Phew. I have good news and bad news.

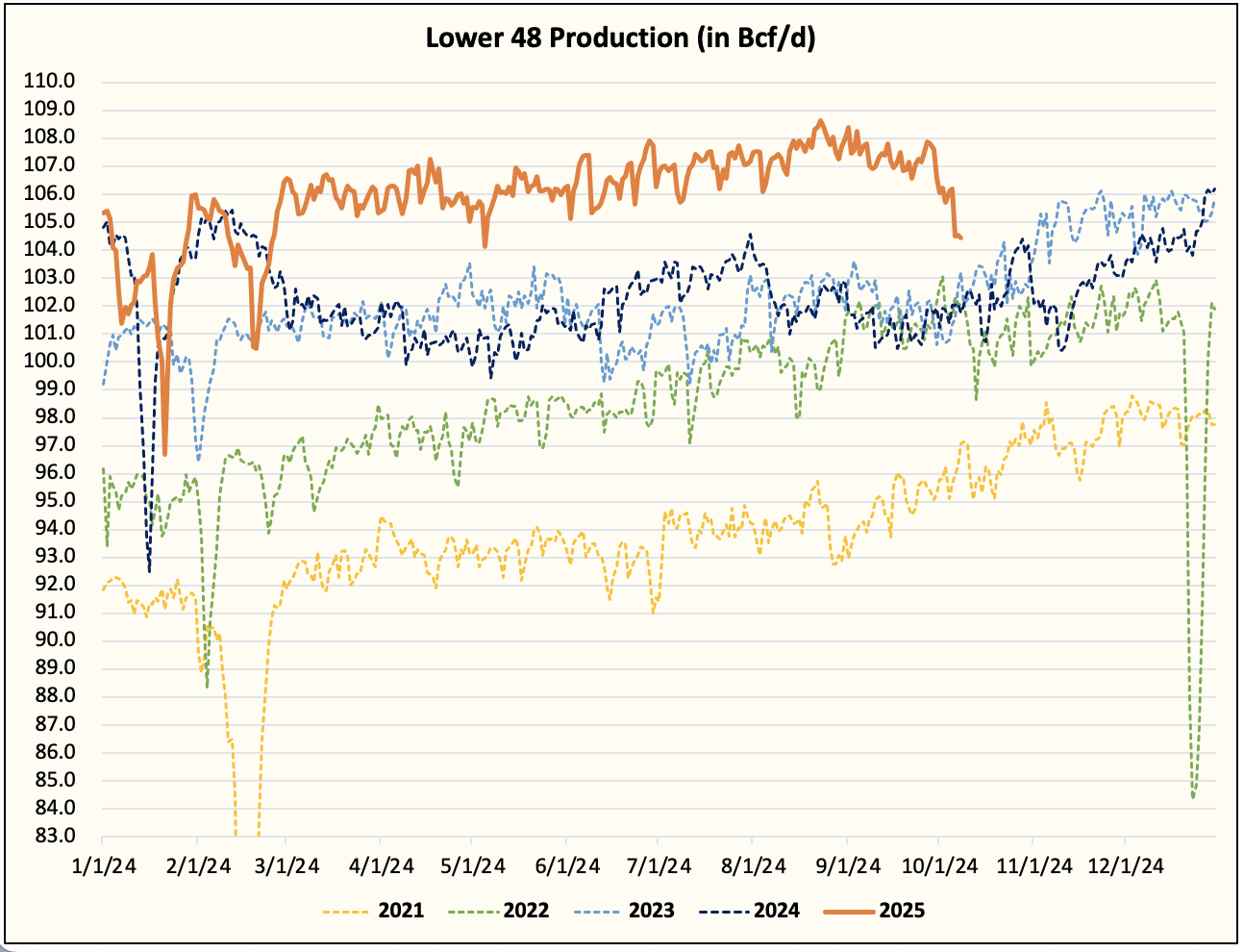

The good news is that the recent decline in Lower 48 gas production will help the natural gas market navigate the October injection season.

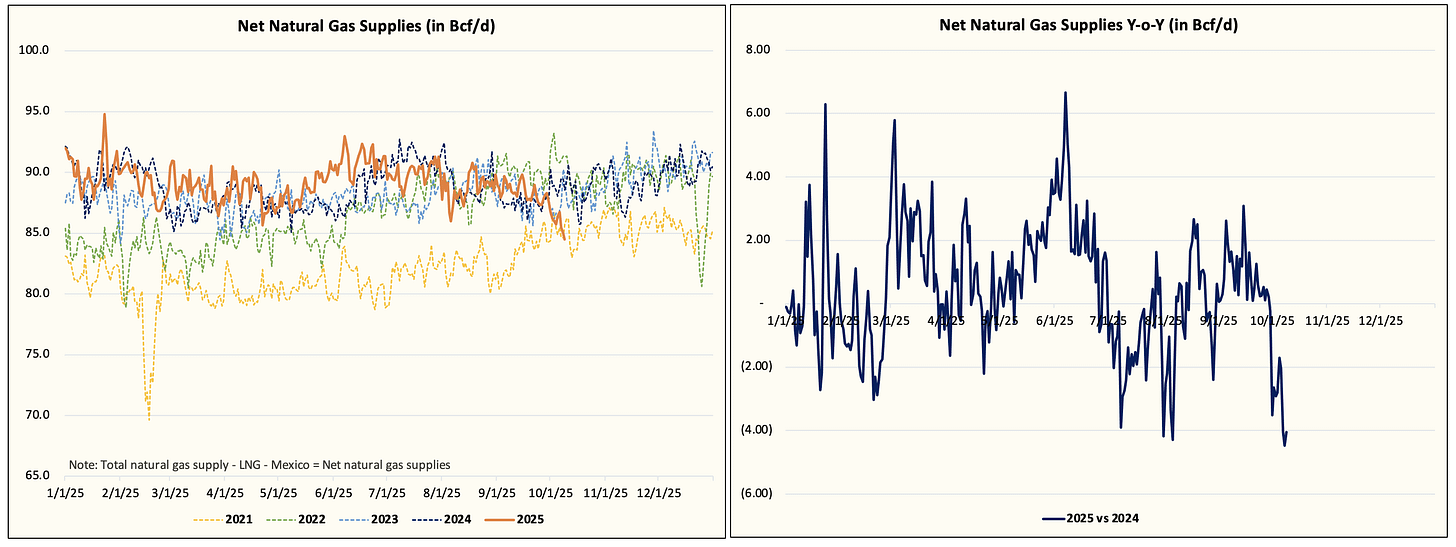

The material drop in production has sent net gas supplies lower y-o-y by ~4 Bcf/d.

The net result is a material drop in the daily supply-demand balance.

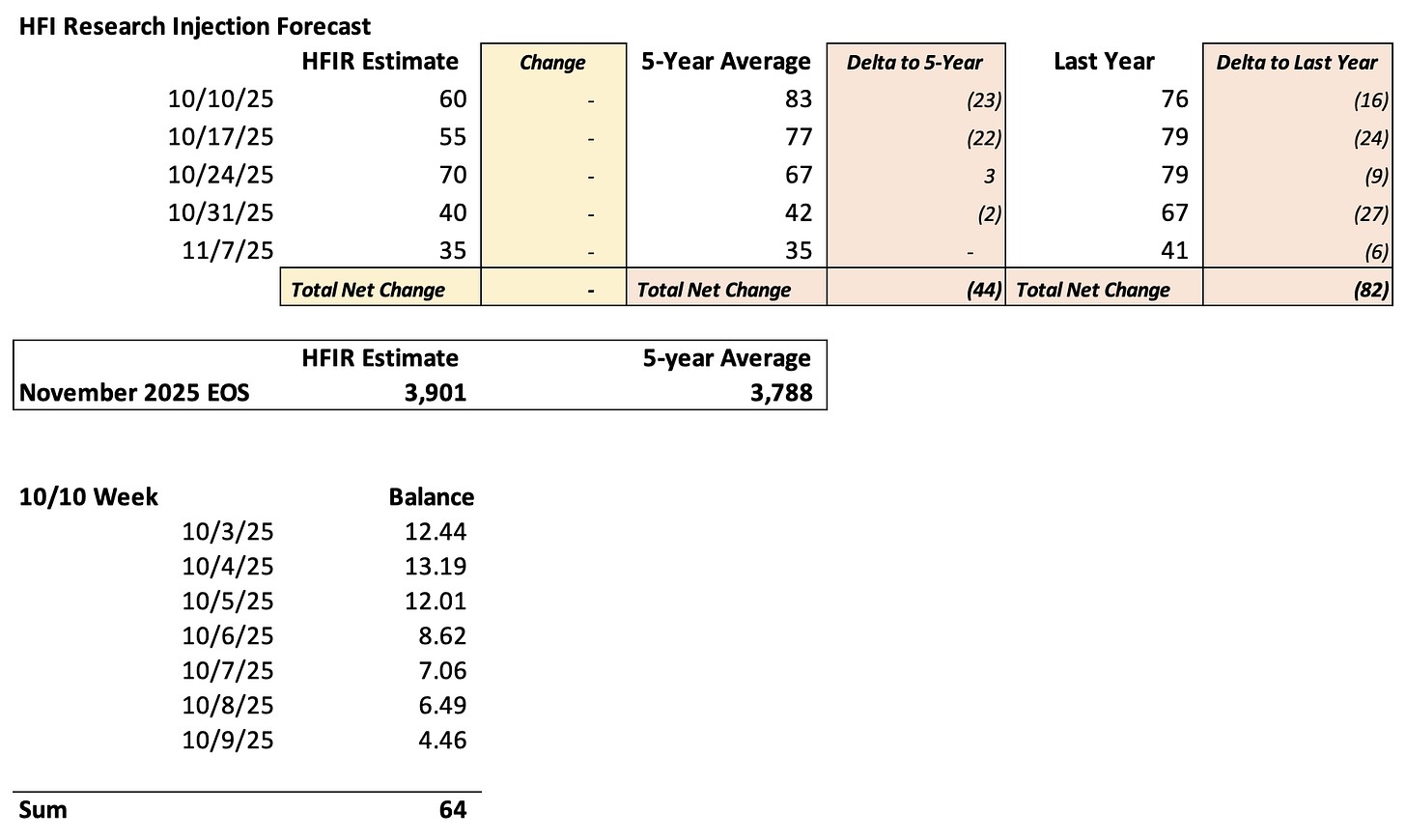

You can see in the 10/10 week flow that since the production drop started, the implied balance fell to just +4.46 Bcf/d today.

Now the bad news is that the production drop is largely due to maintenance and partially due to negative gas prices in the Permian.

Based on all available pipeline maintenance schedules we’ve seen, Lower 48 gas production is expected to return to ~107 Bcf/d by the end of next week. This means that the 10/17 balance will likely be tight, with 10/24 balances returning to normal.

Fundamentally, the material drop in injections we see towards the end of this week and into next week could help usher in the end of storage below ~4 Tcf. The current model pegs November storage at ~3.901 Tcf, or +113 Bcf higher than the 5-year average. This is far better than the +250 Bcf we expected earlier.

So what’s driving all the volatility you are seeing in the natural gas market?