Natural Gas Shakes Off The Early Start To Injection Season

And an update on the HFIR Natural Gas Portfolio.

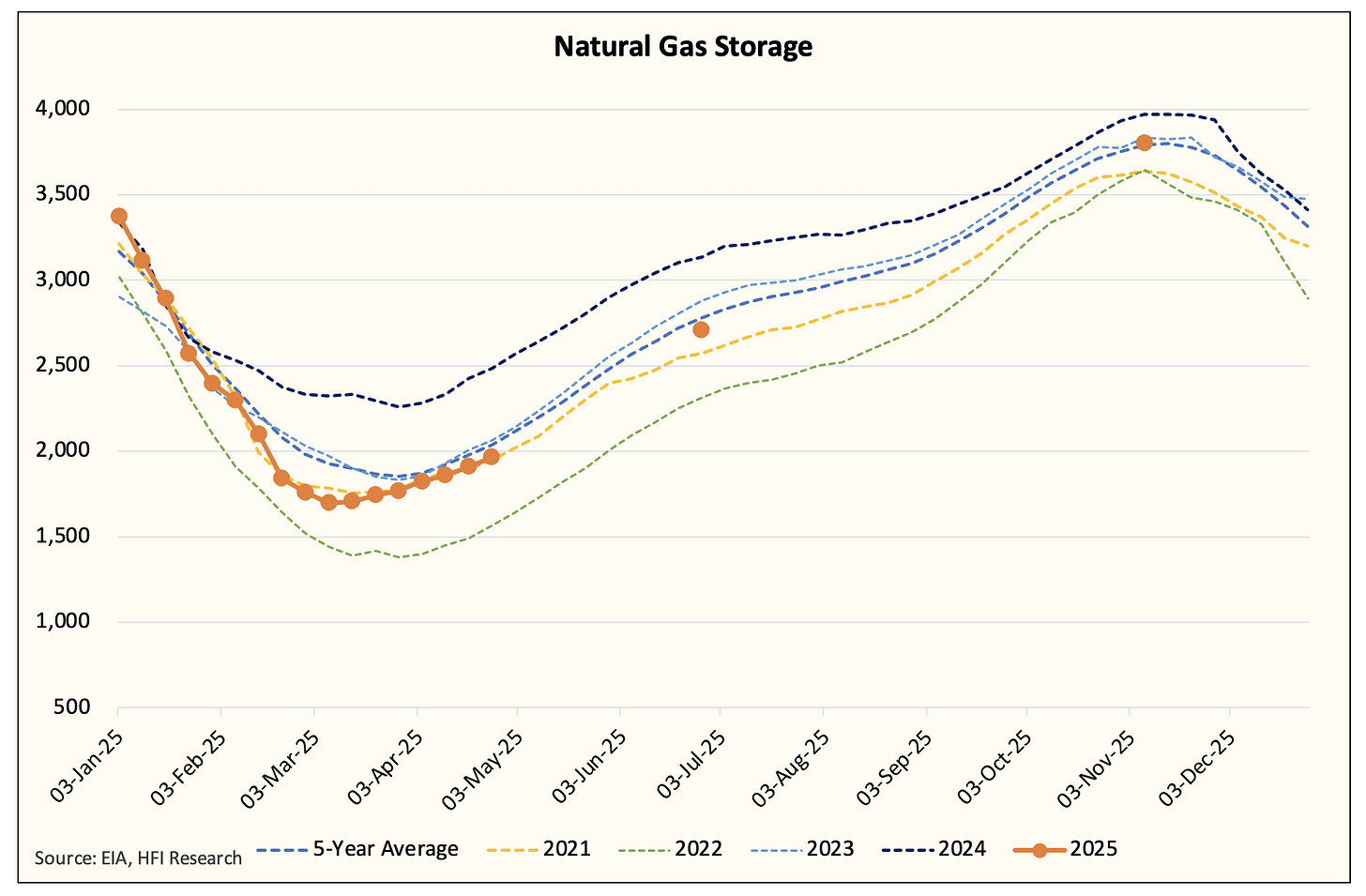

This is not your normal natural gas trading year. The bias will continue to favor the bulls. Natural gas prices have held the $4/MMBtu level despite materially warmer-than-normal weather to finish off March. The trading community has pointed out that this is one of the earliest starts to the injection season we've had in years. Looking at our natural gas storage forecast, this is very true.

Over the next 5 reports, natural gas injection will be 50 Bcf higher than the 5-year average and 32 Bcf higher than last year.

On an implied supply & demand basis, the natural gas market today is showing a surplus of 1.43 Bcf/d.

Keep in mind that on a fundamental basis, the natural gas market this year will be nowhere near the tightness we saw in 2022. So if you are expecting natural gas prices to reach $7/MMBtu, please throw that idea out of the window.

Now, if you look at our storage projection to the end of June and November, you can see that we will start to diverge from the 2021 trendline in May and get closer to ~3.8 Tcf by November.

Our forecast is based off the assumption that Lower 48 gas production will move to ~106.5 Bcf/d soon. If this forecast does not materialize, then storage estimates will be much lower.

Real-time data shows production averaging ~105 Bcf/d. This has pushed total net supplies lower y-o-y.