If you told me a month ago that 1) September Henry Hub contracts would dip below $3/MMBtu, 2) power burn demand would fall below ~40 Bcf/d during peak summer, and 3) futures are trading in line with cash prices, I wouldn't have believed you.

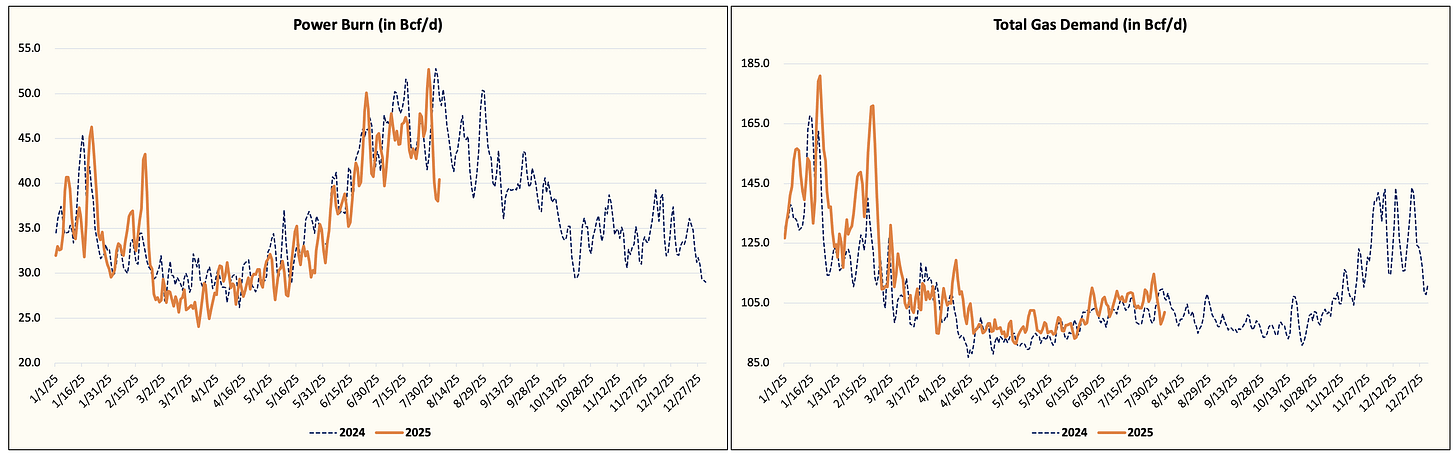

Power Burn and Total Gas Demand VS Last Year

Yet, here we are.

What's particularly troubling about today's sell-off was that the market understood (going into the weekend) that power burn demand was going to be disappointing.

Cooling degree days were projected to be below the 30-year norm and well below the 10-year norm.

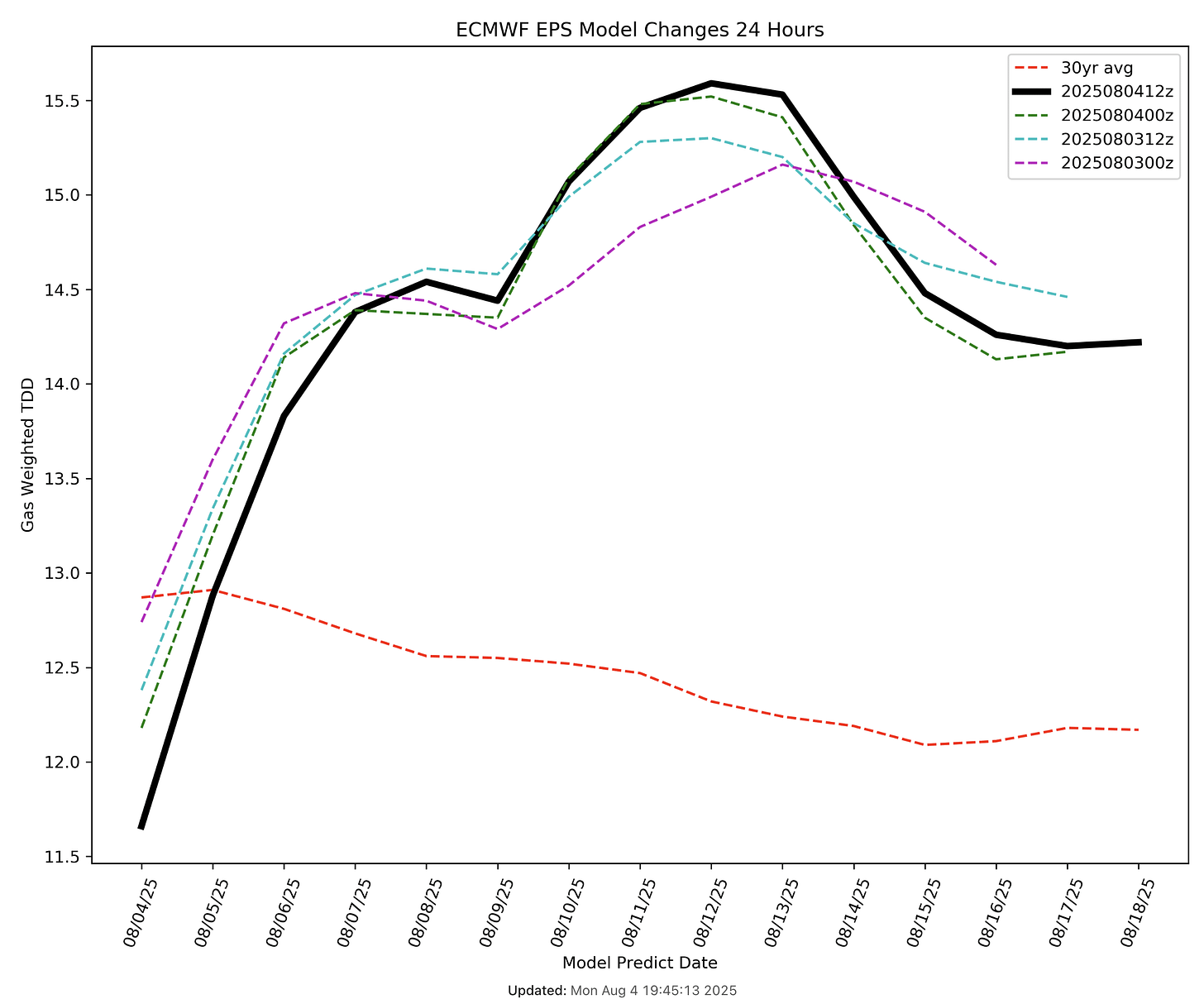

Note: The latest ECMWF-EPS TDD chart shows TDDs below the 30-year norm.

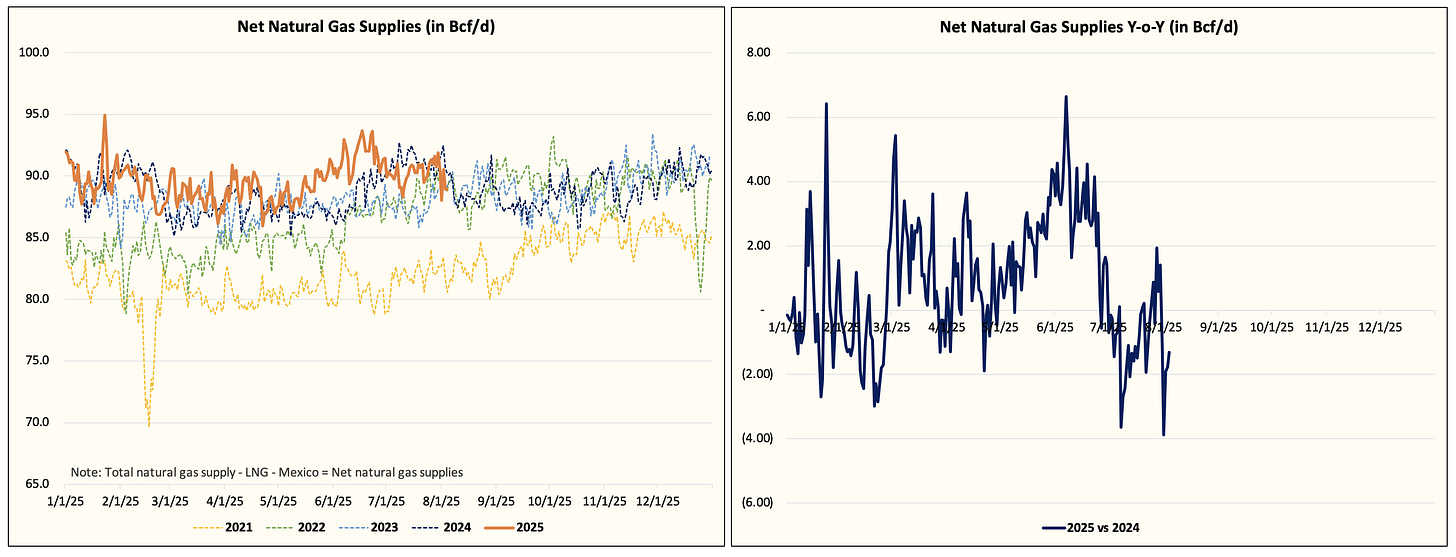

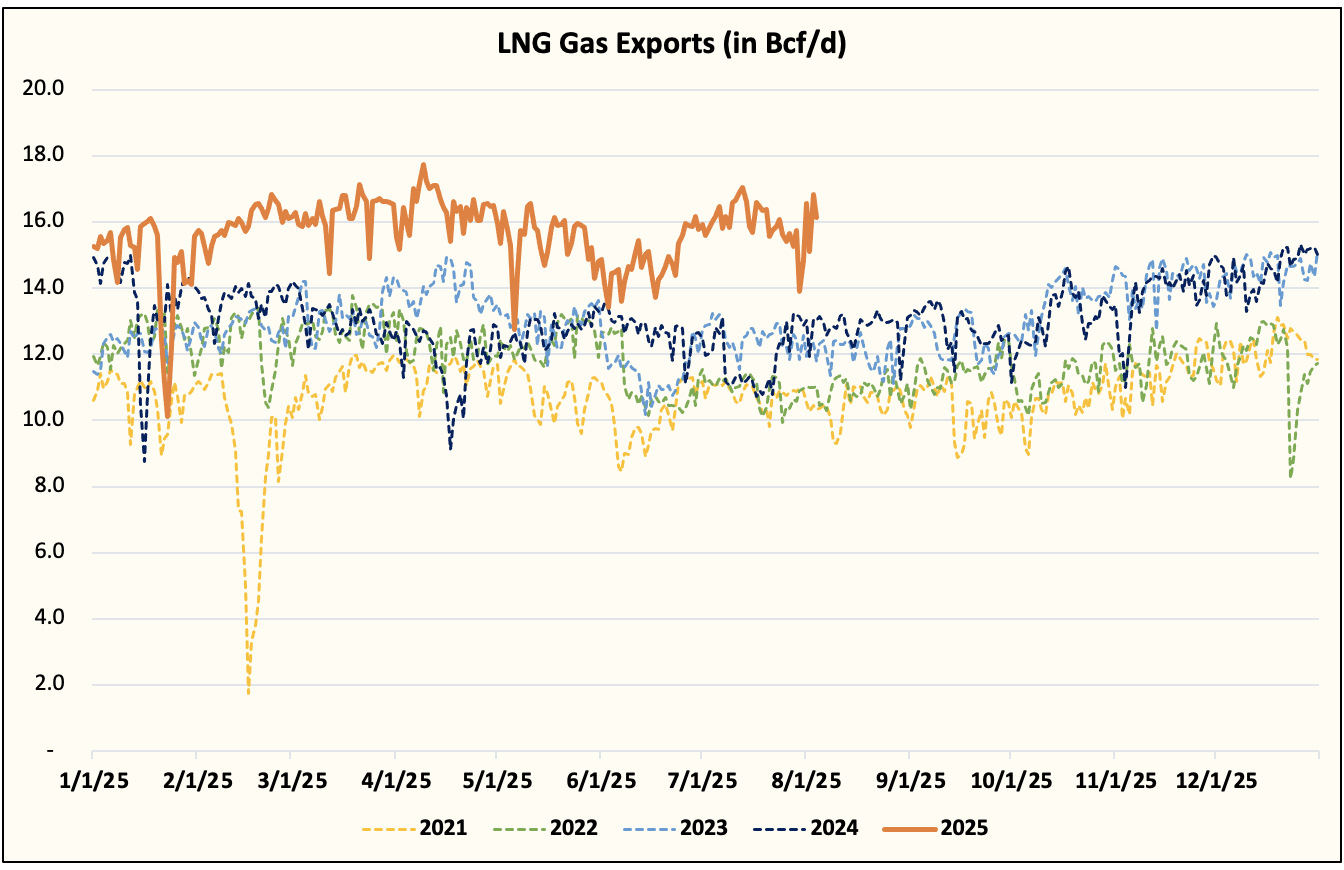

Meanwhile, net gas supplies remain constrained despite elevated Lower 48 gas production readings over the weekend. LNG feedgas has returned with flows above ~16 Bcf/d.

Net Gas Supplies

LNG (Note: The dip you see in the chart from last week was from the Freeport disruption.)

As a result, the sensible conclusion to reach would've been to brush aside the temporarily depressed power burn demand due to bearish weather and look at the incoming cooling demand.

But nope, the market lost its mind. The bears took over, and the bulls are giving up.