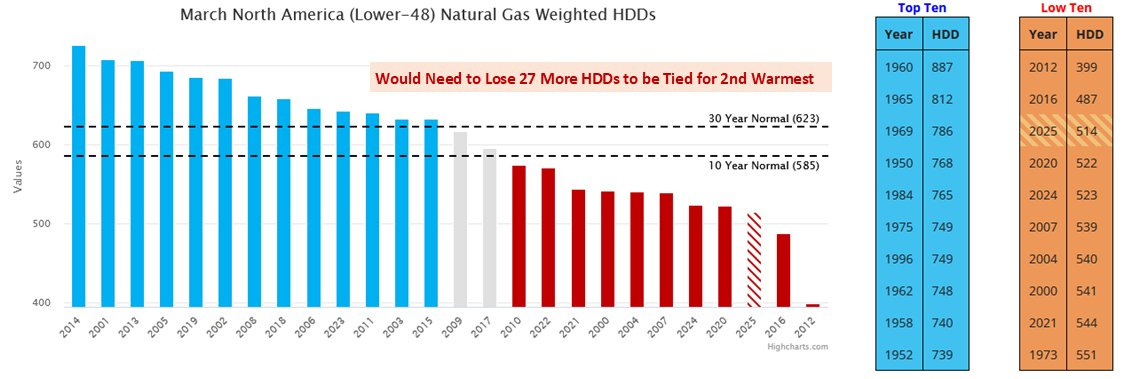

First and foremost, the weather outlook is dismal to finish March. The latest weather models are showing a much warmer-than-normal outlook to finish off the heating demand season. According to Commodity Wx Group, March is expected to be the 3rd warmest March since 2000.

Source: CommodityWxGroup

And looking at the daily weather model updates, you can see the warming pattern in the 6-10 day clearly, while the backend of the model is much more uncertain.

ECMWF-EPS TDD Chart

6-10 Day

10-15 Day

15-Day Cluster

But the bad news for the natural gas bulls is that instead of natural gas storage finishing withdrawal season near ~1.6 Tcf, storage is now expected to be around ~1.8 Tcf. This ~200 Bcf flip is largely due to the current implied supply & demand balance showing a surplus in storage versus the typical withdrawal.

As you can see in the daily supply & demand table, we have seen injections in the balance since March 10th. This is a sign that the lower heating demand is resulting in much looser balances than previously expected.

To put it in perspective, the bearish weather element is resulting in the natural gas market to be temporarily oversupplied by ~5 Bcf/d.

Natural gas bulls should be thankful that Mother Nature was supportive this winter heating demand season.

With storage near ~1.82 Tcf in April, where does that put natural gas storage by November?