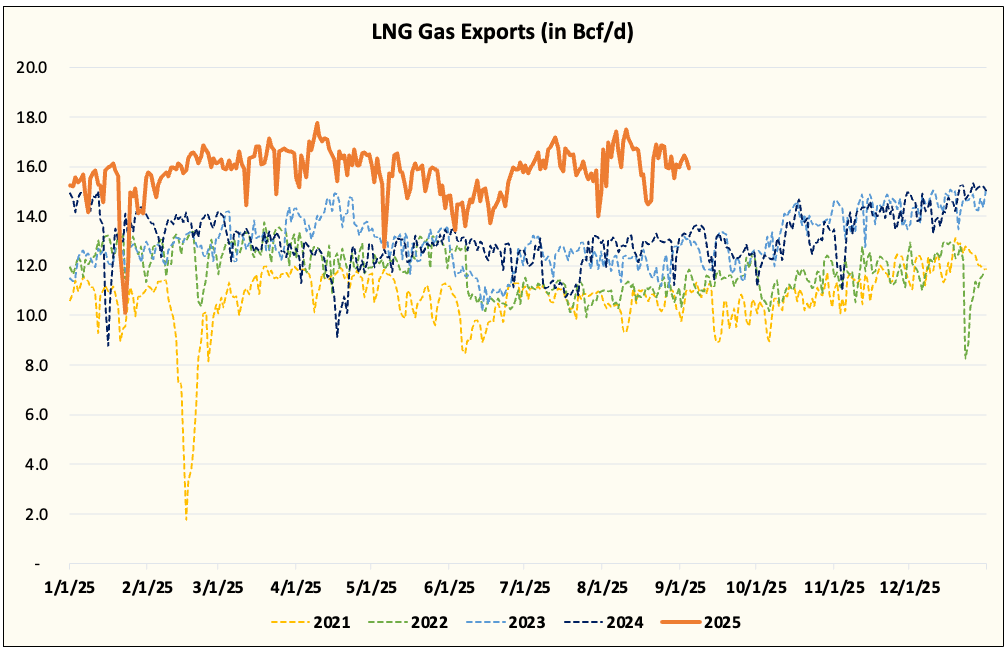

With the peak power burn demand season behind us, the recent fundamental changes we are seeing in the natural gas market have actually trended to the bull side. Despite much lower power burn demand now, Henry Hub cash prices continue to hold at $3/MMBtu giving support to October contracts, and LNG gas exports remain stellar around ~16 Bcf/d.

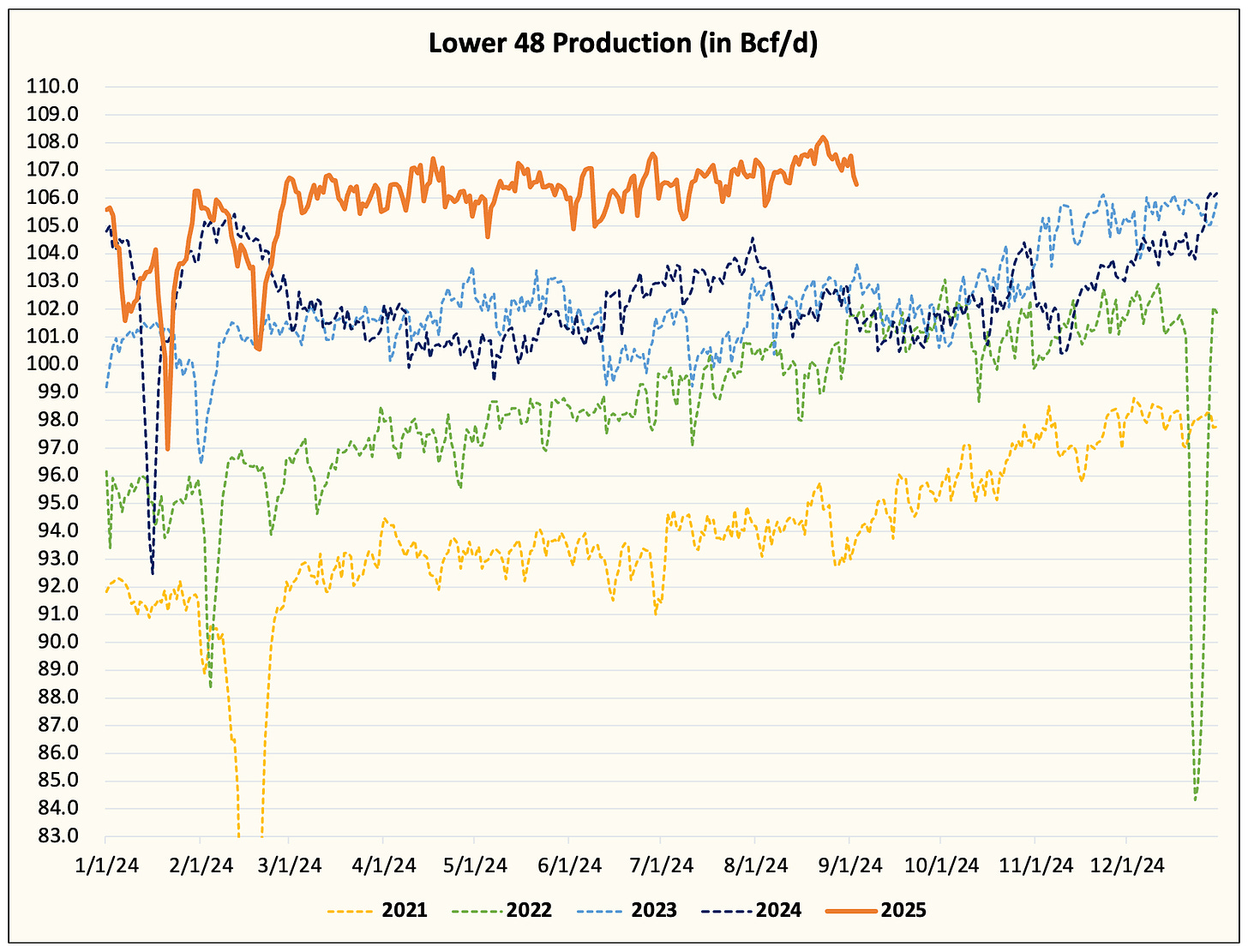

We wrote in last week's NGF that with the drop in natural gas prices, natural gas production won't surprise to the upside going into year-end.

Following the peak we saw on the 3rd week of August, Lower 48 gas production has fallen from ~108 Bcf/d back to ~106.5 Bcf/d. Early-month nominations usually create more volatility in the data, but it's obvious that producers will start to taper back production into the shoulder season.

What is important to note here is that Lower 48 production will reach ~108.5 to ~109 Bcf/d by year-end (in line with our estimate). With ~3 Bcf/d of additional LNG gas exports coming online by year-end, the market will easily absorb the production increase.