In this article, I will go through the following:

The extremely disturbing trend we are seeing in US shale.

My thoughts on OPEC+ and the policy going forward.

Trump and Iran's sanctions enforcement.

My oil price forecast.

An Extremely Disturbing Trend

This is the 3rd week in a row where EIA reported lower crude storage figures than our forecast. This implies that US crude oil production is meaningfully lower than our current forecast (13 million b/d).

Judging by the magnitude of the crude storage miss, implied US crude oil production is sitting at ~12.7 million b/d today.

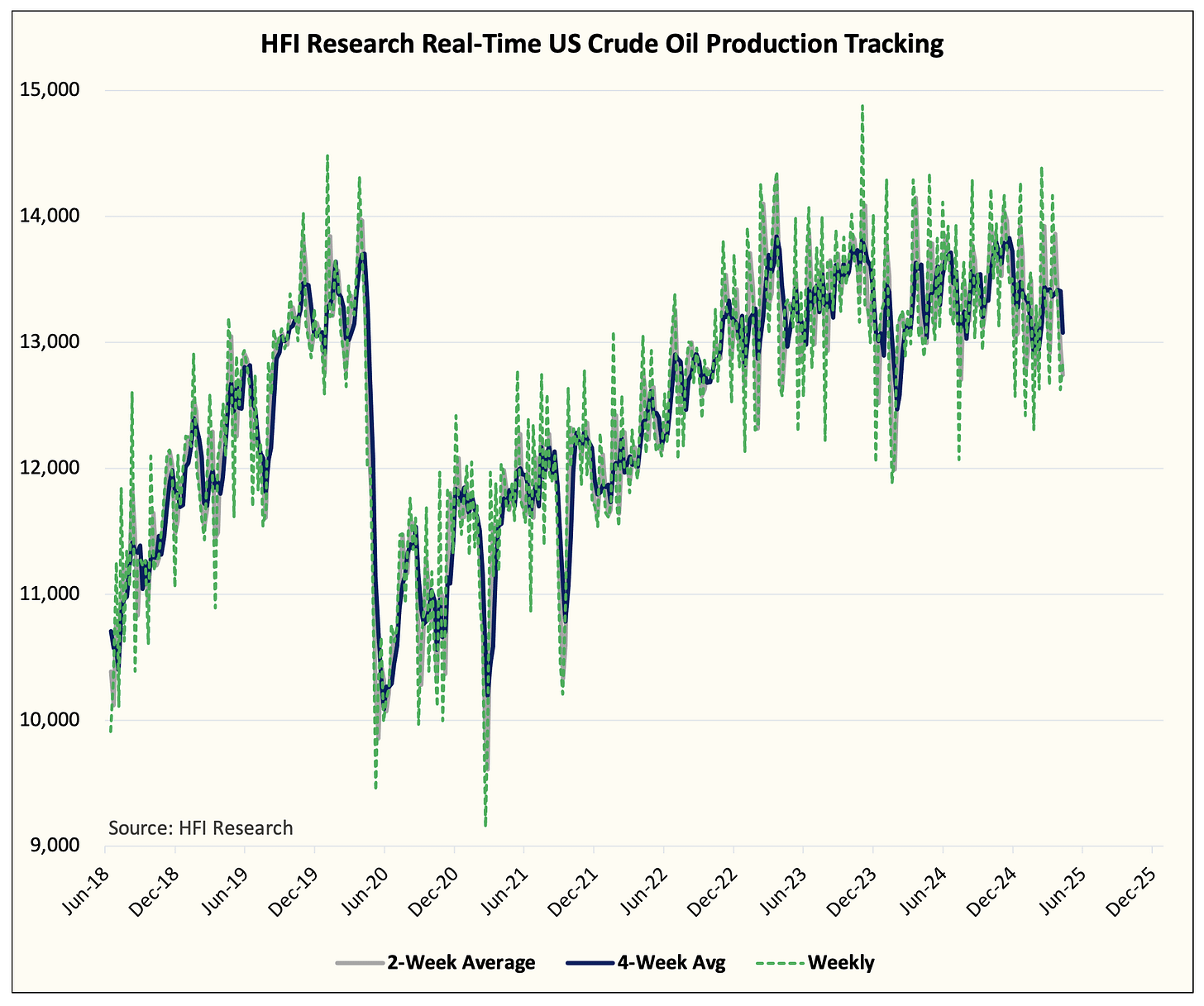

Our real-time US crude oil production tracker shows the recent weakness perfectly. This also aligns with everything we are hearing on the field. US shale producers have started to throttle back drilling/completion activity and delaying capex.

At $70/bbl WTI, management teams could not justify letting production decline when the economics still made sense and the free cash flow generation was plentiful enough to support share buybacks and dividends.

But at $62/bbl WTI, the economics changed, and producers have 1) the incentive to wait for higher prices and 2) the justification needed to preserve high-quality inventories. In addition, this downturn likely opens up another wave of M&A for the "haves" of the industry.

I am certain that top-tier producers like Diamondback are currently salivating at some of their competitors' misfortunes. The lack of hedging from some of the private producers coupled with increasing gas-to-oil ratio (GOR) is going to force them to look for an exit.

It's a good time to be a top-tier producer.

For the "have-nots" of the industry, the future is about as gloomy as gloomy gets. Well results are likely showing an explosion in GOR, which is precisely what we are seeing in the real-time data. The sub-par producers are going to have an increasingly difficult time in justifying more capex into the field as their all-in breakeven is closer to $70 to $75/bbl.

There are really only two exit plans going forward: 1) sell themselves or 2) let production decline.

But neither scenario is good. For the buyers, they know that the economics are going to be constrained at lower oil prices, so the purchase price will be lower than the PDP value of the asset. This is to compensate the buyer for 1) the risk of execution and 2) the uncertainty in the unproven assets.

For the sellers, selling your assets below PDP is like giving up your wallet with $100 in it for $75. If you don't have to sell, you will wait out the oil downturn, but that will imply lower production (base decline).

But for the producers with debt, the only avenue out of this would be to sell, so I think you will see more M&A resulting from this oil downturn.

So much for drill baby drill.

But the disturbing thing I'm seeing is that the recent disconnect in associated gas production and crude production is growing ever larger. This became more noticeable since WTI took a sharp turn to the downside.

I think if my analysis of the situation is correct and sub-par shale producers are having to meaningfully throttle back drilling/completion activity, the base decline of the assets almost inevitably leads to a higher proportional decline in crude vs gas.

This is precisely why we are seeing associated gas production remain elevated, while our real-time US crude production figure is falling.

Now I am mindful that the magnitude of the disconnect may be a bit overstated here, and I think we need 6 more weeks of data to confirm this, but I think we are broadly on the right track.

This is why I tweeted that April and May will be pivotal months in deciphering the future trajectory of US shale.

Fingers crossed.