On Feb 11, we issued a trade alert notifying subscribers that we went long UNG and BOIL. These were the reasons that drove the rationale behind the long position:

Natural gas prices relative to storage are low. The market has already discounted the lack of cold risk into the price.

Weather models will have a lot of variability in the coming days, and with the market already positioned on one side (bear side), we thought the risk/reward would be favorable.

Here are my latest thoughts on natural gas.

The Weather

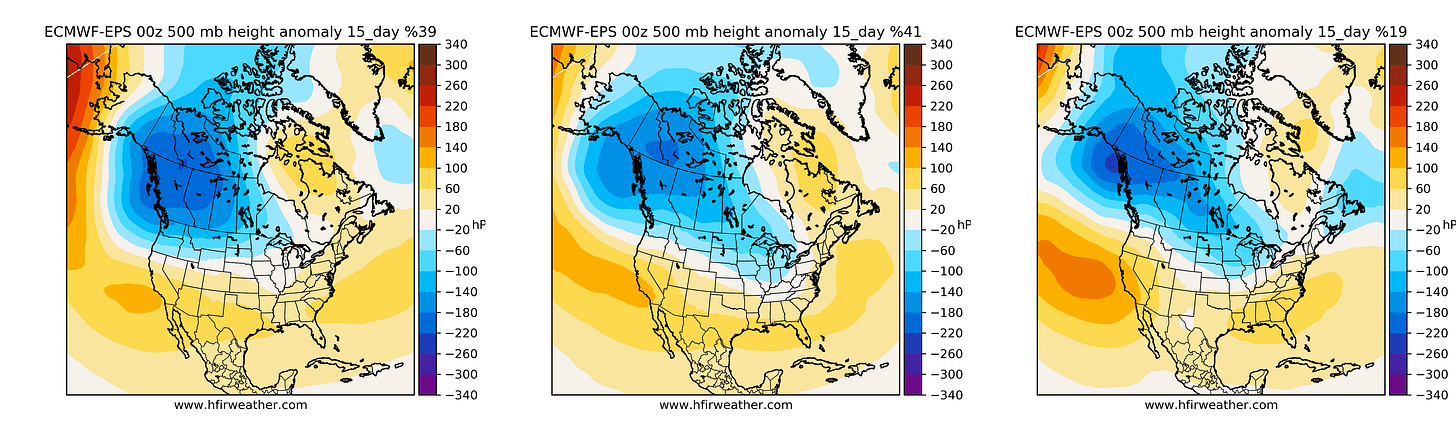

Currently, the outlook is not favorable for the bulls. The current 15-day forecast shows warmer-than-normal weather on the horizon. The infamous Alaska trough (blue in Alaska) makes a return, which usually foreshadows warmer-than-normal weather.

To make matters worse, ECMWF-EPS long-range outlook suggests that there’s no cold risk until mid-March.

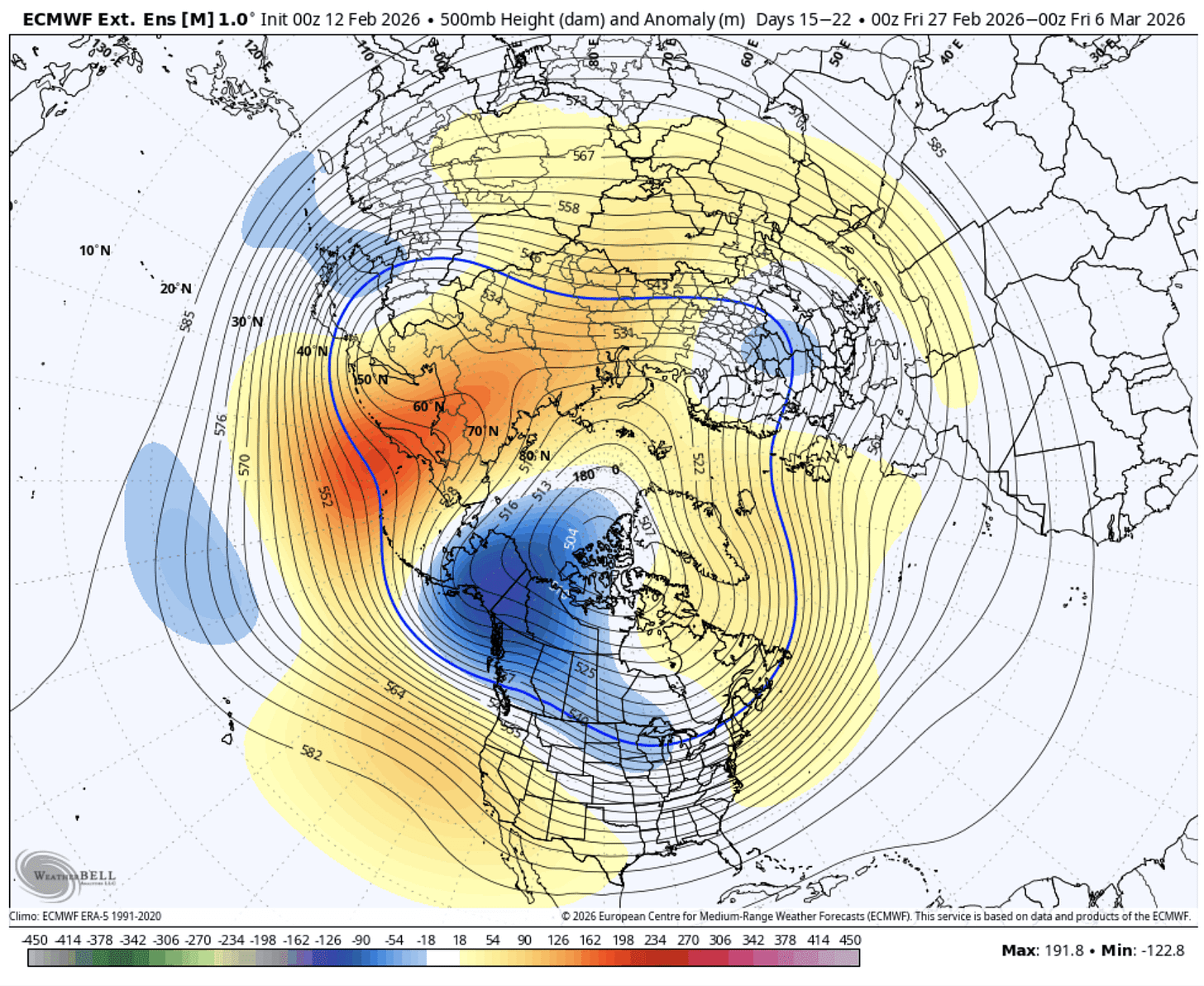

15-22 Day

Source: Weatherbell.com

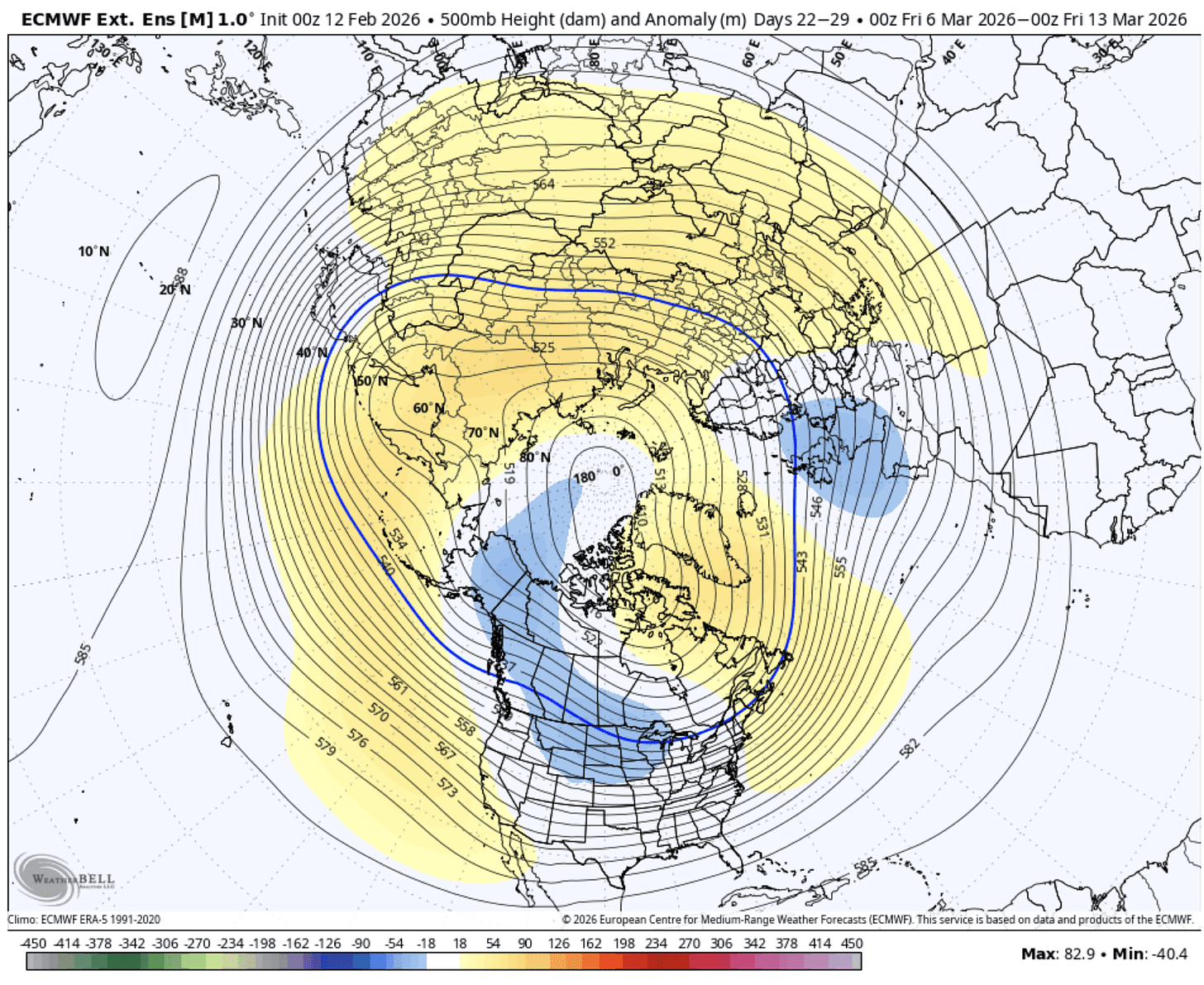

22-29 Day

Source: Weatherbell.com

It’s important to keep in mind that ECMWF-EPS weekly has the tendency to flip on a dime.

In this case, the Alaska pattern is the most important variable to watch as any subtle changes there could have a material impact on the heating demand forecast.

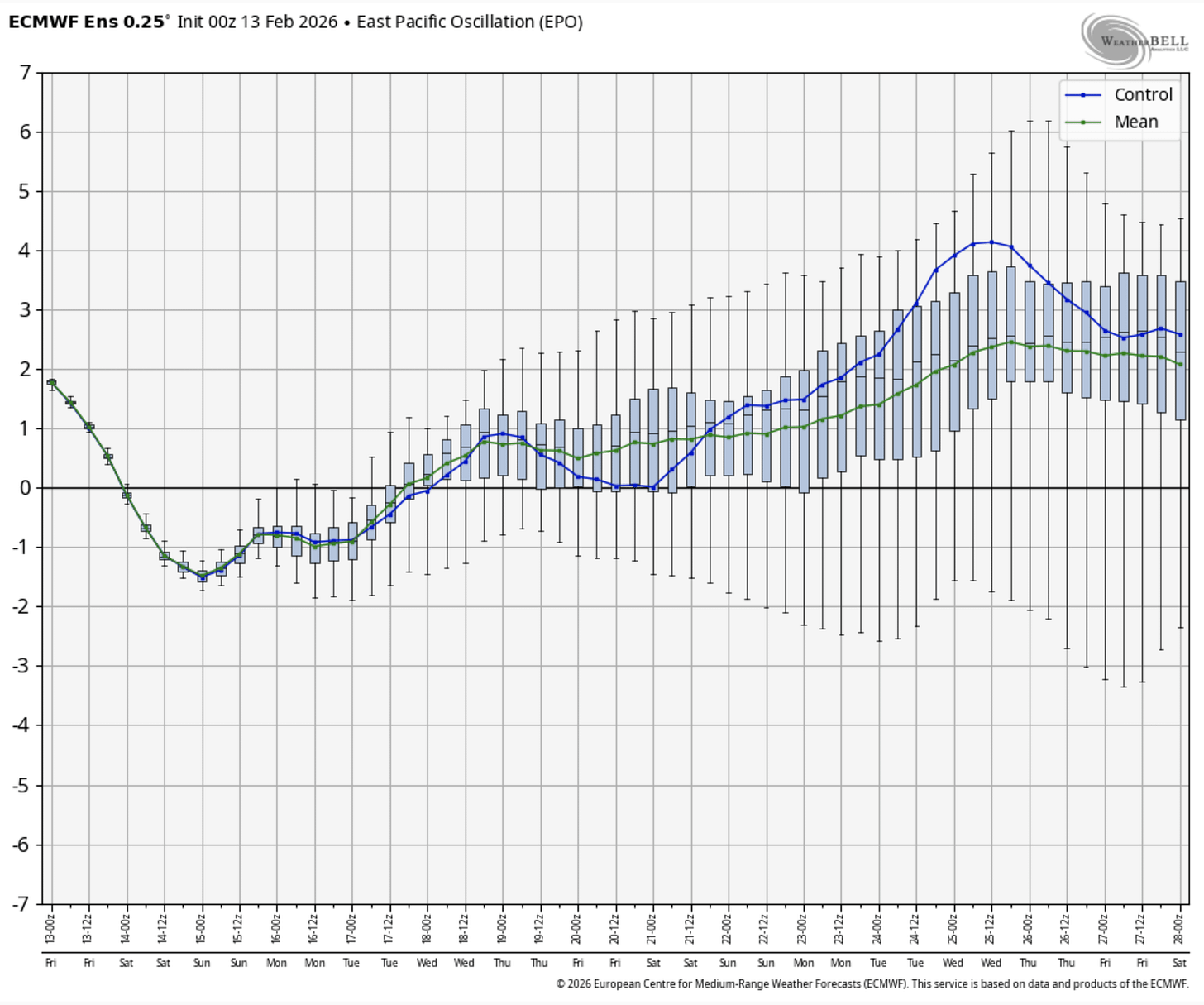

Source: Weatherbell.com

The Eastern Pacific Oscillation, or EPO, needs to trend negative to signal the return of the Alaska ridge (red in Alaska). As you can see in the teleconnection chart above, the variability remains wide amongst the 101 ensemble members. The mean has been trending higher, and we have not seen any meaningful loss in heating degree days. This is a good sign, but it’s not a signal the bulls want to see lasting any longer.

The other teleconnection signals are more mixed.

Source: Weatherbell.com

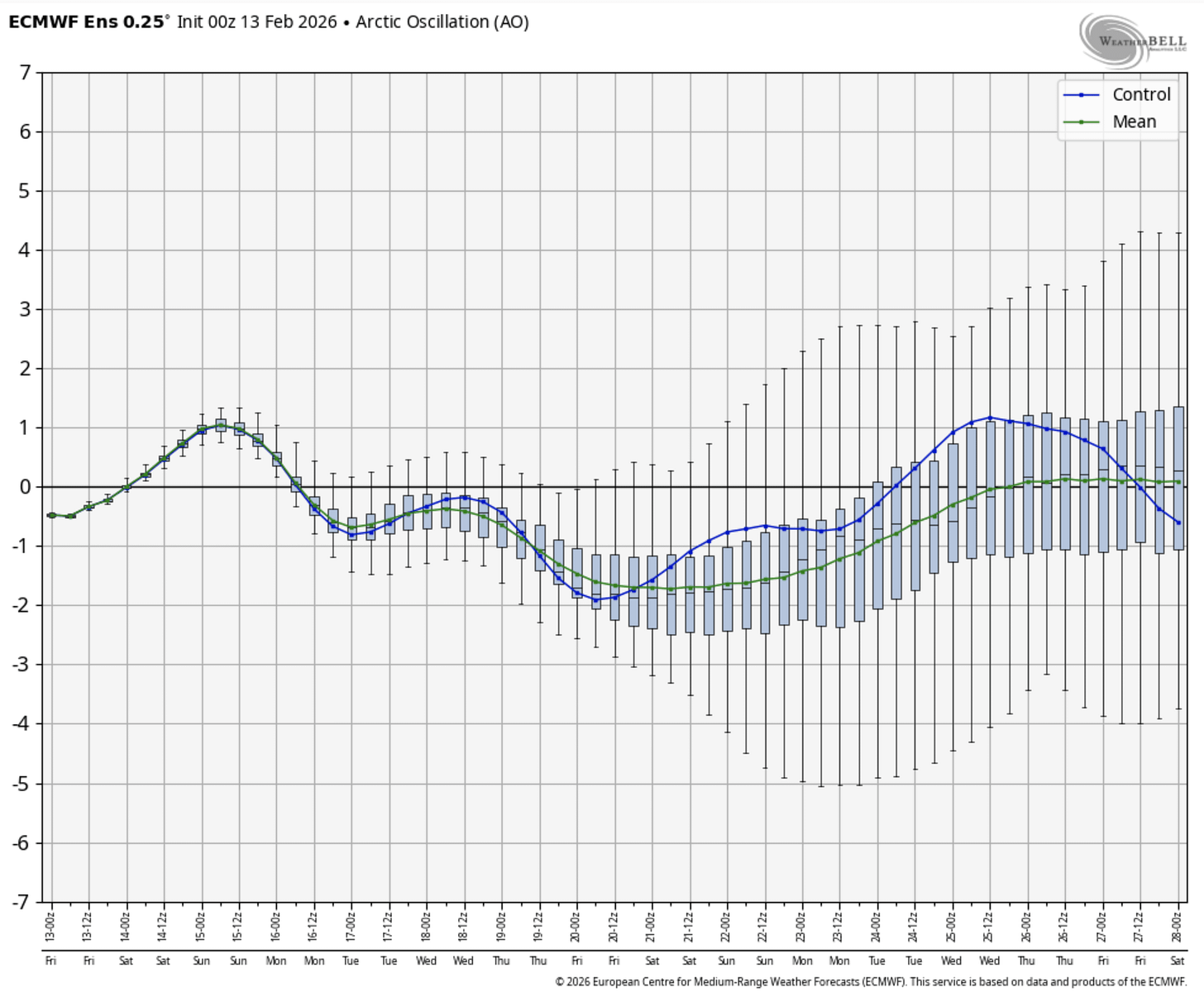

The Arctic Oscillation is also showing a lot of variability with the ensemble members showing a gradual negative trend. If AO remains negative, this is good news for the bulls.

Source: Weatherbell.com

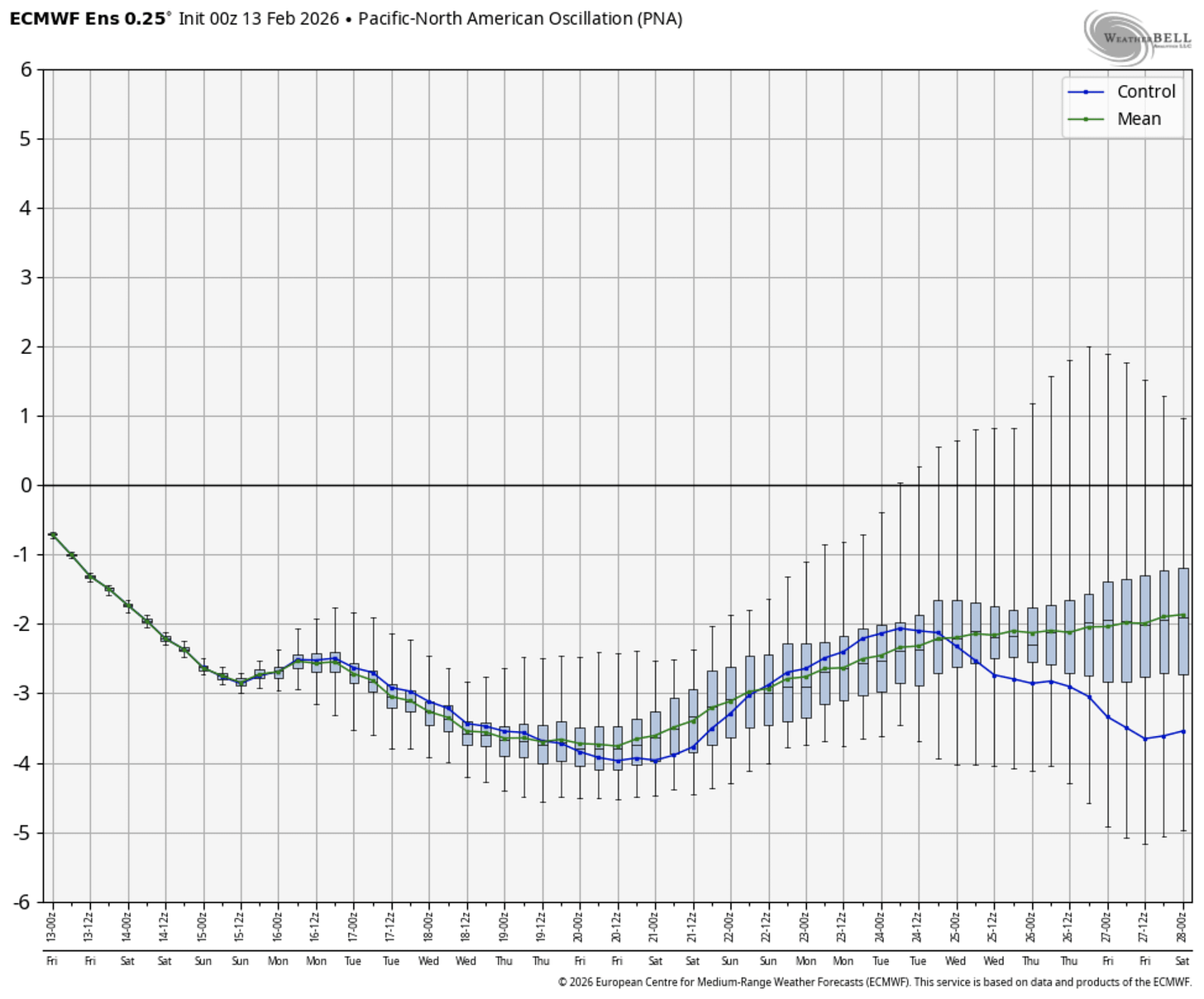

Last but not least, the infamous Southeast ridge or the Pacific North American Oscillation remains negative, which is bearish. As we’ve explained in the past, PNA has been a key source in killing bullish weather patterns in the past, and this time is no different. While the range is wide towards the backend of the model, the negative trend remains a headwind.

Based purely on reading the weather maps, I fear that our long trade in natural gas was premature.

What about fundamentals?

This is where it gets a bit conflicting.