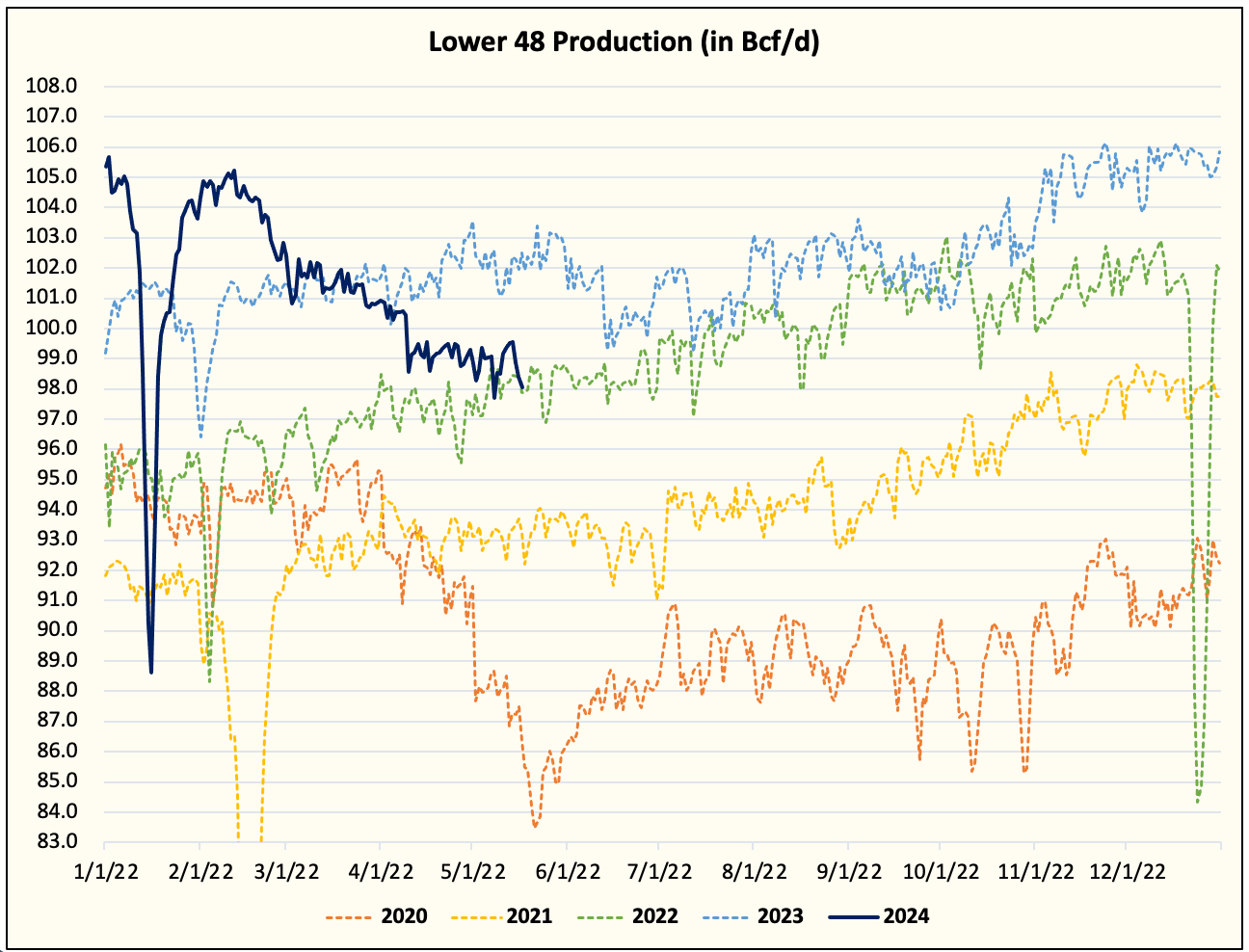

Wow, what a turn of events in the natural gas market. With Lower 48 production still hovering around ~98 Bcf/d and power burn demand picking up, the cash market has meaningfully tightened and prompt gas futures are trading near $2.50/MMBtu.

Source: CME

Readers, however, need to keep in mind that while the prompt gas futures have rallied meaningfully (June contracts), July contracts are just up from $2.37/MMBtu or ~13%. The steep contango we saw in the curve just a few weeks ago is vanishing, and the market is now testing at just what price level we see a production response.

Remarkable Discipline... So Far

Lower 48 gas production remains dismal despite the rebound we are seeing in natural gas prices. The steep drop is catching some traders by surprise as producers are currently sidelining a lot of production in the form of TILs (turn-in-line wells). Typically, with a lead time of 4-6 weeks, producers can bring TILs onto production, so we could see a meaningful pick-up in production by late June.

In addition, the announcement by Chesapeake Energy and EQT in March is having a more prolonged impact than what we initially believed. EQT had mentioned that the production curtailment would only last in March, but judging by the Northeast gas production volume, it still exists today.

How much longer will production remain low?