Natural Gas Prices Blunted By LNG Demand Loss But Fundamentals Remain Tight

The US natural gas market just went from a one-sided bet to a mediocre one-sided bet (to the upside). While the international natural gas market just went from a mediocre one-sided bet to a one-sided bet (to the upside). With the loss of Freeport LNG exports of ~2 Bcf/d, the already starving global LNG market will be starving more from here to the end of 2022. While the company expects a partial restart, none of us know what the sustainable capacity is, and as a result, the market is already pricing in some dire scenarios.

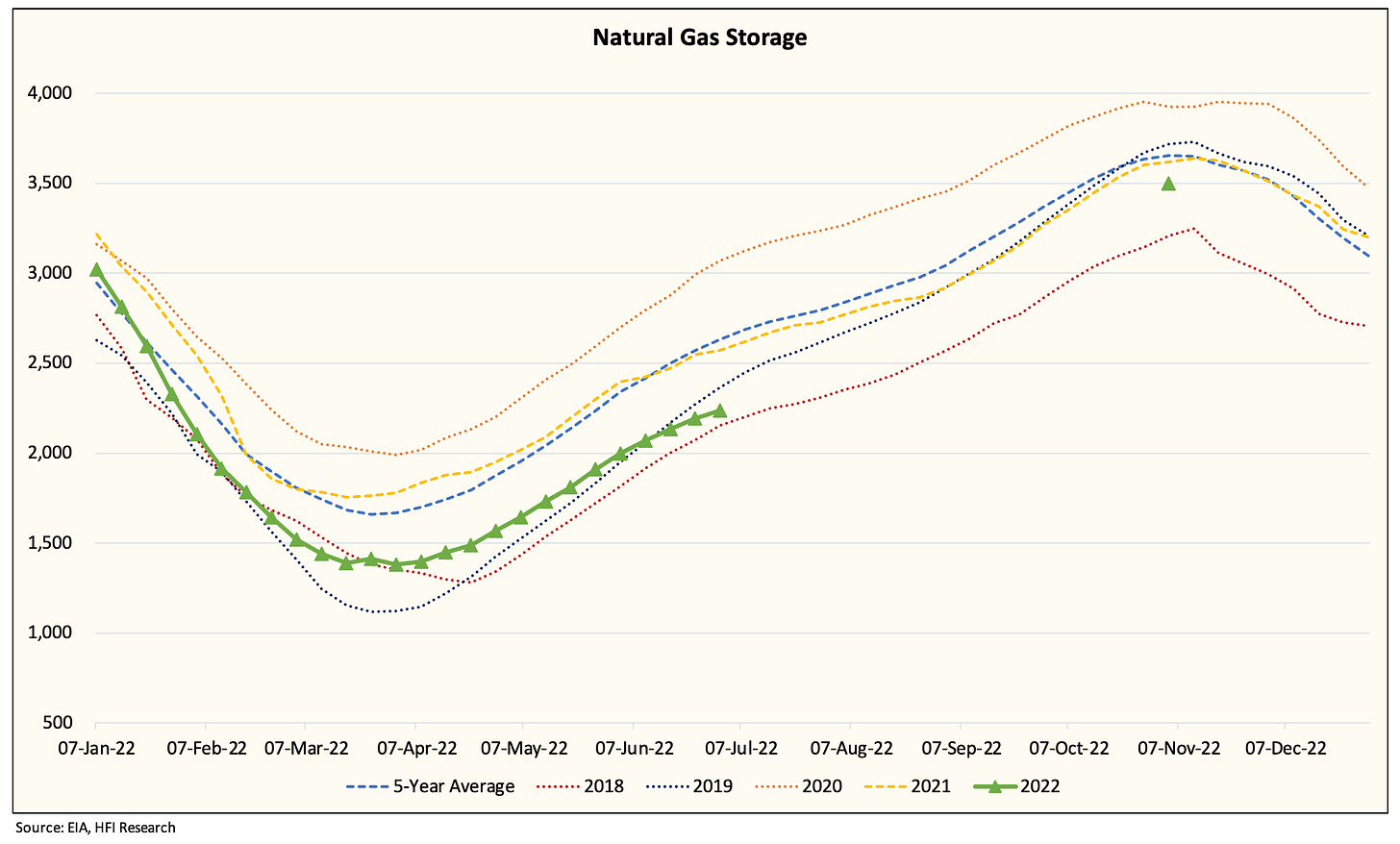

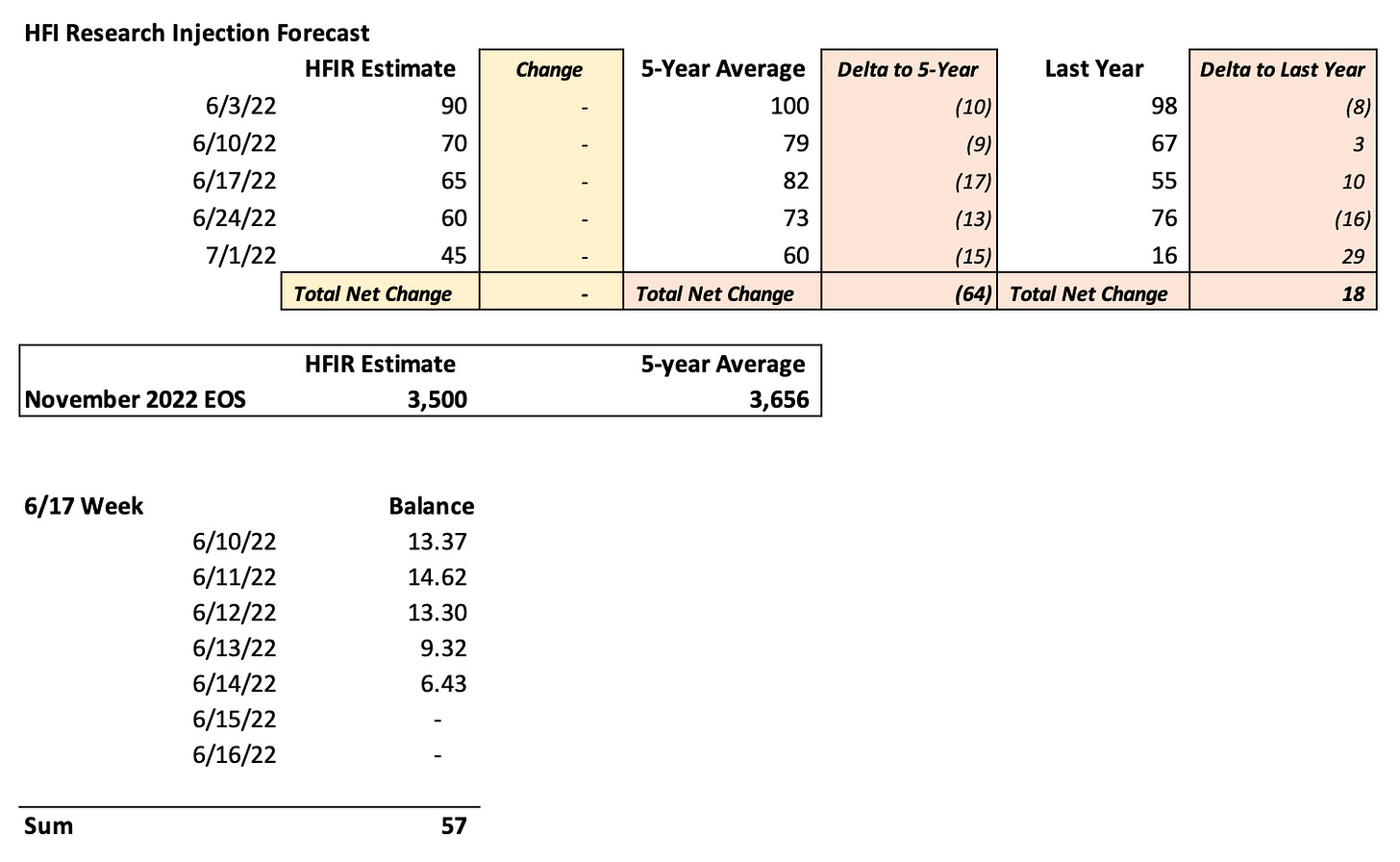

On a pure supply/demand basis, the loss of ~2 Bcf/d and a portion of it from today to the end of the year would result in EOS increasing from ~3.3 Tcf to ~3.5 Tcf.

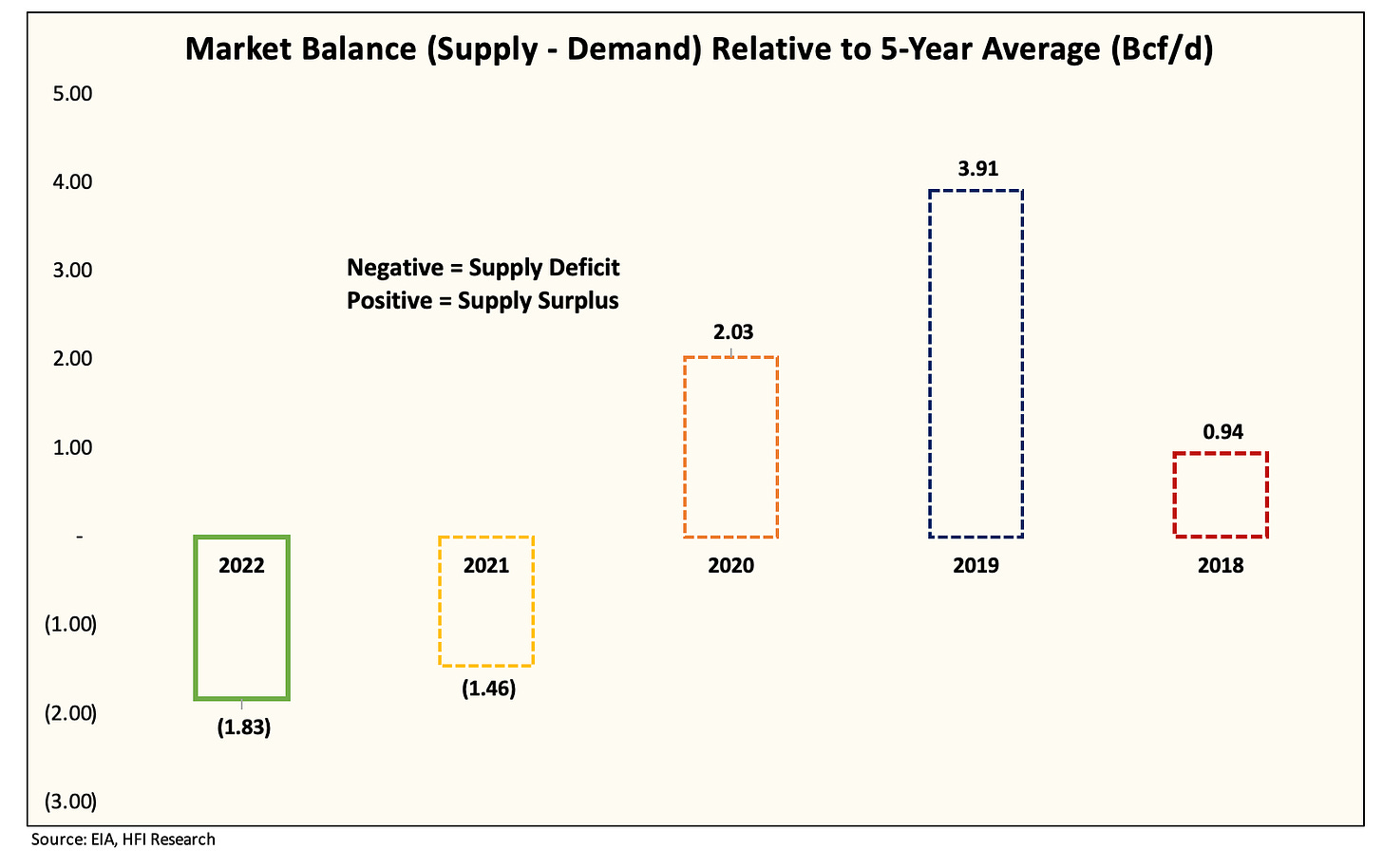

Looking at our forward storage projections, we still expect the market to remain in a deficit of -1.83 Bcf/d.

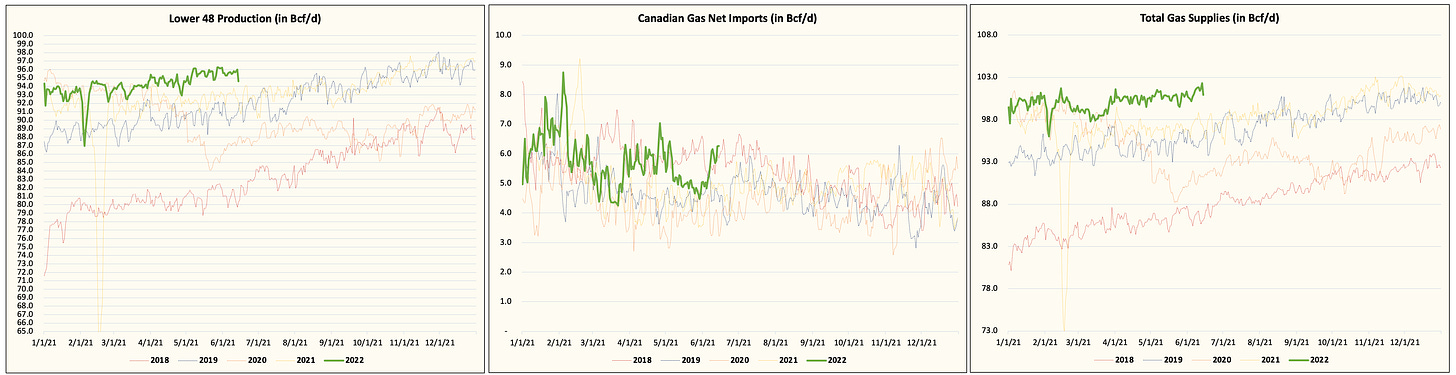

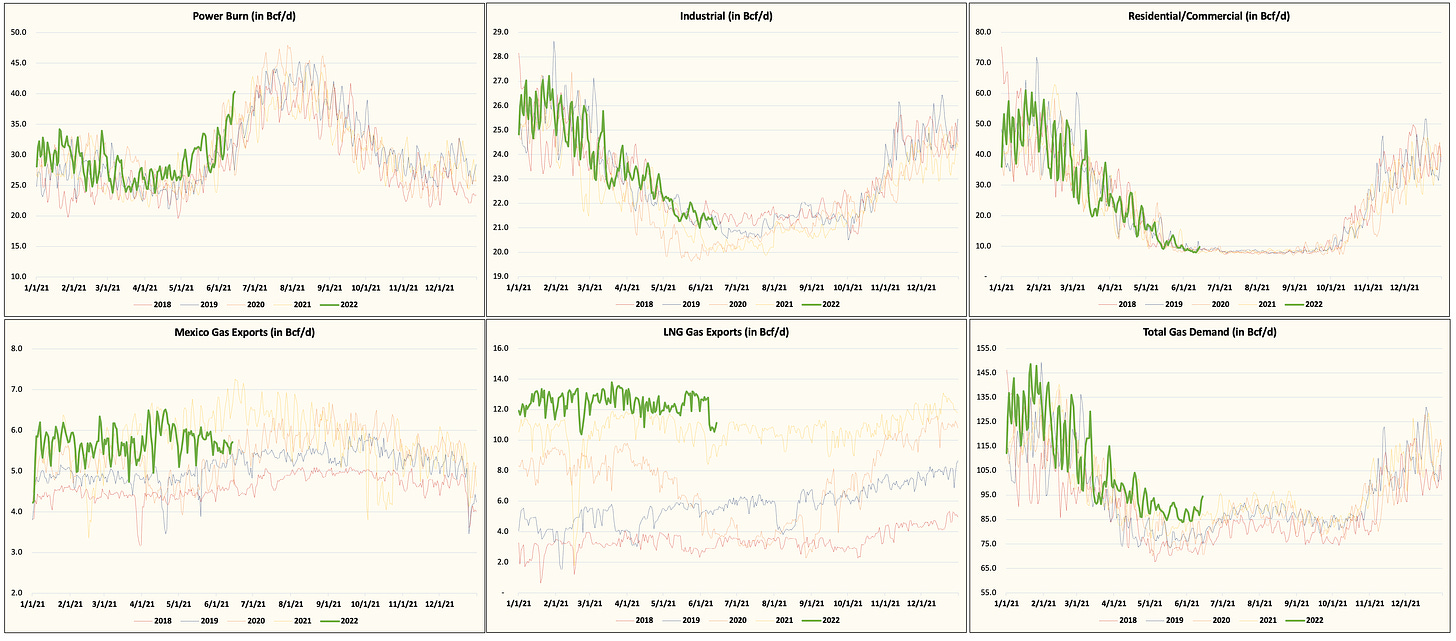

The reason for the severe sell-off is that prior to the LNG demand loss, the US natural gas market was truly a one-sided bet. Lower 48 production has failed to keep pace with the rise in demand. You can see it in the supply and demand breakdown below:

As a result, the market was starting to push US gas prices closer and closer to the international price. But with LNG exports now down ~2 Bcf/d, that arbitrage trade is going to unwind. We would argue, however, that given how tight fundamentals are still today, natural gas prices will continue to grind higher, but at a slower pace.

One thing people appear to be forgetting is that if cooling demand is high over the summer, and it appears to be so far, power burn demand could easily eclipse the ~2 Bcf/d loss from LNG exports. This would still put downward pressure on storage. In addition, if Lower 48 production fails to gain traction and doesn't recover to at least ~97+ Bcf/d, the balance going forward will only tighten.

All things considered, US natural gas prices should still move higher despite the temporary hiccup. Fundamentals remain tight and we are in a structural bull market. While it's not comforting to see prices drop over ~15% in a day, you should be aware that US gas fundamentals are still bullish.