Natural Gas Flirts With $2 As Market Brushes Off Incoming Cold

Mother Nature is coming to the rescue, but as of this writing, the incoming cold is not enough to materially move natural gas storage lower.

TDDs

6-10 Day

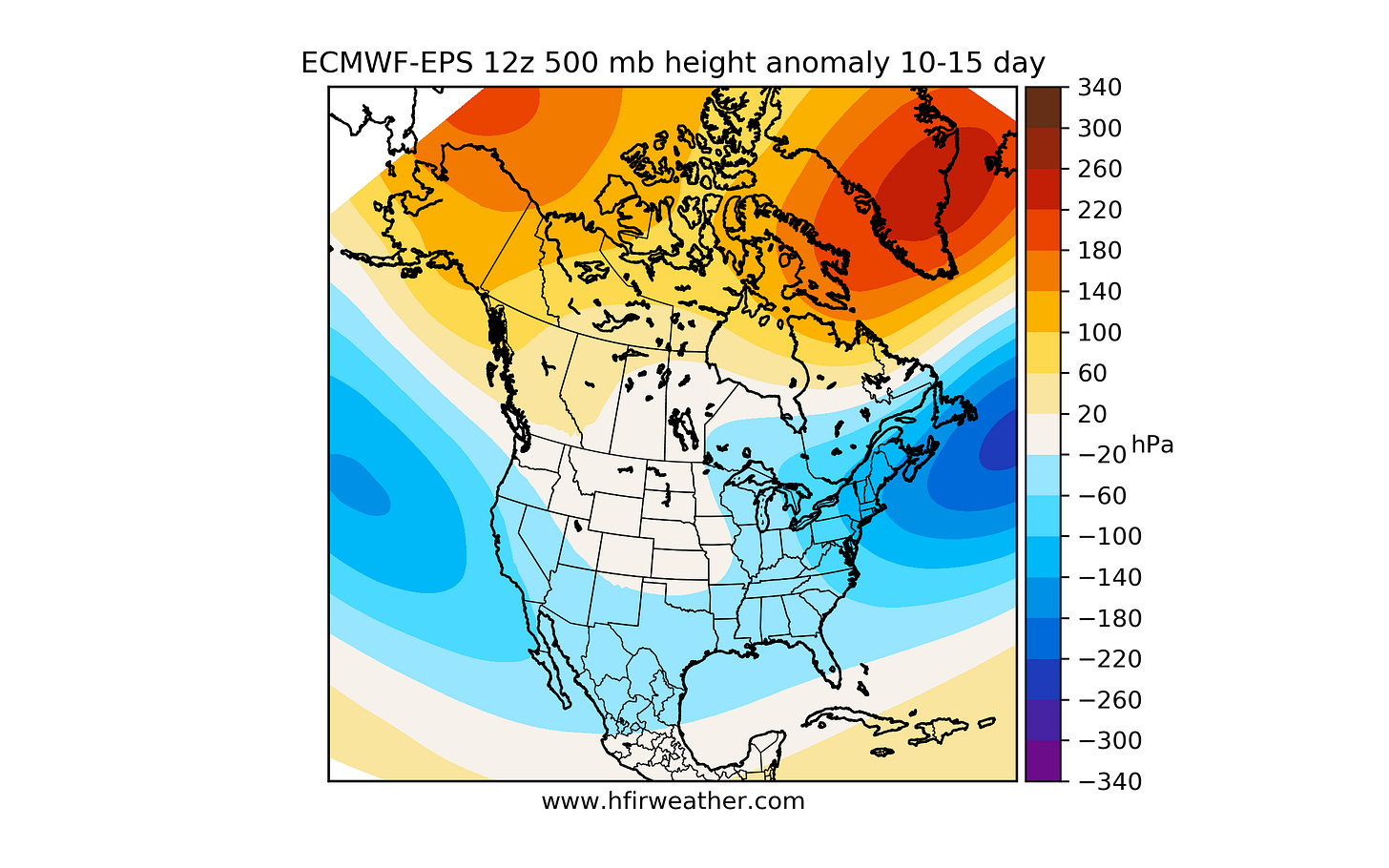

10-15 Day

15-Day

As you can see, following the bearish 1-5 day period, weather does start to normalize with colder than normal weather returning. But there are several issues we still have with this:

Despite the colder-than-normal weather, storage projections are not meaningfully changing due to the bearish balances we are seeing in the near term.

Lower 48 gas production has all but recovered, which will result in the surplus balance going into the end of the withdrawal season.

And with very low demand expected over the next week, cash market will remain weak and with storage projections showing a surplus to the 5-year average, traders will have no incentives to go long natural gas.

Balance

All of these variables continue to make us gun-shy. While bullish weather, in itself, is a good catalyst to push prices higher, natural gas bulls need "very" bullish weather if it is to dampen the surplus we see in storage.

Subscribers will get real-time notification if we are to put on a long natural gas trade, and for now, we remain on the sidelines.