Natural Gas Just Got A Whole Lot More Interesting

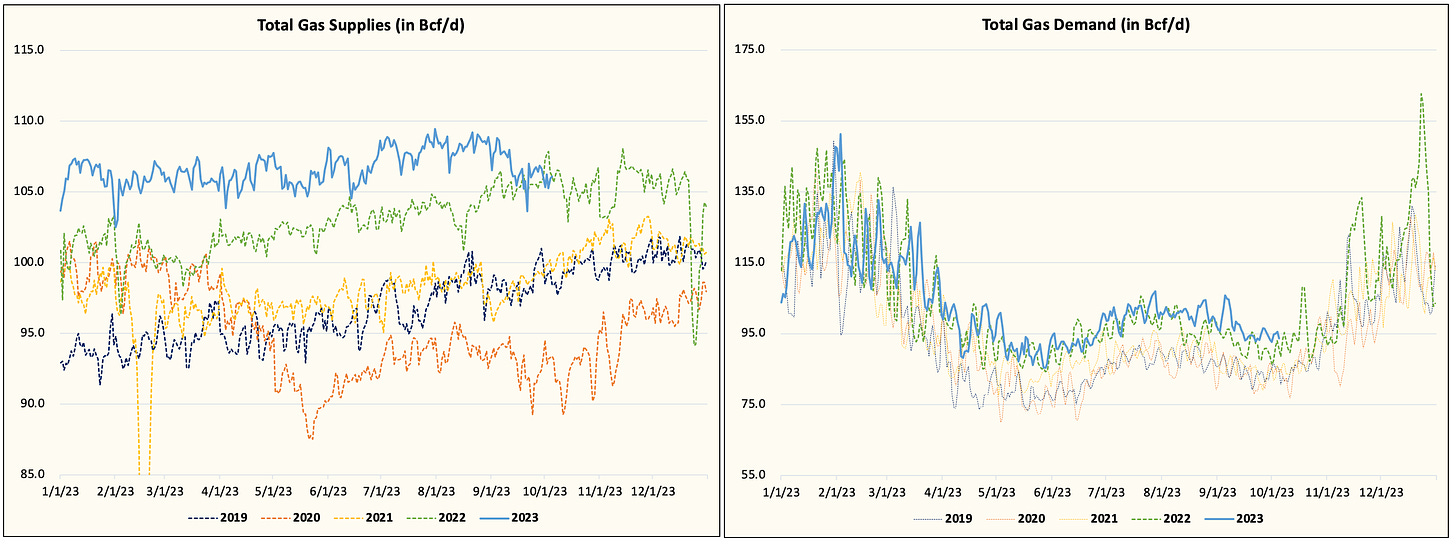

Since the beginning of the year, we have been uninterested in natural gas. Lower 48 gas production was much higher y-o-y resulting in total gas supplies exceeding total gas demand growth. This resulted in a rangebound market with no clear direction for much of the year. But taking today's price action aside, fundamentals just got a whole lot more interesting.

Here is a chart comparing total gas supplies vs. total gas demand. What do you notice?

For the first time this year, demand growth y-o-y is now above gas supply growth.

Throughout our NGF this year, we repeatedly said that two things needed to happen for us to be interested in natural gas again:

Lower 48 gas production to fall.

Storage to normalize.

With injection season slated to end over the next 5-weeks, storage peak is near, and with production falling, this winter is going to be very interesting.

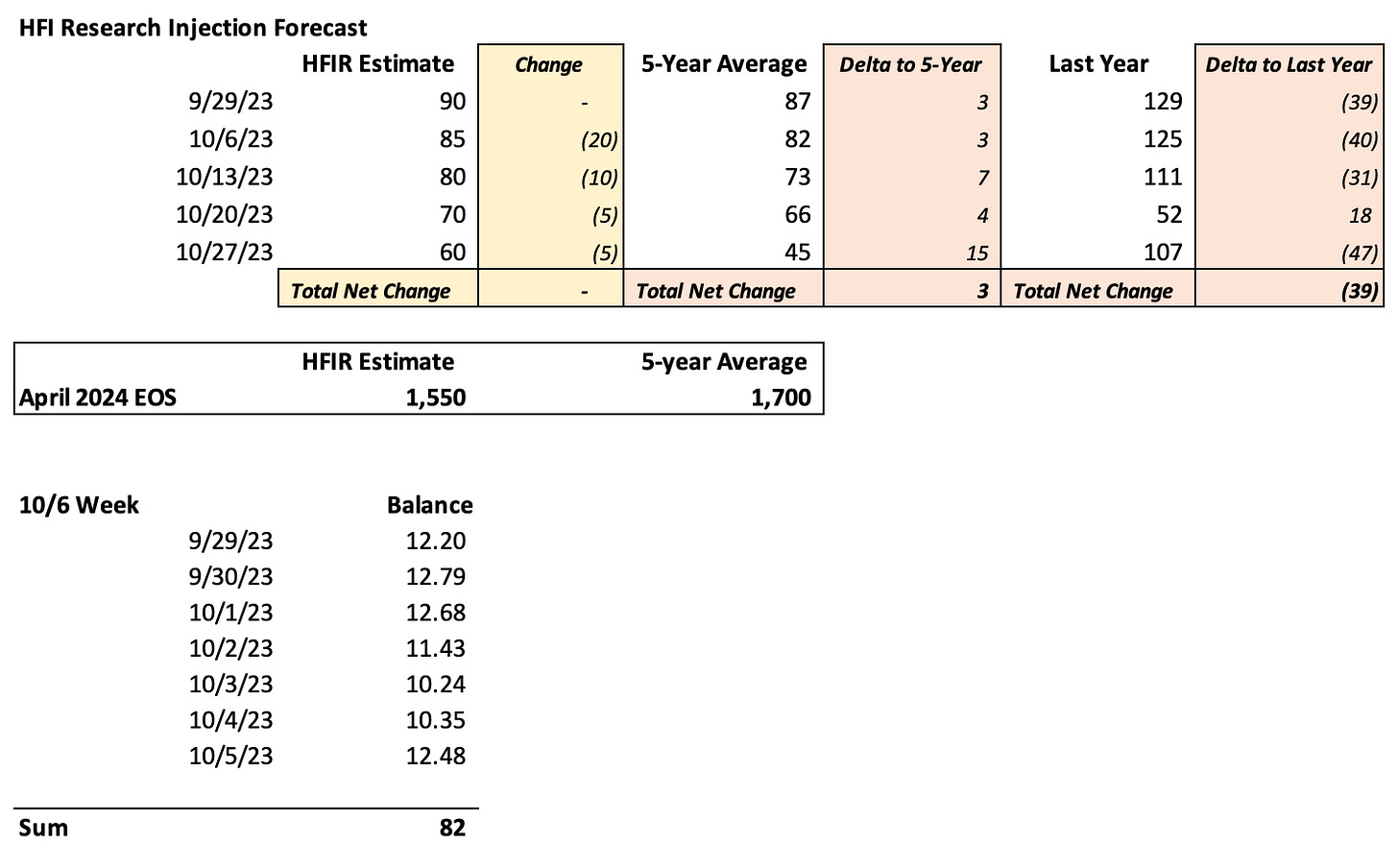

Physically speaking, natural gas balances have also been more bullish than we estimated.

EIA's storage report today of 86 Bcf was below our estimate of 90 Bcf. And looking at our balances over the next few weeks, we have revised total injections lower.

We have also estimated that natural gas storage finishes April 2024 around 1.615 Tcf, or below the 5-year average. This will require a normal winter, however, so Mother Nature will play a big role in determining this outcome.

Low prices cure low prices...

Since late last year, one of the biggest headwinds against natural gas was the relentless production growth.

Thanks to persistently low prices throughout the year, we are finally starting to see weakness creep back into production. In terms of oil production, we are also seeing the same thing as US oil production growth stalls out.

Now for those of you who did not get a chance to read our US oil production update, please be reminded that EIA changed its methodology. To make an apples-to-apples comparison on production, we need to adjust how much US oil production finished Dec 2022. We estimate production was closer to ~12.8 million b/d.

At the current trajectory for Lower 48 gas production, we think the exit range will be between ~99 to ~100.5 Bcf/d. This would put us flat y-o-y. If so, US oil production today is running around ~13 million b/d, so this would result in a 200k b/d decrease. Again, associated gas production has always been a good leading indicator for US shale oil production.

The combination of lower US oil production and low natural gas prices will push Lower 48 gas production lower. Despite the earlier surprise to ~103.5 Bcf/d, Lower 48 gas production was unable to maintain that. And given the current frac spread count, we don't think there's much growth left into year-end.

Simply put, because we don't expect Lower 48 gas production to grow from now to April 2024, that's why you are suddenly seeing gas storage balances flip to a negative. It really is that simple.