My Latest Thoughts On Oil And Natural Gas With Winter Storm Fern On The Horizon

The natural gas market was upended this week following the bullish weather development that unfolded over the weekend. From a fundamental storage perspective, the jump in heating demand reduced storage by ~500 Bcf.

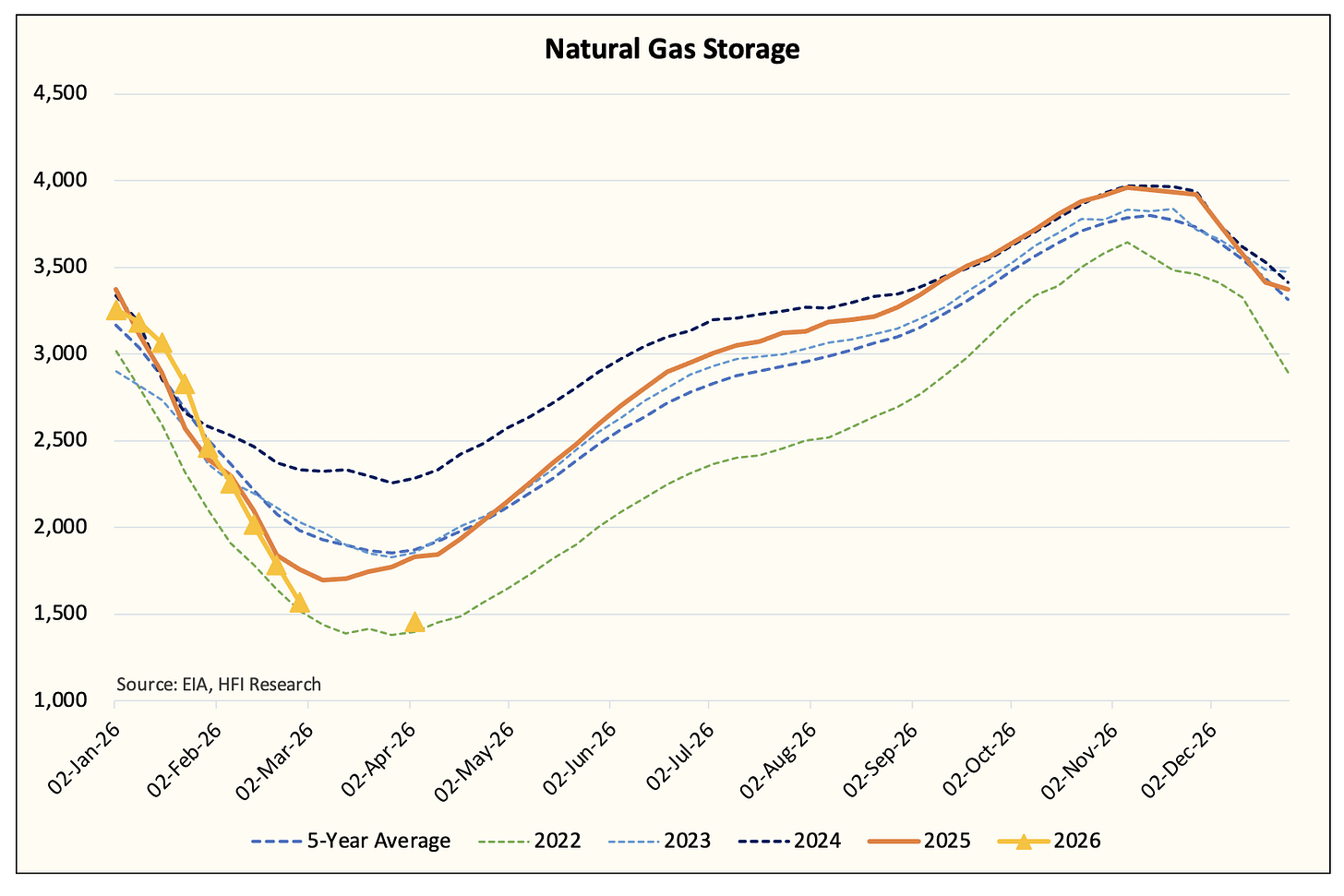

Based on the latest storage projections, we have US natural gas storage falling to ~1.5 Tcf by the end of February. Following the near term cold blast, the weather is expected to turn colder-than-normal again.

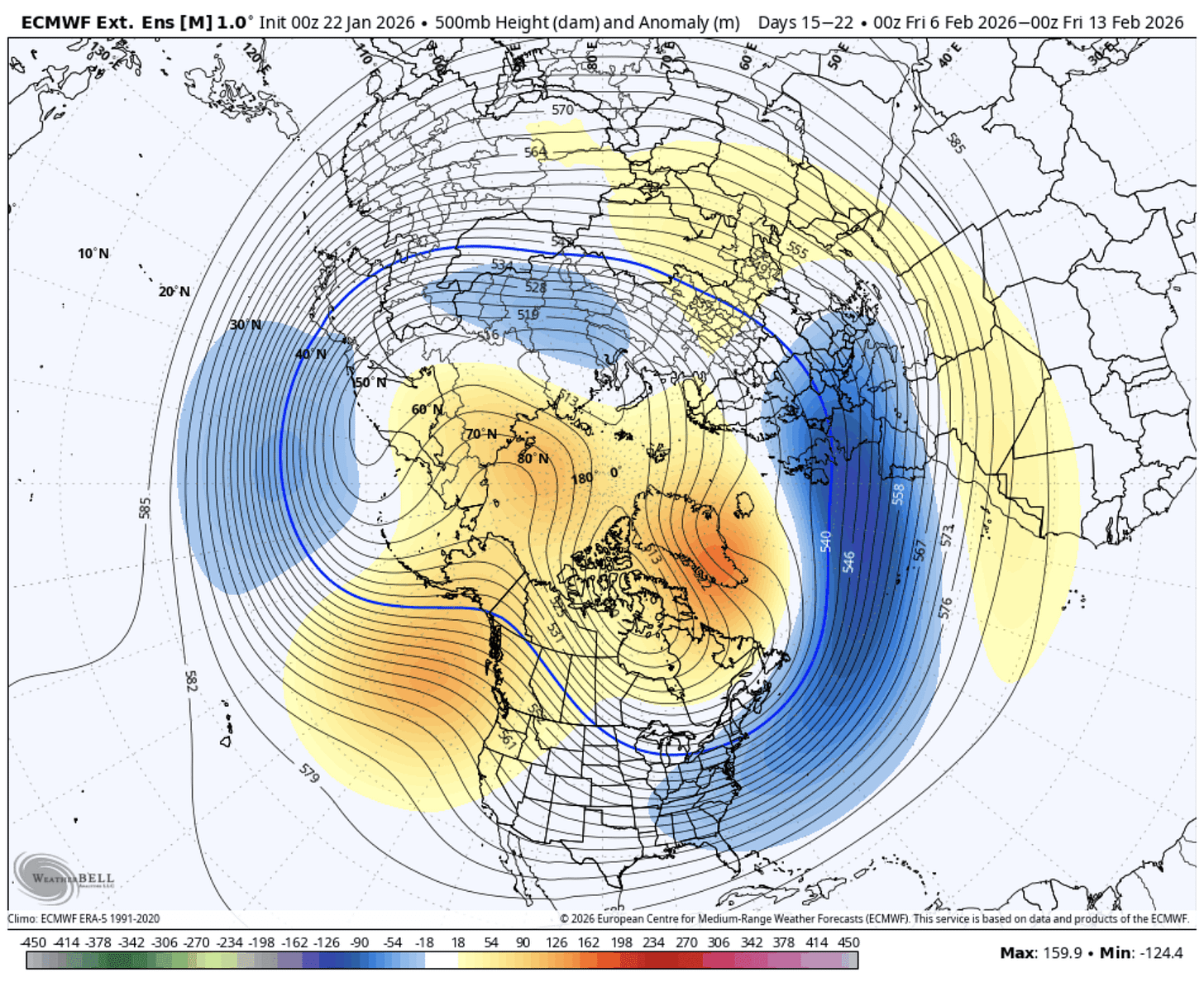

15-22 Day

Source: WeatherBell.com

In this article, I will go through with you my latest thoughts on both the oil and natural gas markets. Things are moving so fast that it’s hard to do long-format articles to summarize everything. Instead, I hope readers understand that I have to compile everything into one article to help clarify a few things.

Natural Gas

Natural gas prices took a breather today following another surge to start the trading day. Everyone is currently fixated on 1) how much production will be impacted by freeze-off, 2) if there are issues with power burn demand arising from power outages, and 3) how much heating demand will materialize.

We have not seen this much cold since 1985, and in the US shale era, we do not know what that implies for production freeze-off. To make matters worse, it seems like most energy tourists aren’t paying attention to any of the extended weather model forecasts. ECMWF-EPS weekly long-range is projecting another stretch of cold that lasts into the end of February. If such a forecast materializes, the natural gas market will start to price in the lack of storage scenario.