Should've, would've, could've, that's the best way to summarize the disappointing summer trading season for the natural gas bulls.

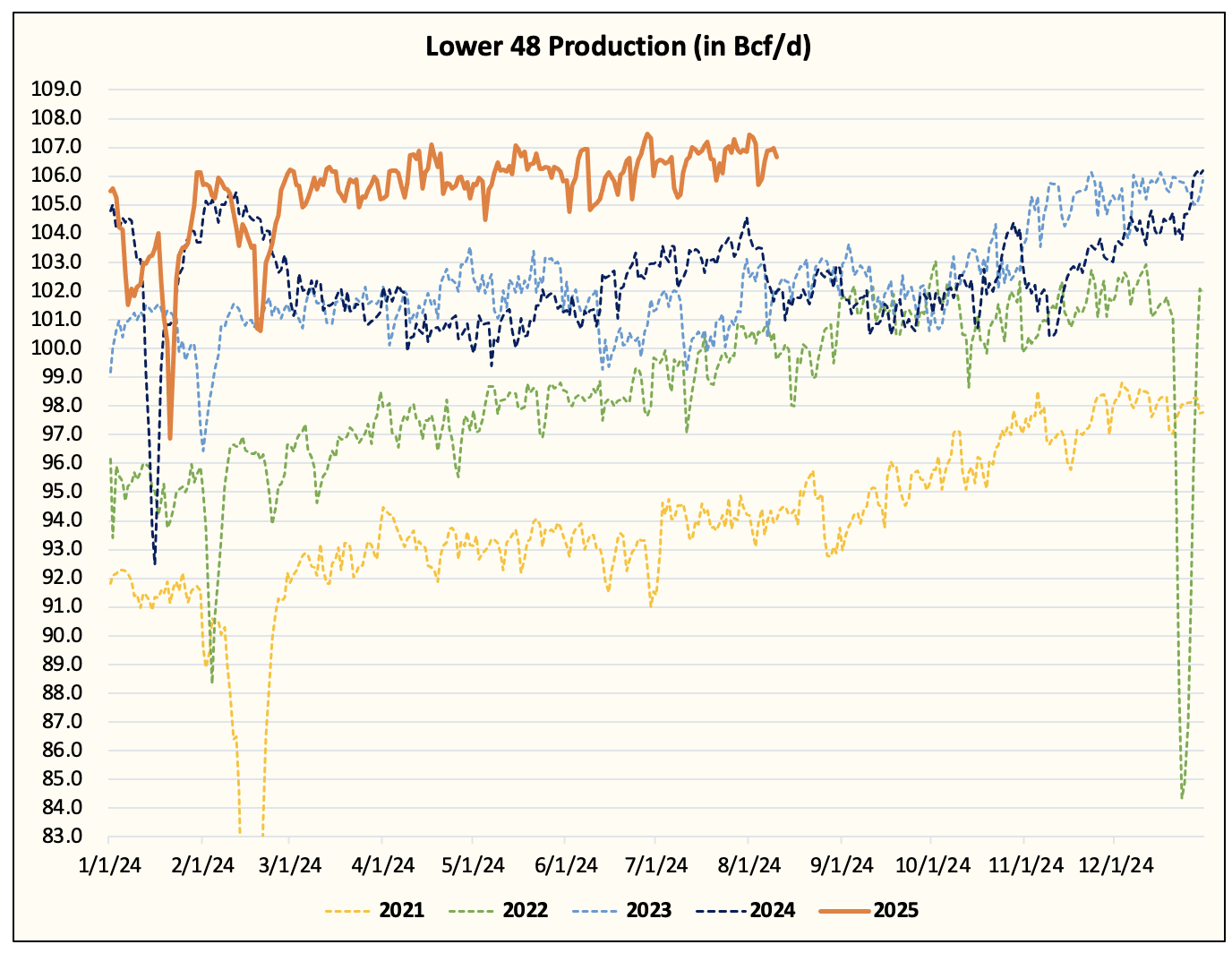

LNG feedgas demand was robust with minor hiccups. Lower 48 gas production remained rangebound between ~106 to ~107 Bcf/d, and all the natural gas market had to do was keep injections close to the 5-year average to usher in higher prices.

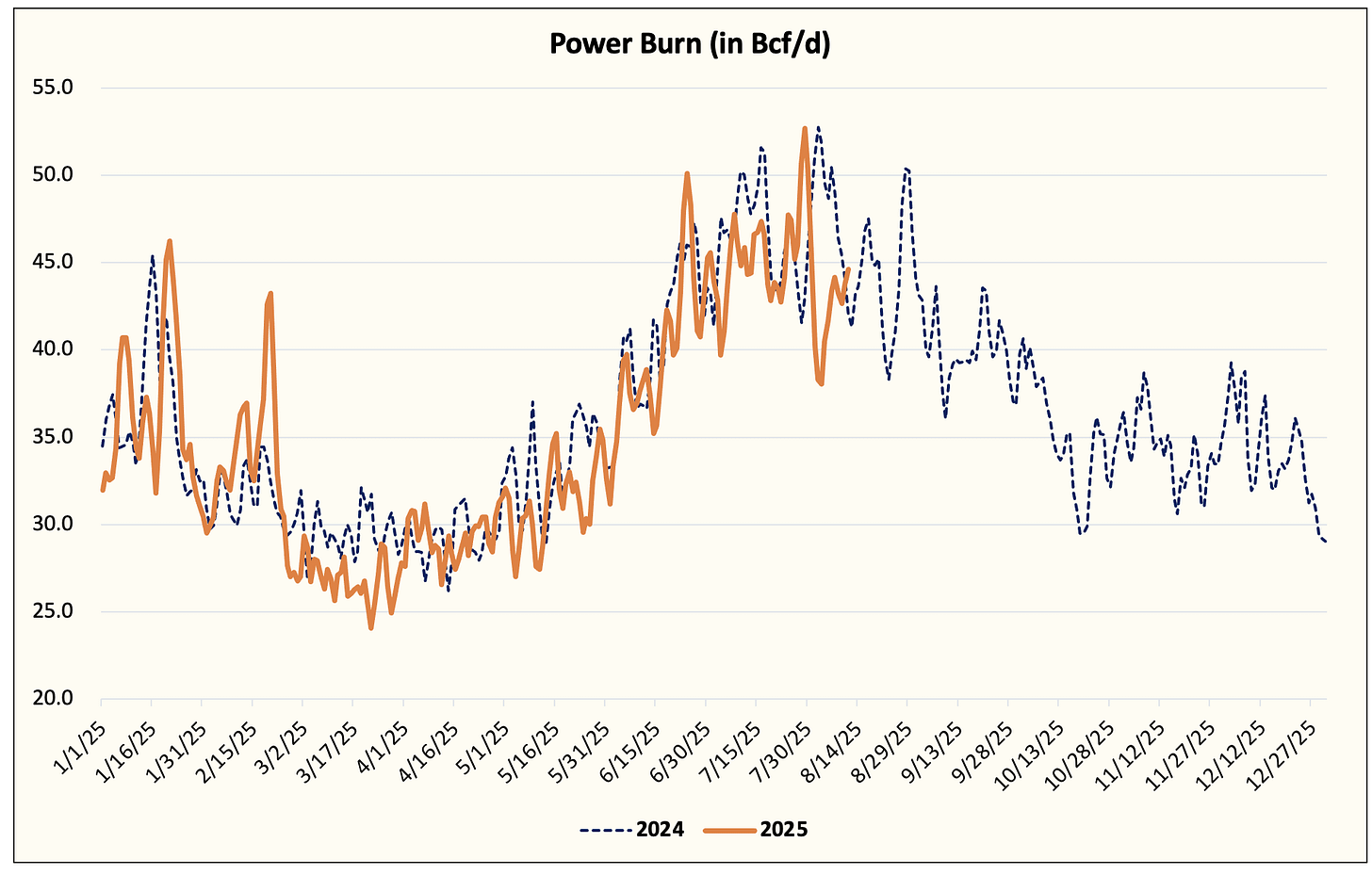

But Mother Nature had other plans in store, and not only did the heat escape the most crucial segment of the summer power burn market (Southeast), natural gas bulls faced the “Charlie and the football” dilemma with the weather updates (initially forecasting bullish weather only to rug pull it right underneath).

Now, the setup going into year-end looks a bit different than what was previously envisioned.

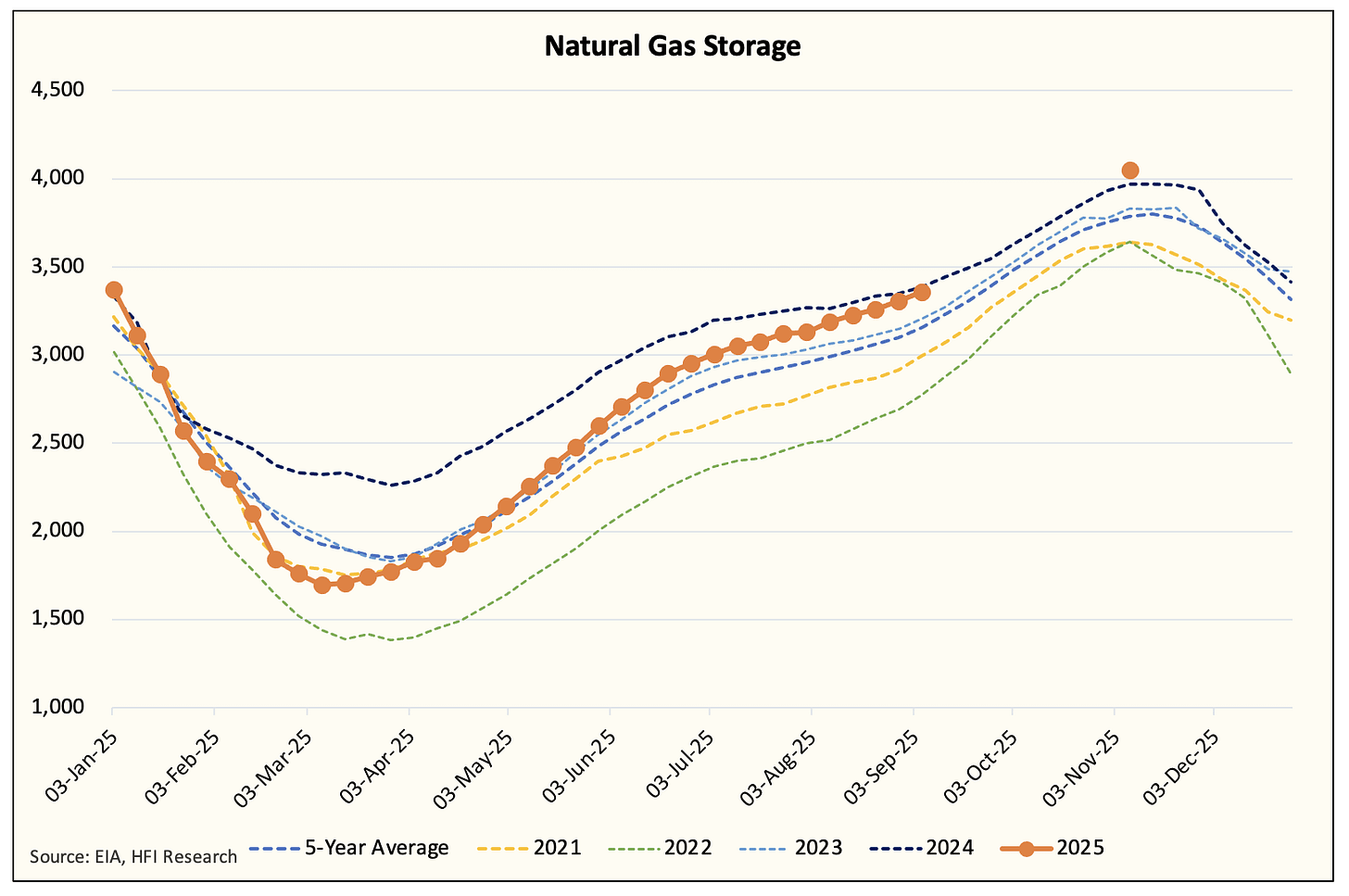

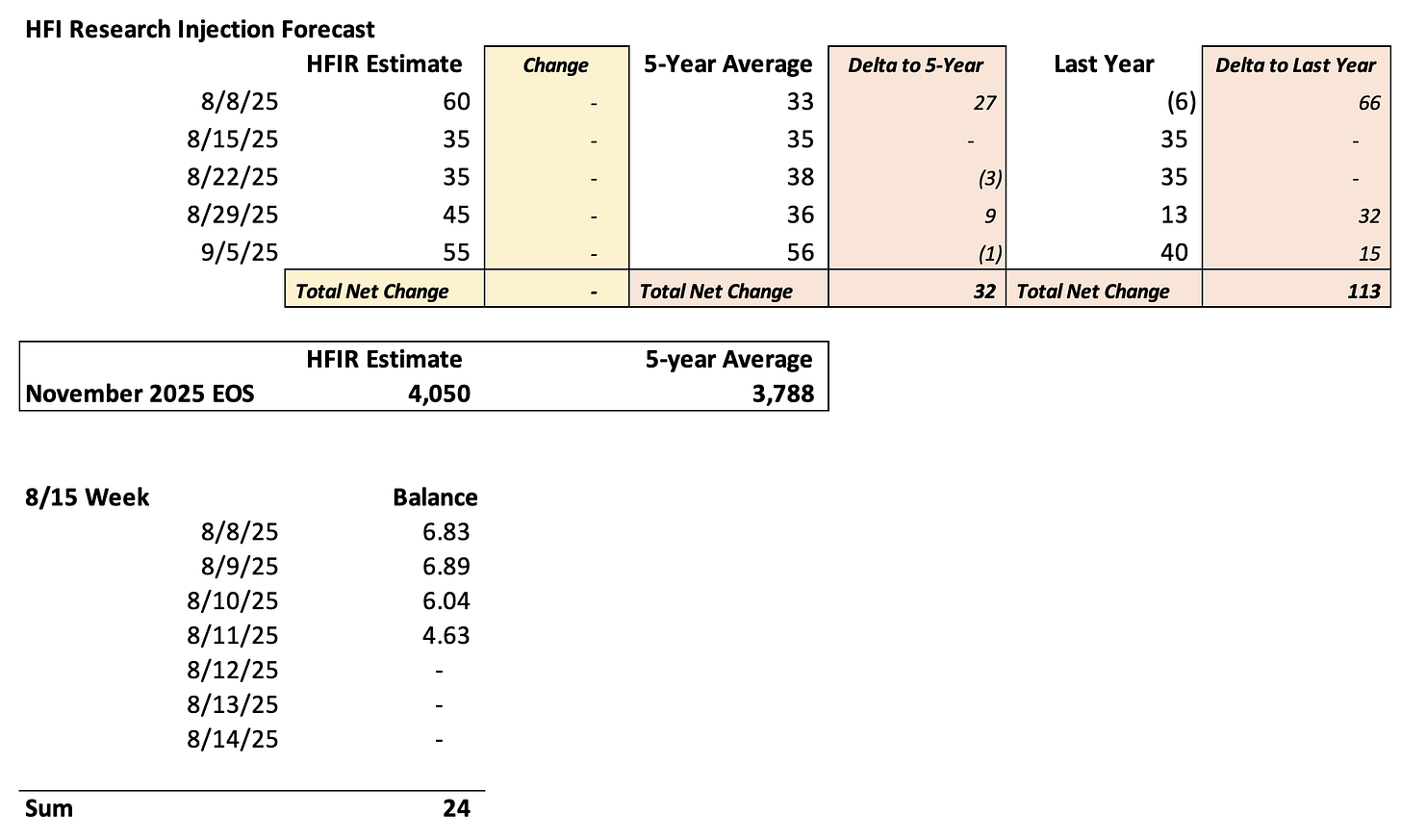

Natural gas storage is expected to finish above ~4 Tcf, with our estimate tracking ~4.05 Tcf. Cooling demand is expected to start falling going forward, and with no material heat on the horizon, injections for the next 5 reports will remain above the 5-year average.

For this week's EIA natural gas storage report, we have +60 Bcf. Contrast that with the +33 Bcf for the 5-year average and the 6 Bcf withdrawal we had last year.

What a difference a year makes.

The notable difference vs 2024 is the lower-than-normal power burn demand and higher natural gas production.

Power Burn

Lower 48 Gas Production

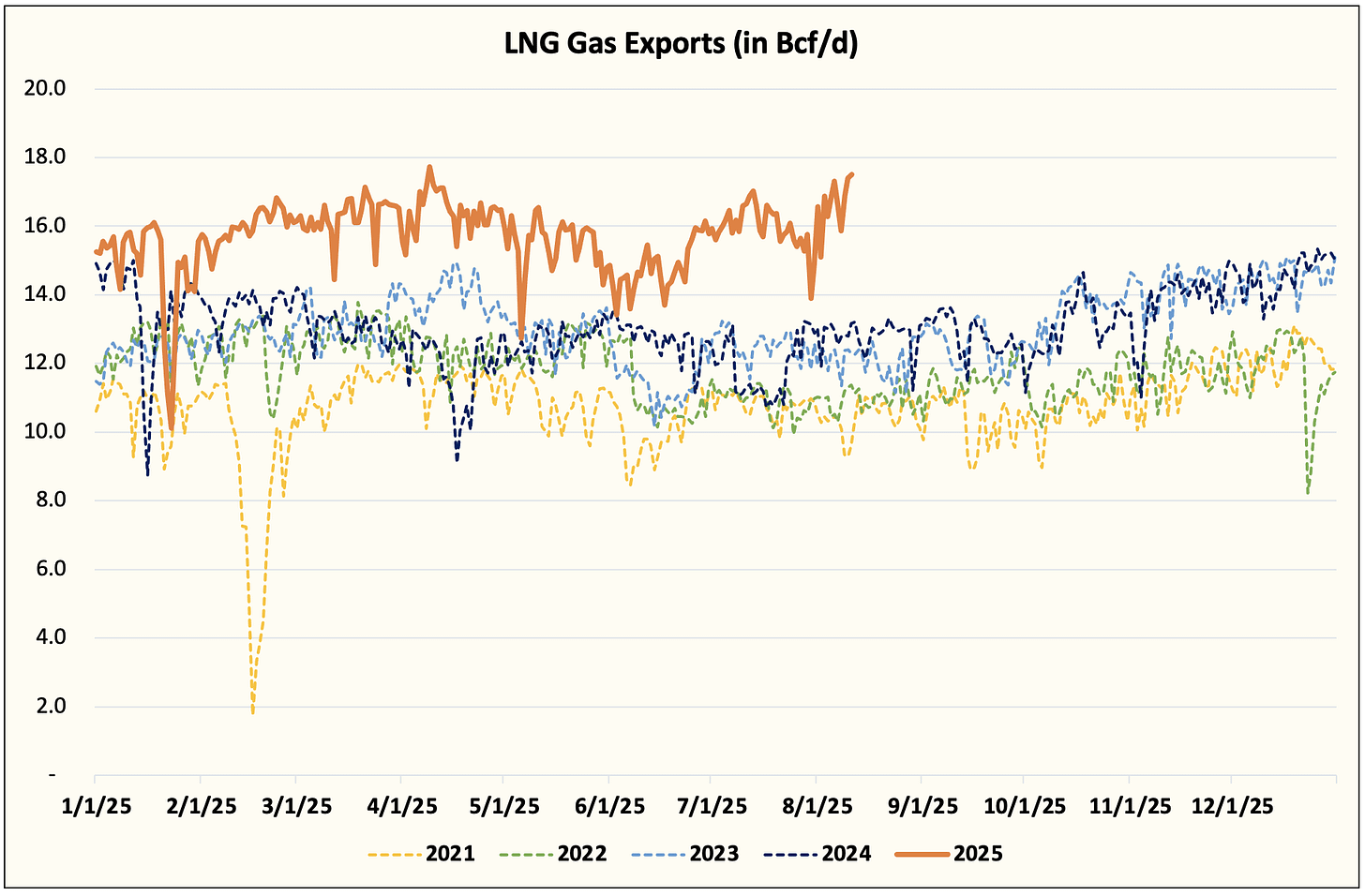

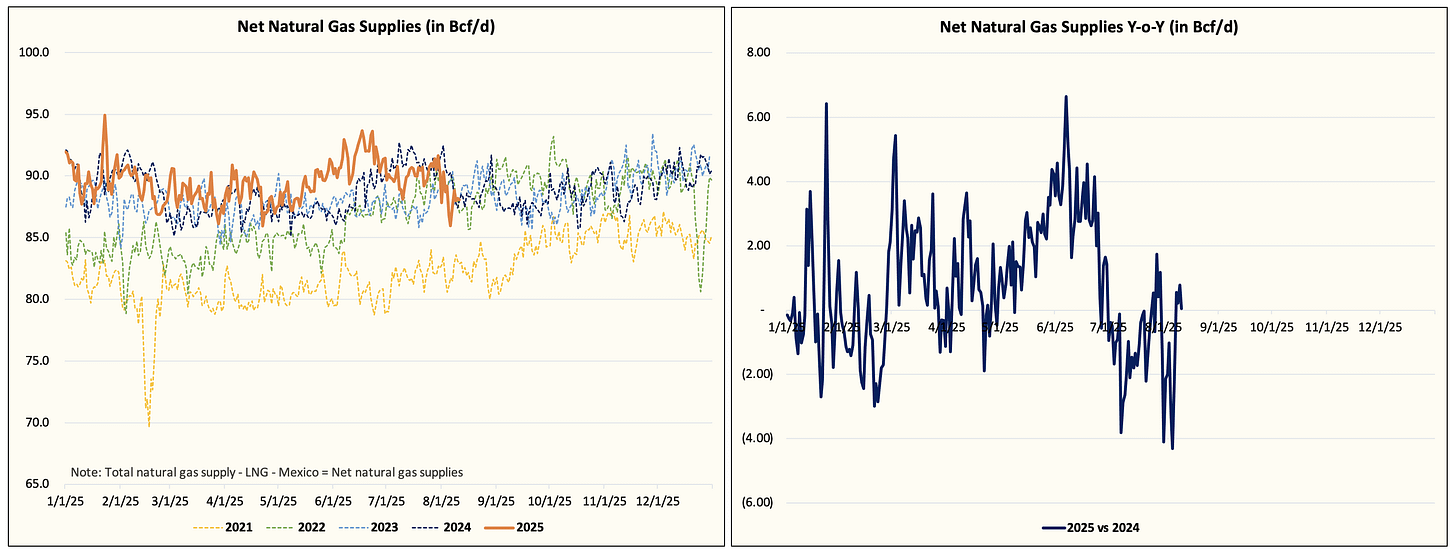

LNG demand, on the other hand, has been stellar and continues to offset the much higher production y-o-y in its entirety.

This has resulted in net gas supplies being flat y-o-y.

Note: Total natural gas supply - LNG - Mexico = Net natural gas supplies