There's a massive disconnect between what OPEC thinks global oil demand is doing and what reality is. For the first time in its existence, the IEA is going to be right about oil demand being weak this year.

OPEC oil demand assumption vs IEA

Now there's an important differentiator here. We've long criticized IEA for its "evasive" oil demand increase methods. One such method they have used in the past is by increasing oil demand from the previous year without changing the year-over-year demand growth. On the surface, oil demand growth year over year will look weak, but on an absolute level, it has increased.

So while it's fair to criticize the IEA for its evasive tactics, what's true this time around is that OPEC is likely far too optimistic about its demand assumptions, and the IEA is probably more right than wrong.

As you can see in the comparison chart above, the difference in demand estimate between IEA and OPEC in 2025 is a staggering 2.1 million b/d. This delta effectively explains why OPEC sees the need to increase its oil production versus IEA's call for a bloated market even if the current cut exists.

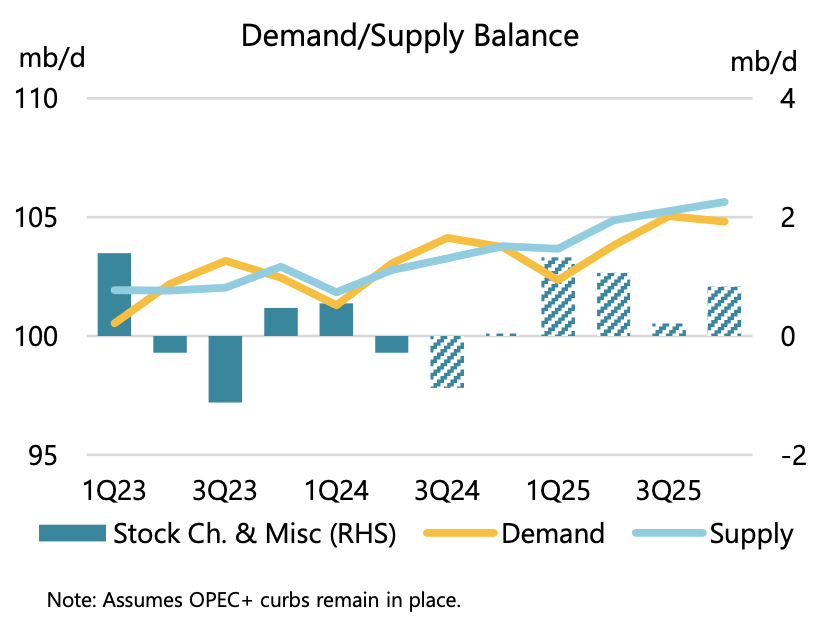

Source: IEA

In the years I've followed the oil market, I have never seen such a large disconnect in oil demand estimates for the incoming year. And there are major implications for the oil market and what OPEC has to do next.