My Updated Thoughts On Natural Gas And Why I Think The Market Is Still Not Pricing It Correctly

Natural gas (Feb contracts) rallied 25% today, but I don’t think the market is pricing in the incoming cold correctly. Despite the large jump, here’s my fundamental explanation for why.

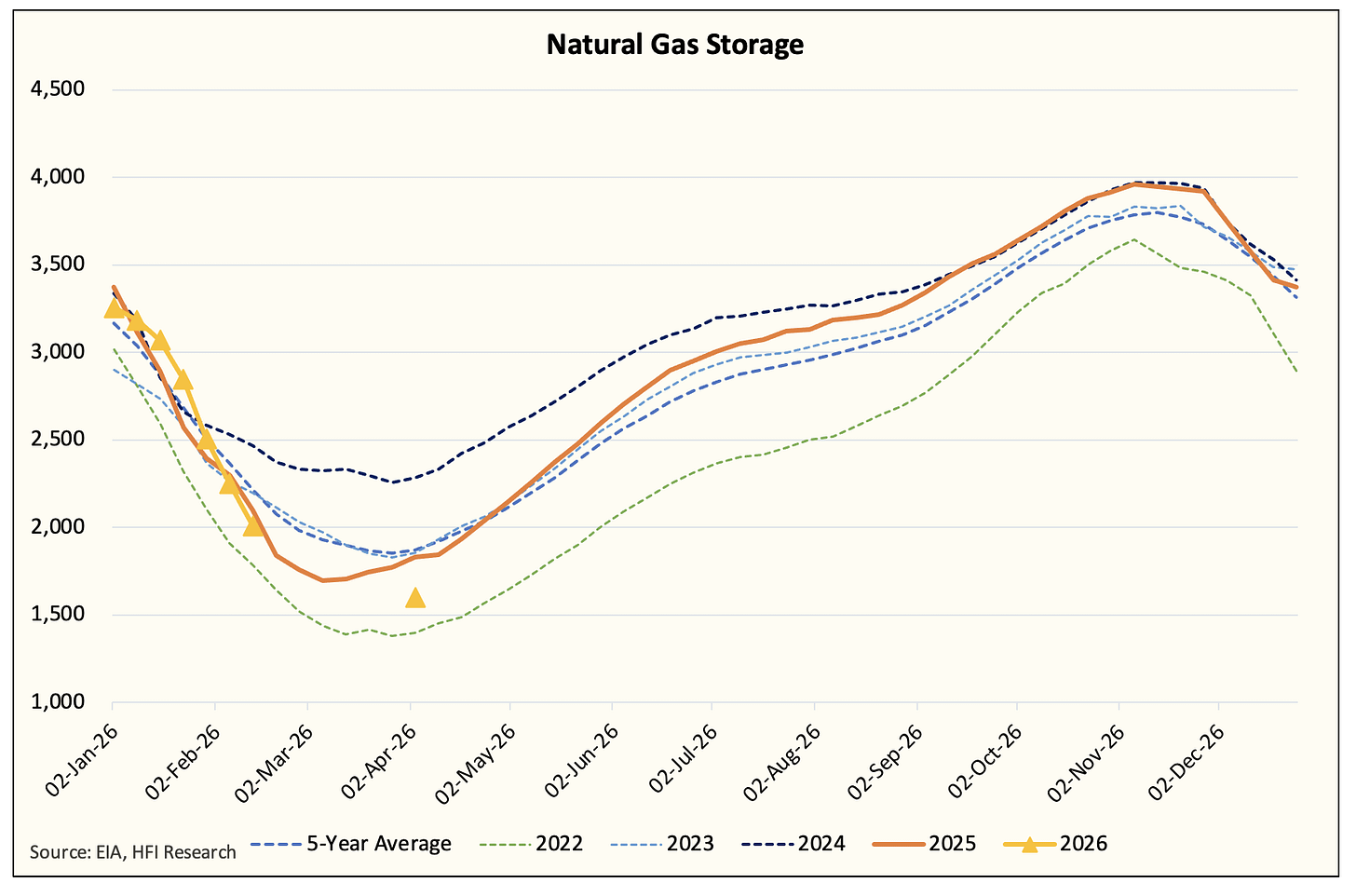

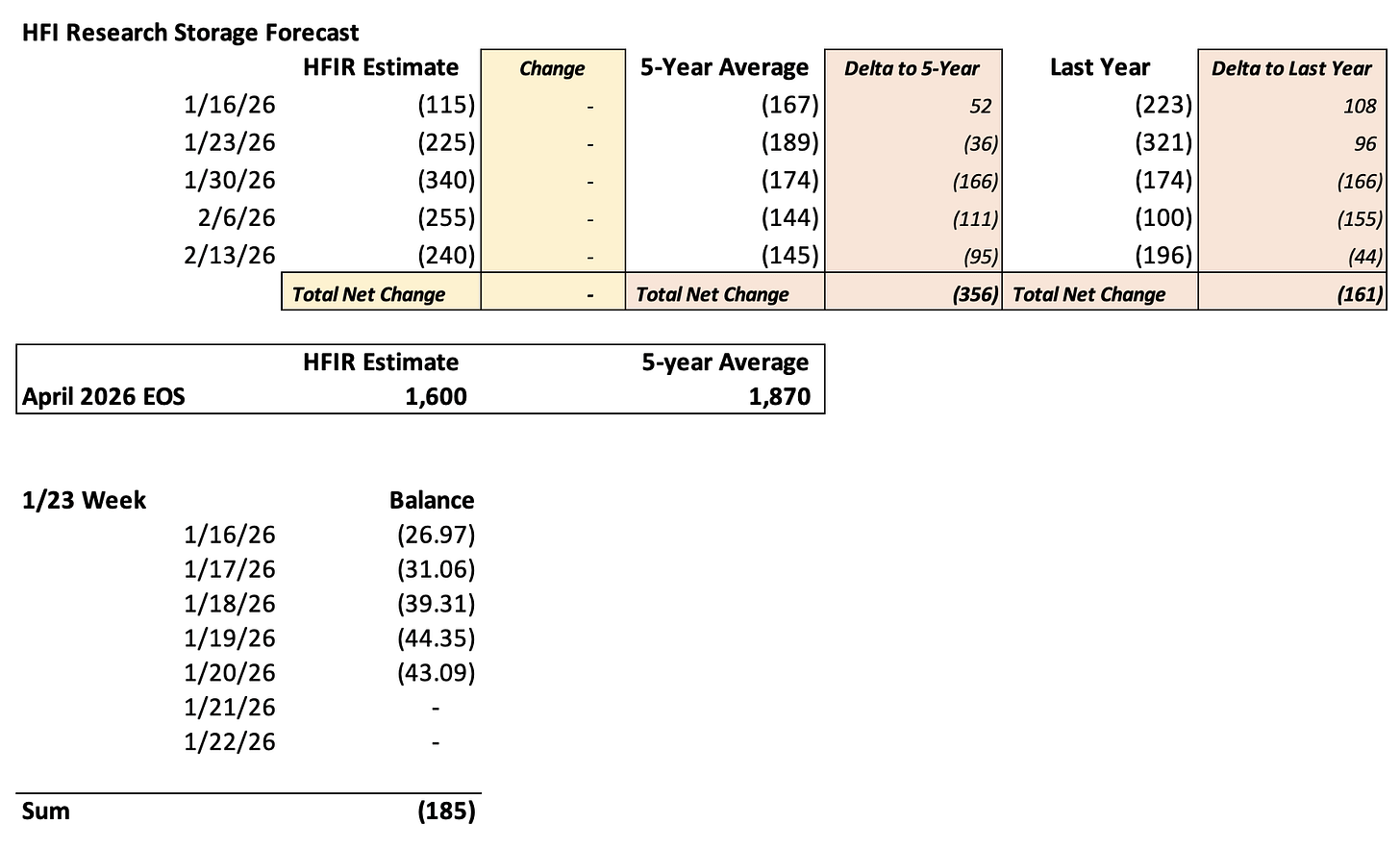

Based on the current projected heating degree days, we are forecasting US natural gas storage to be ~2.01 Tcf by Feb 13 week.

If you were to use the 5-year average storage withdrawal from 2/13 to 4/3 week, you would get a total withdrawal of 349 Bcf. This would put US natural gas storage at 1.661 Tcf. As I will explain below, not only is this not currently priced in, but I also think the market is not pricing in the potential for longer cold risk.

Explanation

Winter natural gas trading is extremely volatile because any sustained cold or sustained warm weather can push storage levels to extremes.

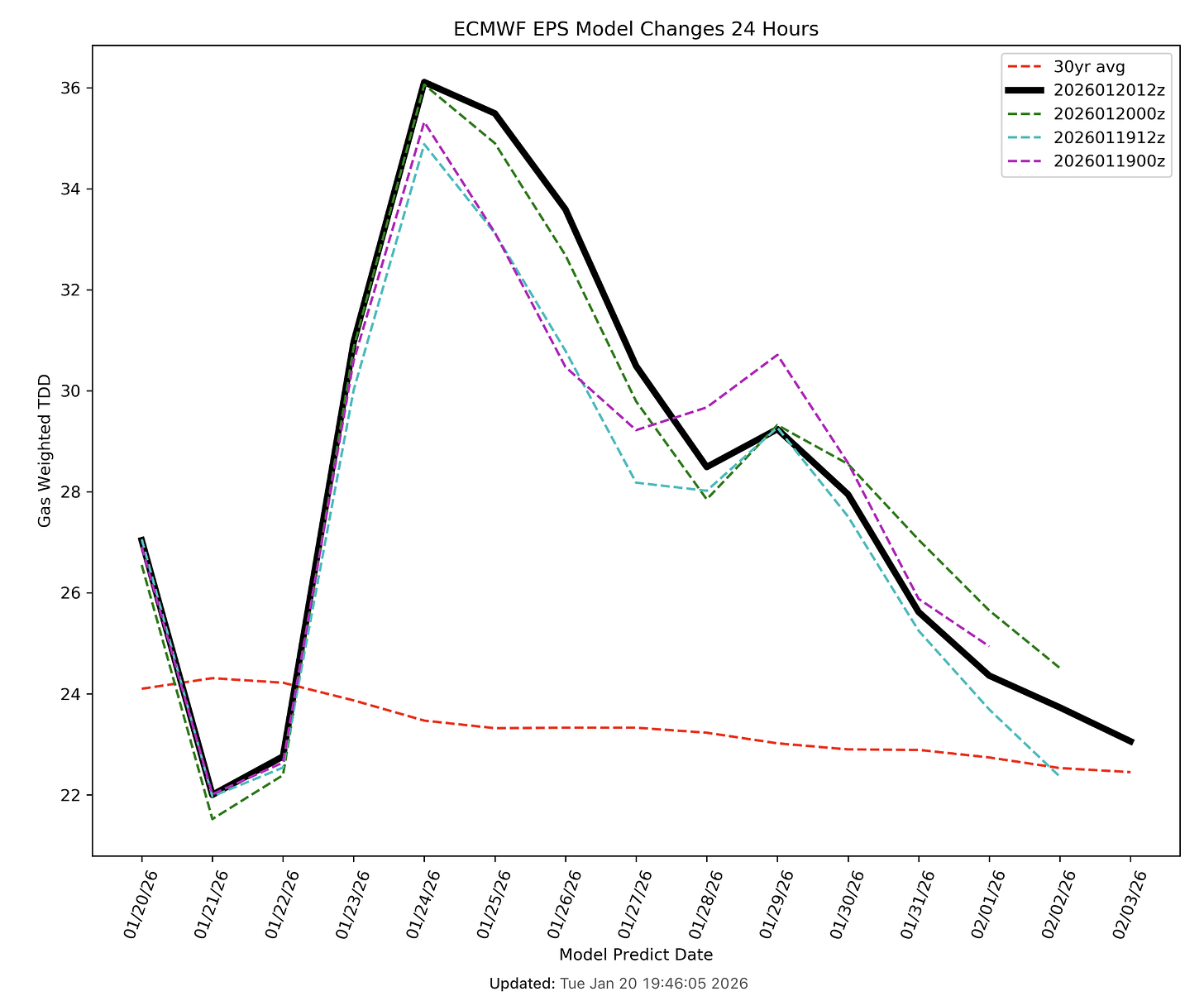

Luckily for the bulls, the bullish jump in heating degree days has catalyzed the market, but the upside doesn’t usually get priced in all at once.

The market can’t be that efficient because, for starters, anyone who bought natural gas last week is looking at the price jump and thinking they should immediately take profits. There are also other commercial reasons why prices don’t usually reflect the “fair value” right away. Then, to top it all off, it’s the weather we are talking about, so even in the face of a materially bullish change, traders will remain skeptical, wary of more weather model volatility ahead.

Fundamentally, the weather changes over the weekend materially changed the trajectory. As we wrote in our earlier natural gas update, the heating demand changes increased projected withdrawals by at least 220 Bcf. But with higher certainty of the incoming cold, we have published the latest storage projections:

Relative to the 5-year average, the next 5 natural gas storage reports will be 356 Bcf higher. We are projecting -340 Bcf for the 1/30 week as this will capture the entirety of the “cold blast” we see in the 15-day forecast.

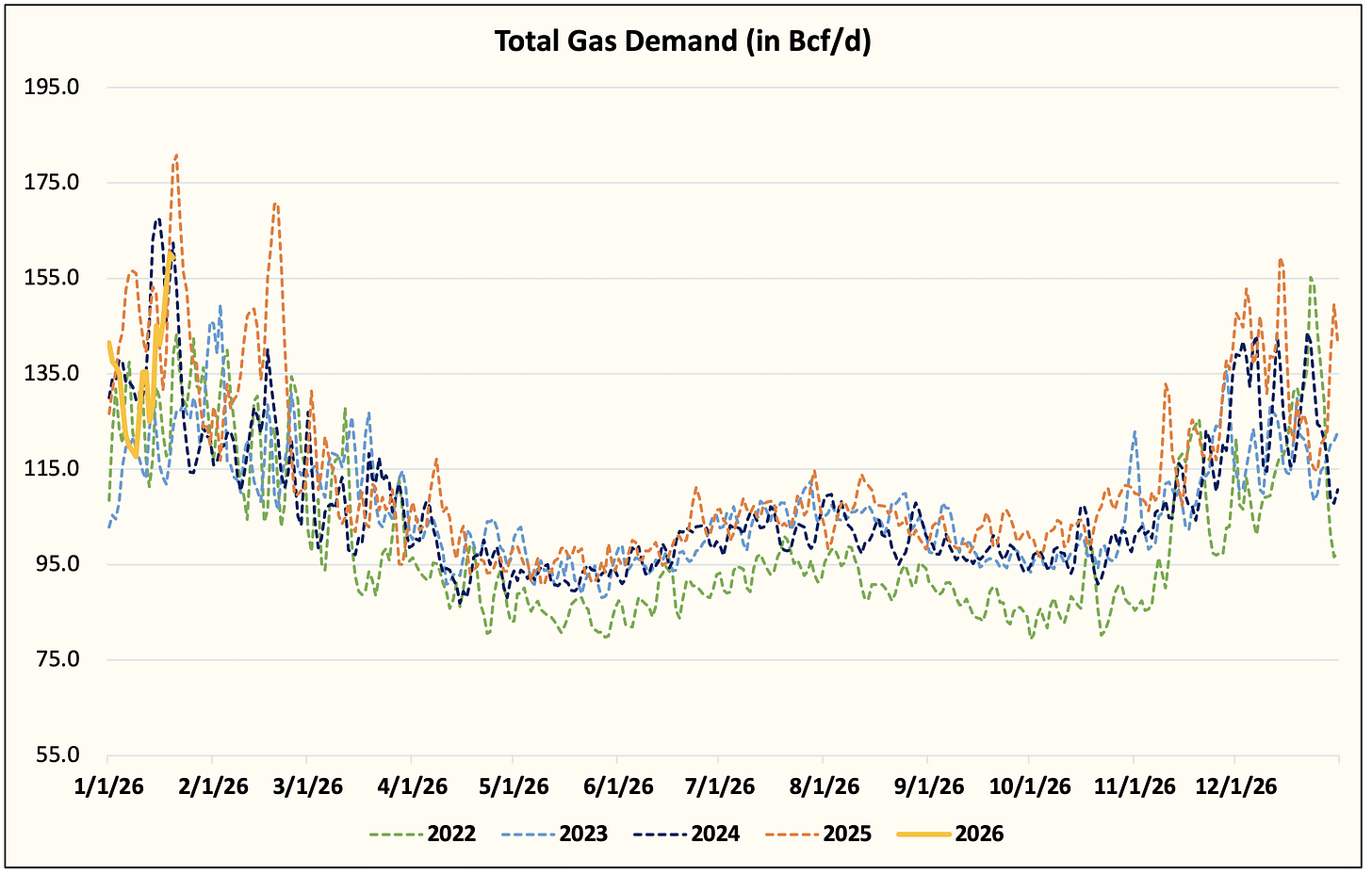

Looking at it from a supply & demand standpoint, total gas demand will hit an all-time high on January 24.

Gas-weighted heating demand will be ~33% higher than today’s reading, and total gas demand has already eclipsed ~160 Bcf/d. This will be very unprecedented. I don’t think people are going to be able to model this correctly (including us).

Taking this uncertainty into account, there’s a better than 50% chance that our withdrawal estimate of 340 Bcf is likely to be on the lower end.

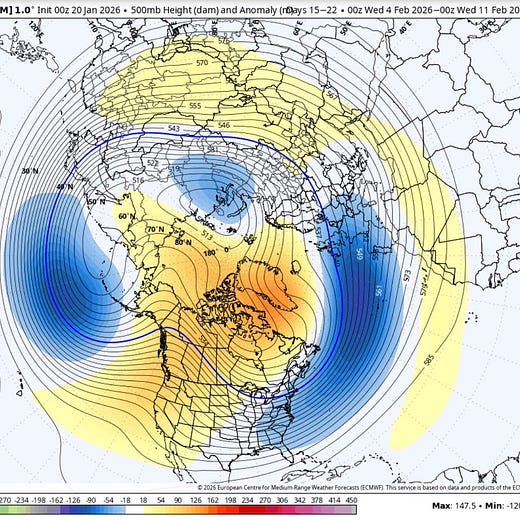

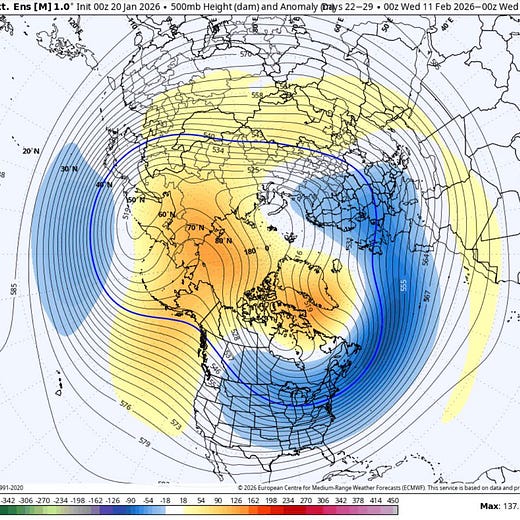

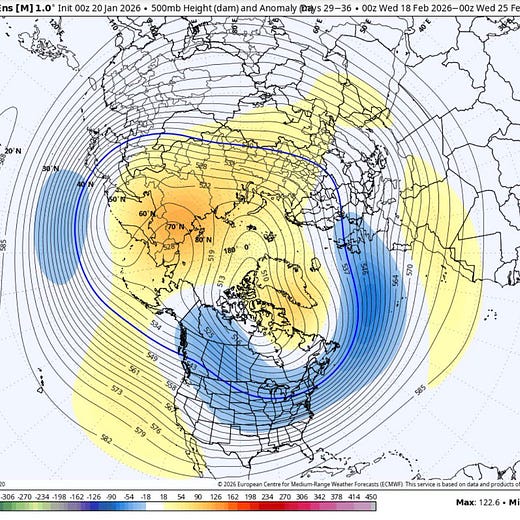

But as you can see in the latest ECMWF-EPS TDD chart, persistently high heating demand is projected after January 23. This trend continues into February where the latest ECMWF-EPS long-range shows persistently colder weather as well.

If such a scenario materializes, this is what our storage projections look like: