Natural Gas Tailwinds Remain Elusive

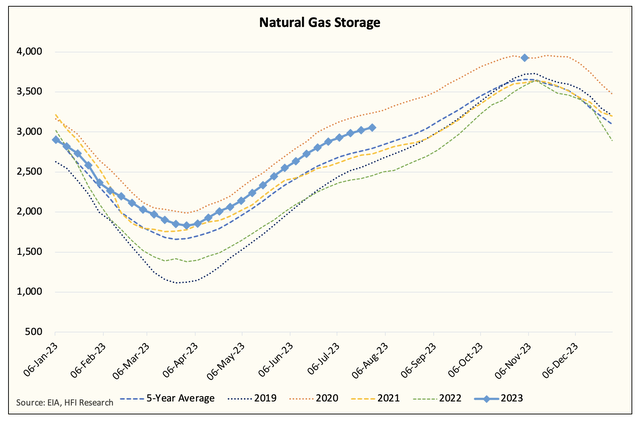

EIA reported a revision to storage today with an implied flow of +49 Bcf. The end result was more gas in storage and the implied balance shifted to the bear side.

For our natural gas projection into November, we see storage finishing at ~3.925 Tcf. This is still well above the 5-year average and gives traders no reason to go long natural gas.

In addition, natural gas demand remains in-line with last year as LNG gas exports remain low.

And while Lower 48 gas production is starting to move in the other direction, total gas supplies are still way higher y-o-y.

Putting it very simply, US gas market is oversupplied today. But thanks to warmer-than-normal weather, cooling demand has been strong, thus eliminating some of the surpluses we are seeing. However, it is important to note that power burn demand is only in-line with last year's and not above.