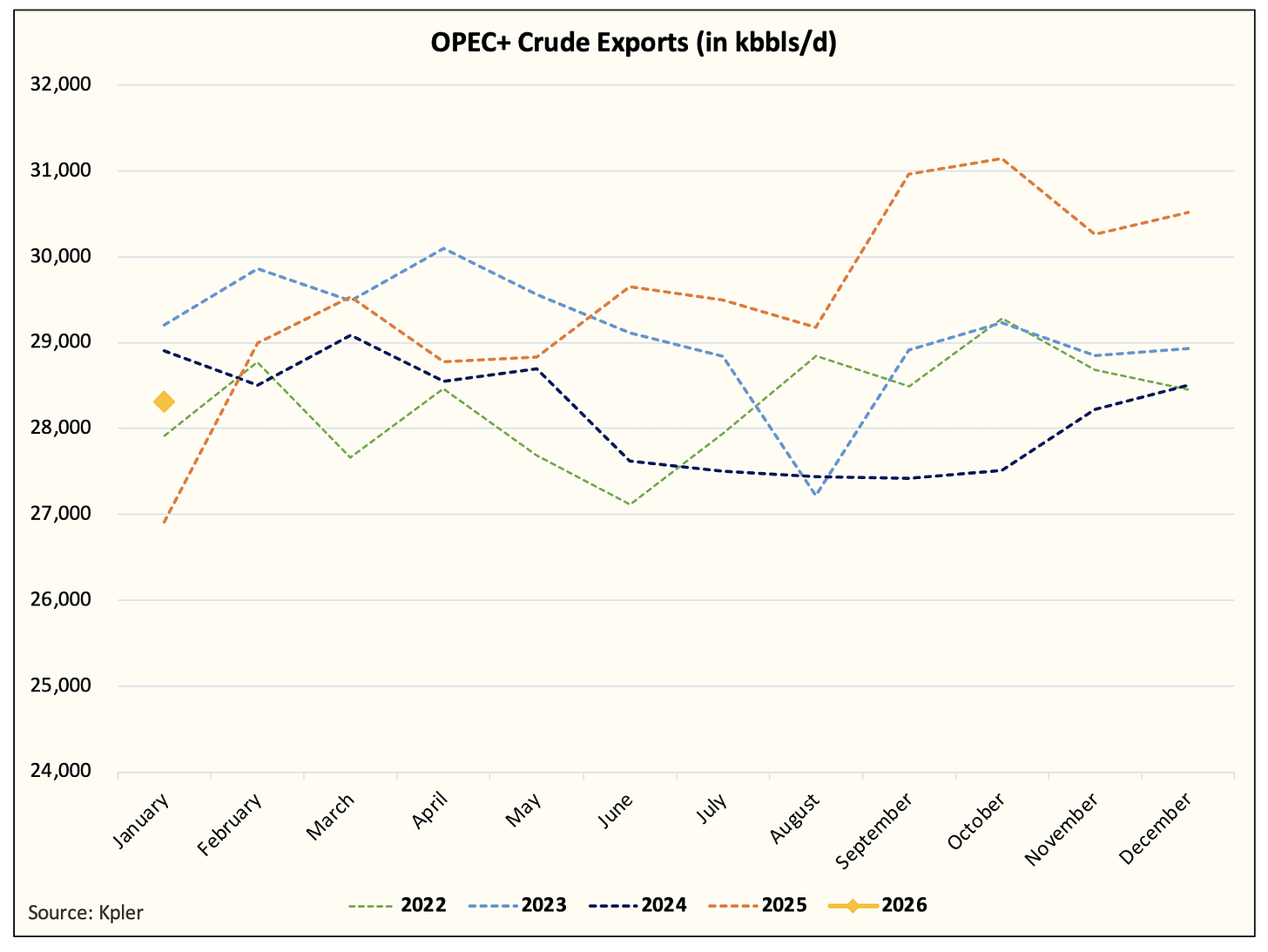

In addition, it appears that OPEC+ crude exports for January will be materially lower m-o-m.

Russia (including Kazakhstan) is down ~779k b/d. Brazil is down ~500k b/d. OPEC is down ~1 million b/d.

The decrease in crude exports has started to push global oil-on-water lower. On an implied balance basis, the surplus for Q1 is +1.4 million b/d. Once data becomes available for post-freeze week (Jan 30), we expect the surplus to decrease to +0.7 million b/d.

Looking at the weather data (more in the natural gas section), if February weather turns out to be slightly colder-than-normal, then we expect a similar surplus to continue, which should start to persuade market participants that Q1 2026 is not as bloated as advertised.

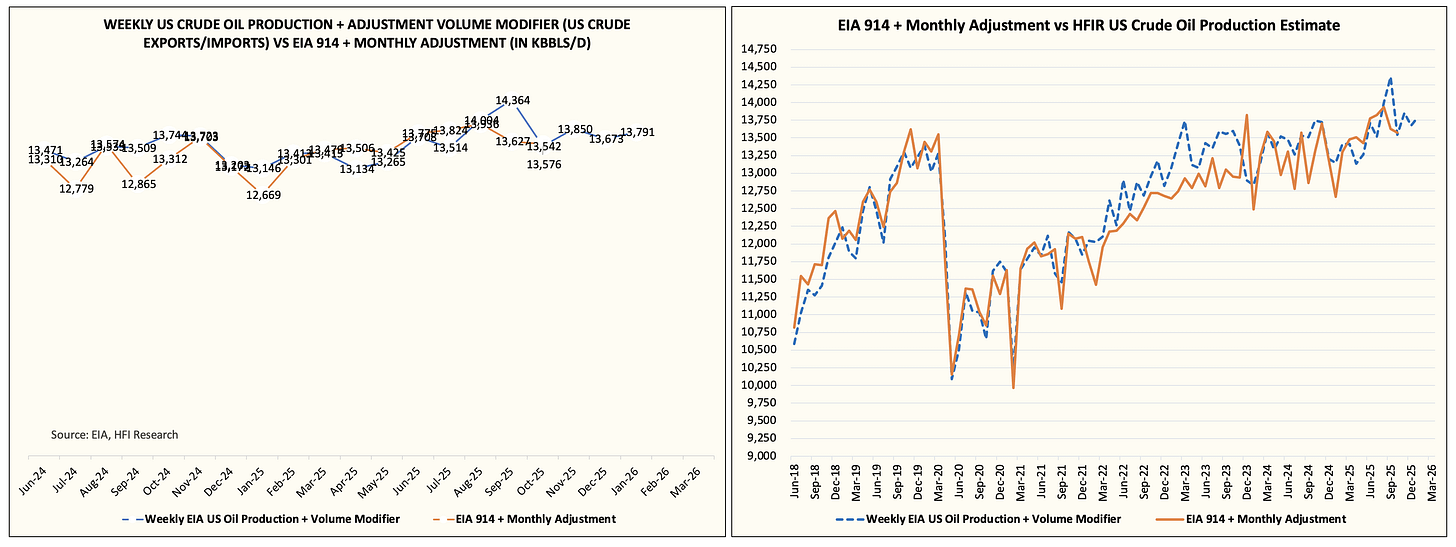

On the US crude oil production side, it’s obvious to us that the surge we saw in September is an anomaly.

In November, we wrote (following the EIA 914 release) that the data quality issue was a large part of the jump in implied US crude oil production. Despite this, EIA monthly petroleum supply reports have consistently reported “record” production while simultaneously reporting large negative adjustment figures. For those aware of the methodology, a negative adjustment figure implies overstated US crude oil production, while a positive adjustment figure implies understated US crude oil production.

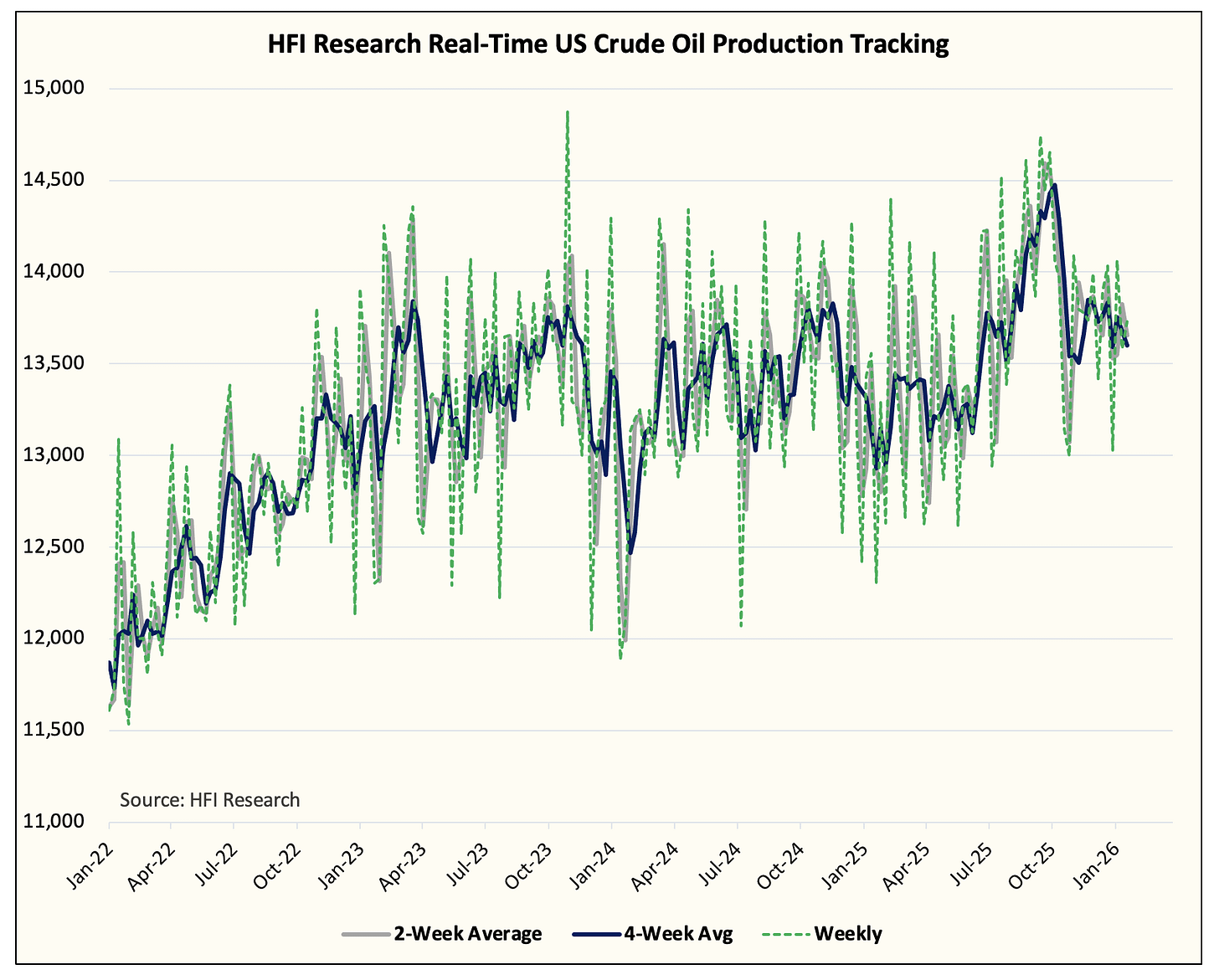

Based on our tracker, you can see that US crude oil production in October was around 13.55 million b/d. Our latest real-time figure puts US crude oil production around ~13.5 million b/d.

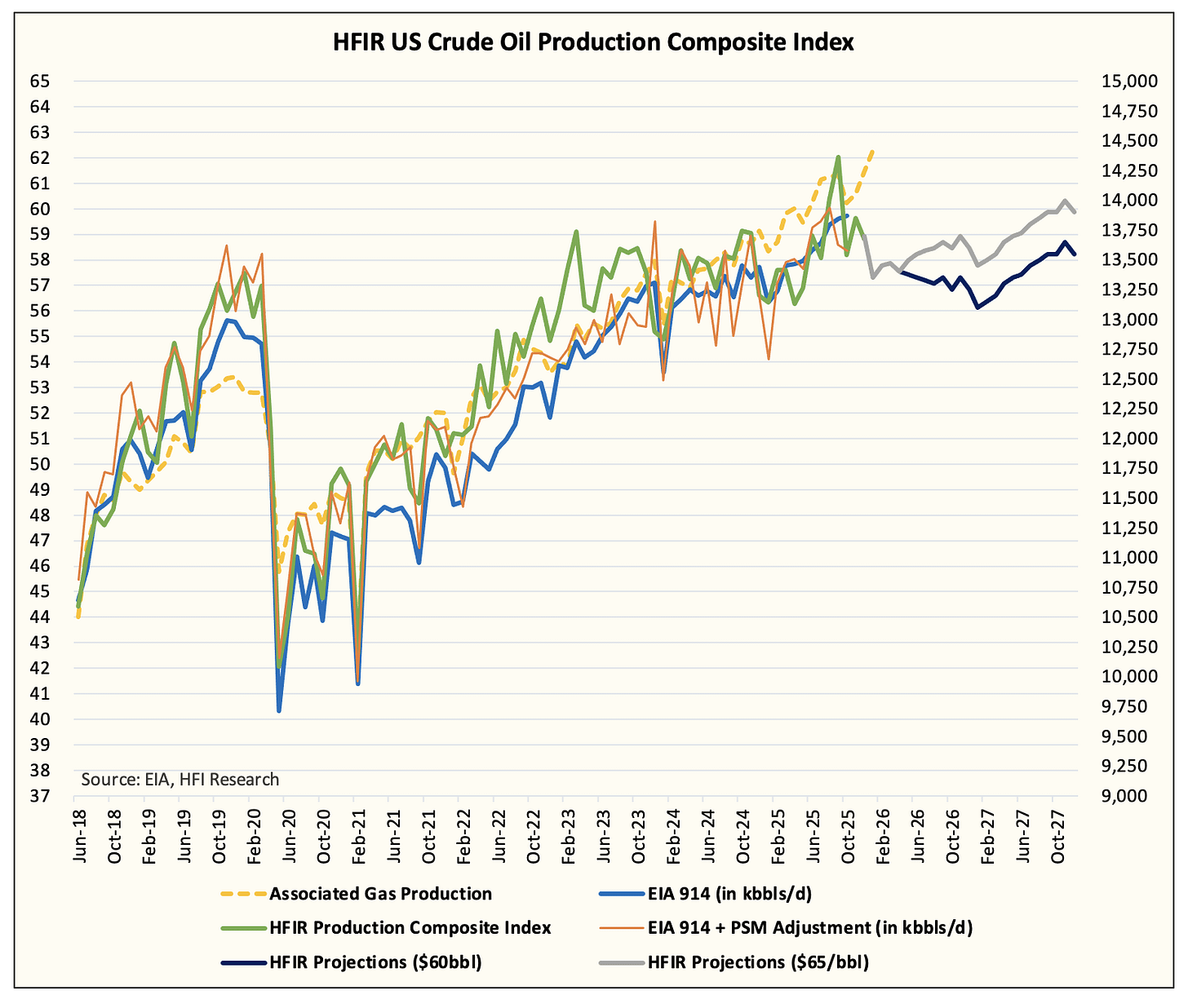

With that said, if WTI averages in the mid-$60s for the rest of 2026, we don’t think US crude oil production will decline to the low ~13 million b/d range.

At $65/bbl, we think the ~13.5 million b/d range would be the lows. Now that’s not to say production can’t just stay there for a long time, but the growth in US shale is all but over.

Even if Exxon manages to drill like crazy over the next 5-years, other producers will show declines, which will largely offset the growth. At most, US crude oil production can provide another ~700k to ~800k b/d growth. But it will decline quickly back to the ~13.5 million b/d range again.

Again, the production tracker doesn’t lie, and we’ve been averaging near this level since 2022. Official EIA data has not captured this.