Natural gas markets are unpredictable in the shoulder season. As we've explained numerous times in the past month, there are no fundamental catalysts that will push prices higher. Fundamental balances were loose with injections for May expected to come in well above the 5-year average. This has been the case so far.

Since the start of the injection season (April 4 week), US natural gas storage saw an injection total of 602 Bcf vs the 5-year average total of 432 Bcf. This is also much higher than last year's total of 460 Bcf.

The primary cause of the bearish injection is the weather.

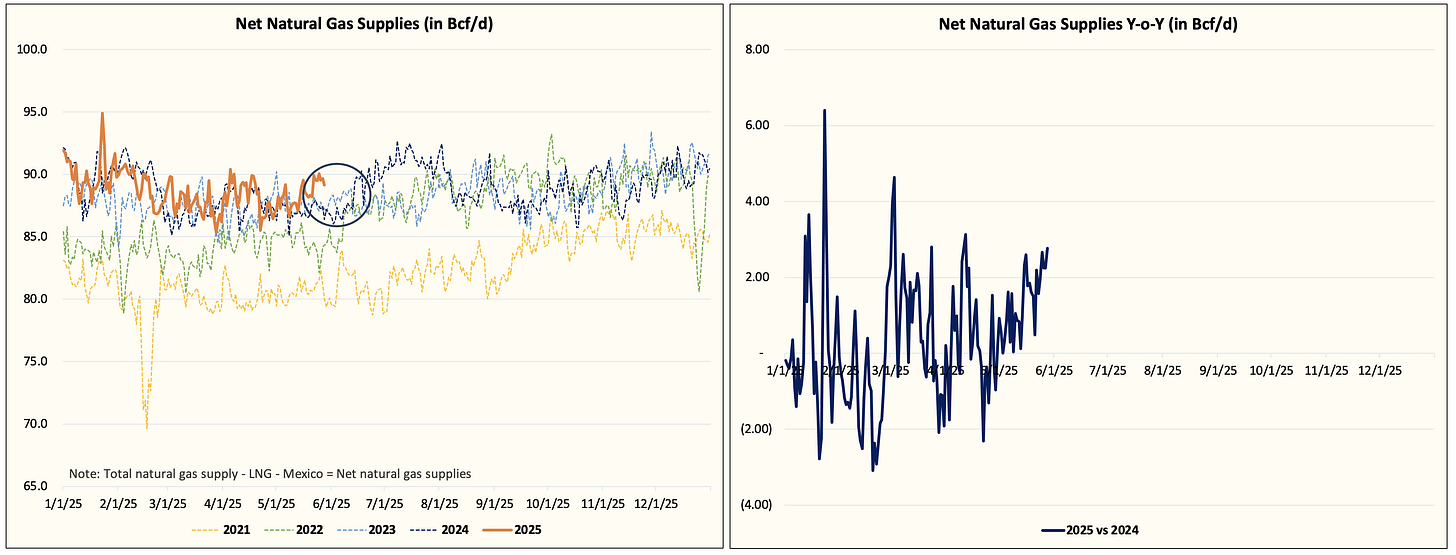

On a fundamental supply & demand basis, net gas supplies (total gas supplies y-o-y - total export demand y-o-y) averaged only +0.37 Bcf/d higher y-o-y. So if you are looking at higher production as the main cause of the bearishness, you are looking at it incorrectly.

But like all commodity markets, narrative can sometimes sway price more than you think. In this instance, you can see that net gas supplies are approaching a "bubble" region.

What does that mean?