(Public) Natural Gas - This Is Bad

For readers who have followed our natural gas articles this year, you will know that we've been bearish. We remain bearish despite the steep decline in price due to 3 main factors:

Extremely strong Lower 48 gas production averaging ~105 Bcf/d.

Very bearish weather to start the winter heating demand season.

Elevated storage going into withdrawal season making the market heavily dependent on a bullish winter.

The only way for us to change our opinion of the natural gas market is if the following 3 things happen:

Lower 48 gas production drops back to ~102 Bcf/d.

ECMWF-EPS forecast shows an extremely cold weather setup in January.

Storage estimates show the end of withdrawal back down below the 5-year average.

At this moment in time, 2 out of the 3 things we listed have a very low probability of hitting. Looking at our storage projections, we have storage finishing March over ~2 Tcf.

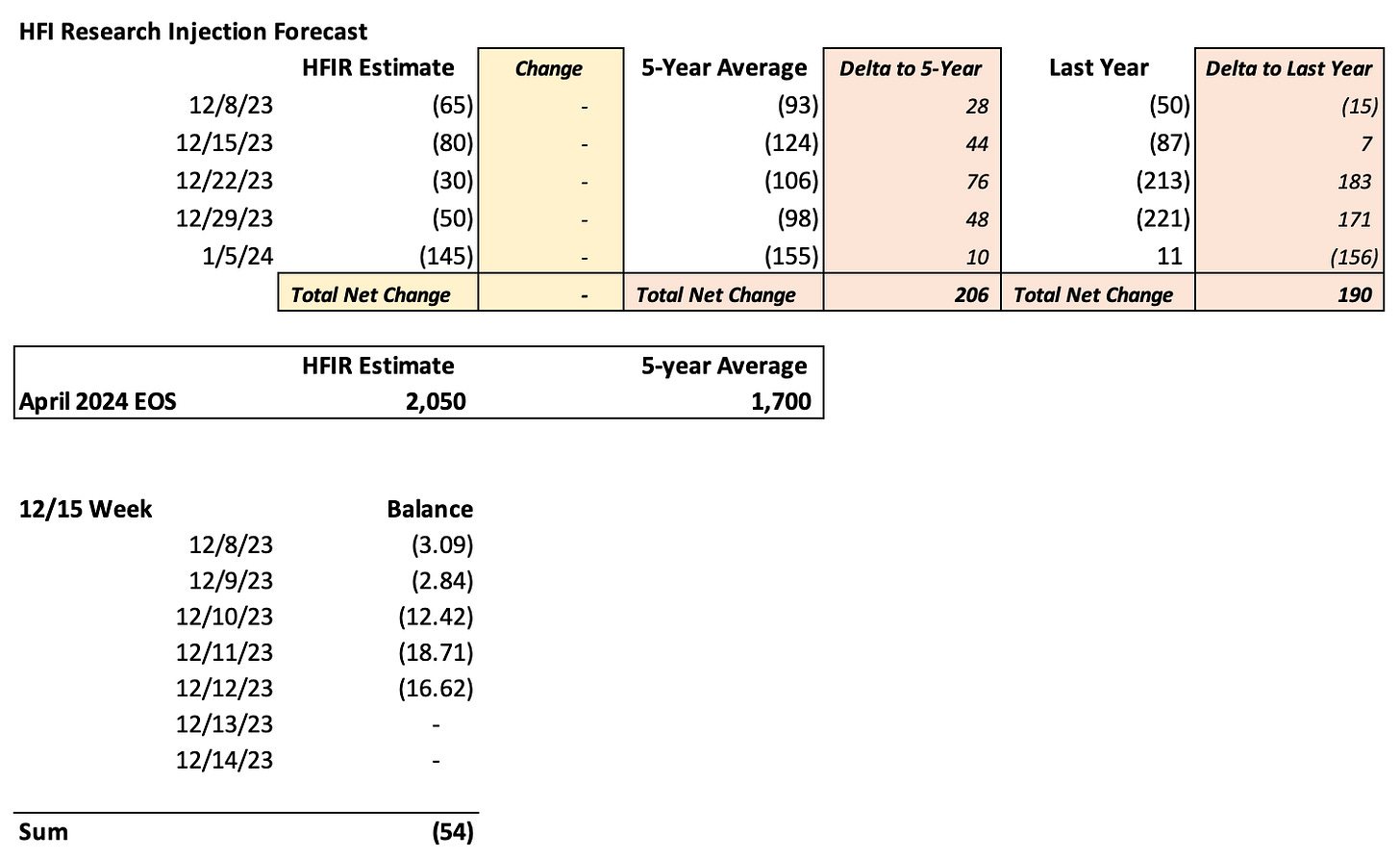

Over the next 5 storage reports, we are forecasting a surplus of 206 Bcf relative to the 5-year average. Unlike last year when we saw an extremely cold event in H2 December, we are seeing the exact opposite with this December showing record low HDDs.

In essence, fundamentally speaking, we need a ~3 Bcf/d drop in production and a ~400 Bcf revision in storage. We would need to see 1) a prolonged cold event in January and February and 2) severe declines in production.

Unfortunately, this looks extremely unlikely. Production has been nothing but stellar this year resulting in the dire price drop we are seeing now. And unless those two things materialize, I don't think natural gas prices in 2024 will see the $3 handle.

But it could get worse...

I think this is the real problem with the natural gas market. While it appears this is about as bad as bad gets, the issue is that this could not be the worst-case scenario. Following a record-warm December, we could have bearish winter weather in January, which would open the possibility of sub $2 gas. For the moment, ECMWF-EPS long-range is showing massive cold potential in mid-January, and for the natural gas bulls' sake, we hope this is true.

Source: CommodityWx

This is a very classic bullish winter weather pattern, and if this materializes, we could see storage draws over 250 Bcf. But again, this is a big if, so we will have to wait for the end of December weather forecasts to see if this materializes.

Not all hope is lost...

As the title of this article suggests, this is about as bad as bad gets. With natural gas prices now falling to the point of eliminating the possibility of any cold risk surprise, the market may get jolted if bullish weather is on the horizon.

For the time being, we don't see any bullish weather surprise in the 15-day outlook, so natural gas bulls will have to wait. But for those of you patient enough, there could be a trading opportunity here given the severity of the sell-off we've seen.

We recommend that if there is indeed the possibility of a bullish weather surprise, we could initiate a short-term (less than a week) position in names like Antero Resources to take advantage of the sentiment. We would not hold these positions long as we remain bearish on natural gas, but it is a tradable event.

For now though, we urge you to stay on the sidelines. Nothing bullish is materializing and may not happen for a while longer.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.