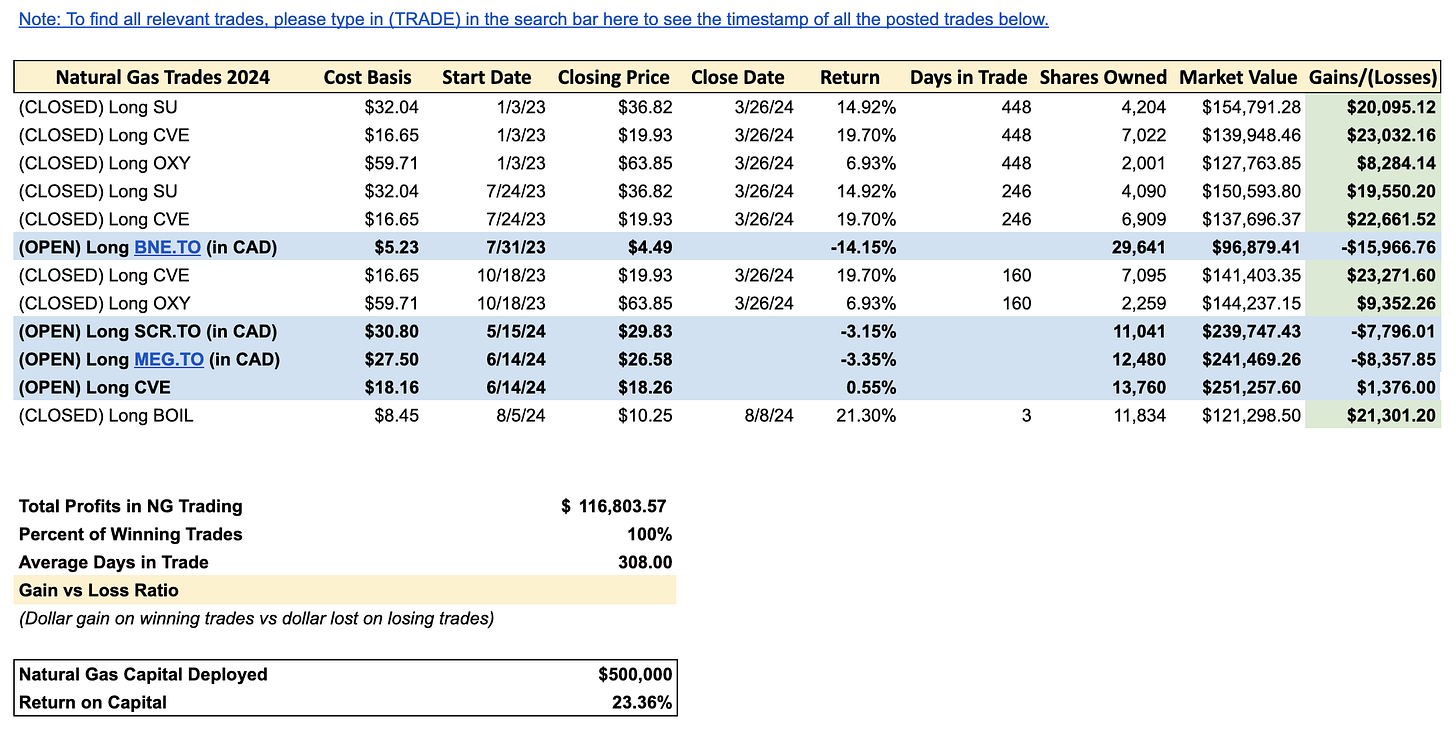

On Monday, we initiated a long position in BOIL as we thought the price had disconnected from where we were going with fundamentals. Like all things natural gas, the reversal is usually quick and fierce, and this time was no different. With October contracts now surpassing the $2.25/MMBtu limit we saw, we took profits on our BOIL long closing the trade out at +21.3%.

In my view, the problems with the natural gas market are far from over, and while the recent reversal is resulting in some excitement to return to the natural gas market again, it's far too early to celebrate, and I'll explain why.

For starters, the contango I am seeing in the natural gas curve today is far too steep.

On the surface, it appears natural gas is an asymmetric trade (buying the prompt month at $2.139/MMBtu), but you can't profit from this unless you own physical gas storage. The steep contango we see today is the market saying to you that it doesn't want natural gas today, but it will pay you for it in a few months when heating demand picks up. In the meantime, natural gas is worth materially less, and we don't want it.

This makes sense considering that despite tighter injections in the past 3-weeks, natural gas storage remains bloated to the 5-year average, and our projection still shows ~4 Tcf by November.

The good news is that with the market pushing prices lower, Lower 48 gas production recovery will stall entirely. We are starting to see some declines now and August should show flat production versus July.

But the bad news is on the demand front, we are already past peak power burn.

The market overall will loosen as power burn demand falls. As a result, injections will start to move higher thus limiting any price appreciation going forward.

The cash market today is also considerably weaker trading near $1.8/MMBtu. None of these are signs that natural gas has any more appreciable upside ahead.