On Monday, we published our WCTW titled, "The Seeds Are Sown: An Inevitable Oil Bull Market." The current weakness in oil is sowing the seeds for another oil bull market in the making, but natural gas will be the biggest beneficiary in the near term.

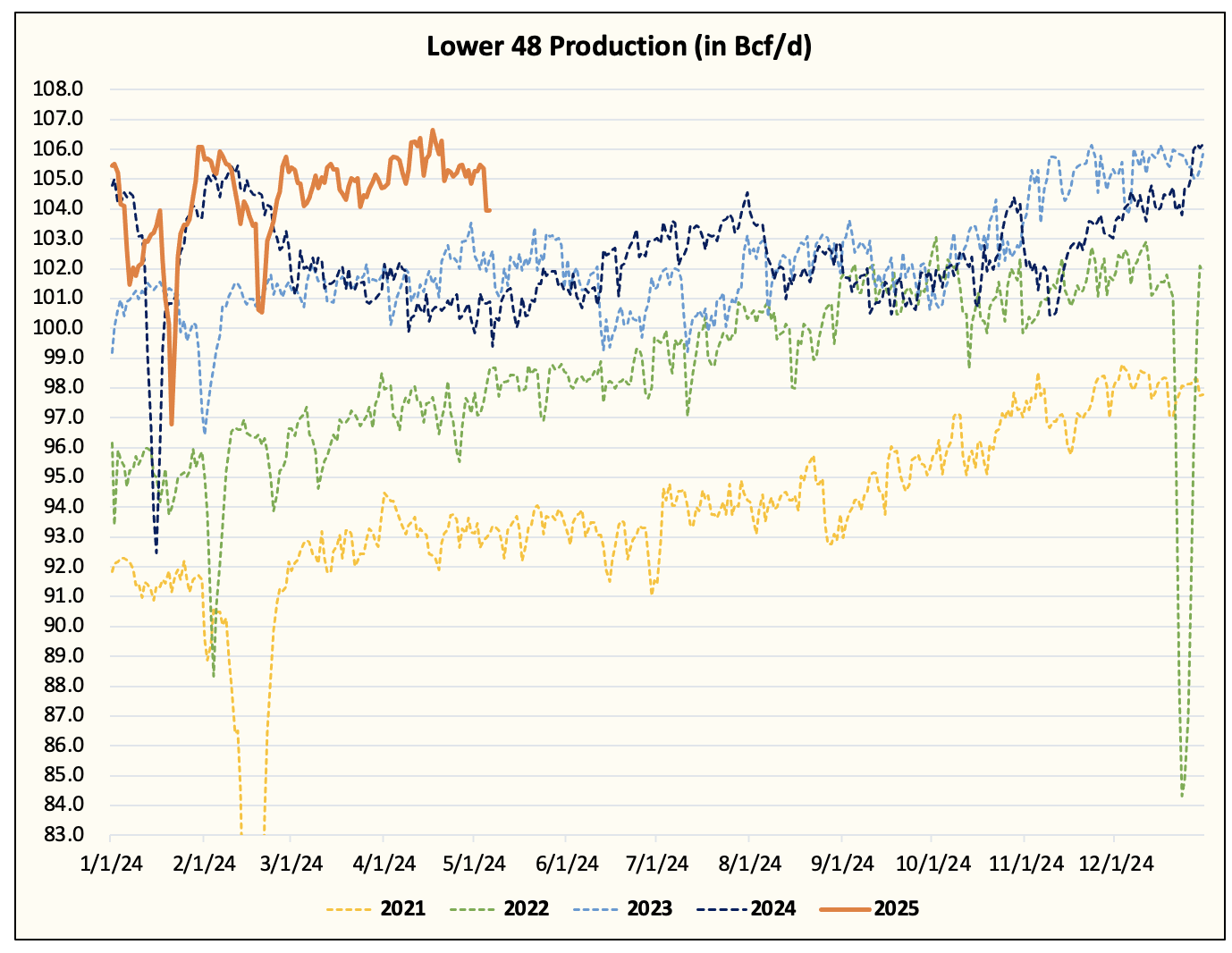

Coming into 2025, we had previously expected Lower 48 gas production to reach ~109 Bcf/d. US shale oil producers are seeing a higher gas-to-oil ratio, and as a result, even if they kept production flat, associated gas production was going to go higher.

One of the key variables we said to watch out for in 2025 was Haynesville activity, which would start to respond once Henry Hub reached $5/MMBtu. But following both the sell-off we saw in natural gas and the oil weakness, we are revising lower our Lower 48 gas production estimate.

Assuming WTI remains flat around $60/bbl, we have Lower 48 gas production hitting ~106.5 Bcf/d by year-end with injection season average around ~105 Bcf/d.

We now have datapoints to back up our forecast.

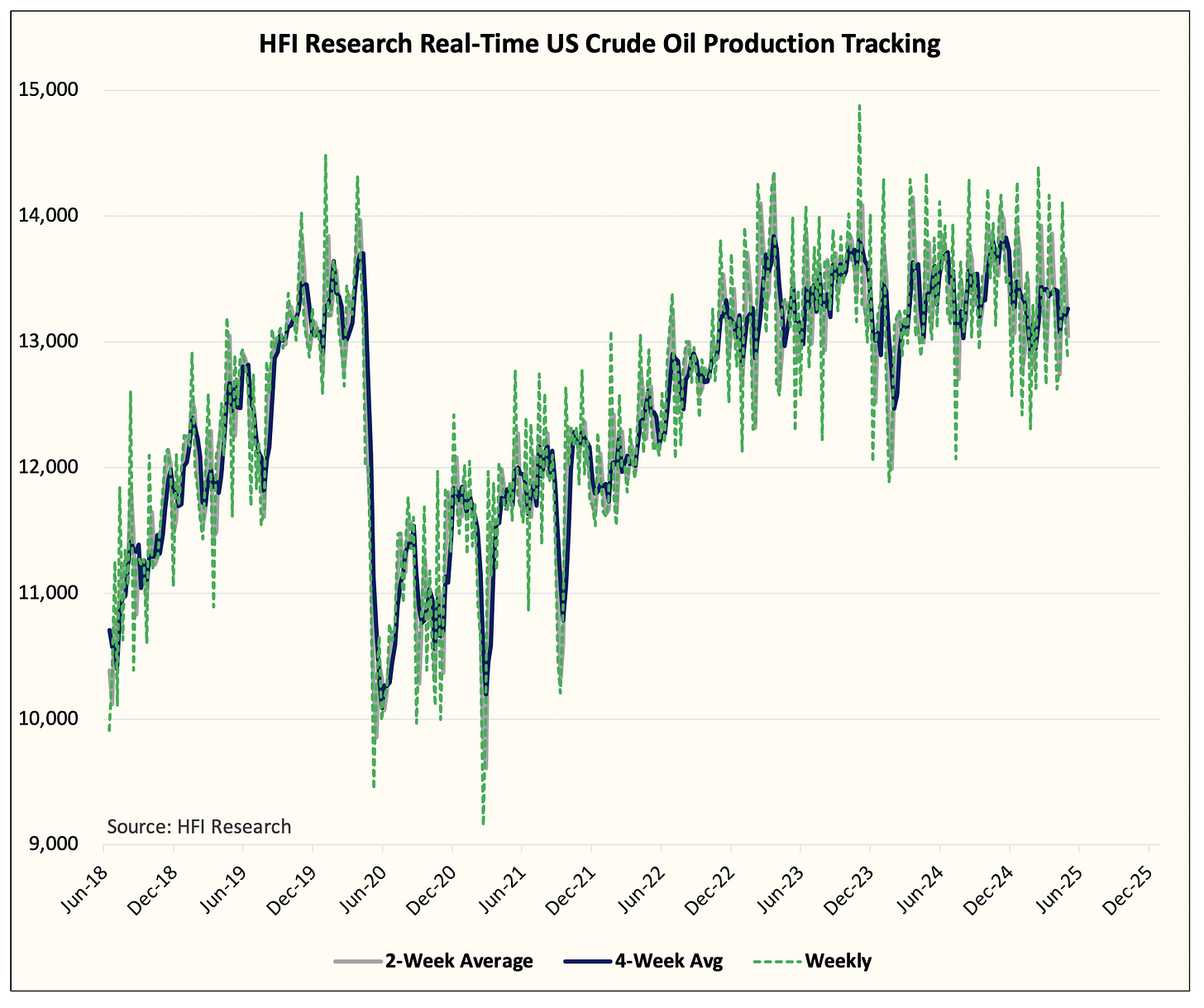

US crude oil production is seeing material weakness with April finishing at ~12.86 million b/d.

Lower 48 gas production averaged ~105.4 Bcf/d in April.

We expect Lower 48 gas production to trend flat throughout the summer months just when power burn demand starts to pick up.

As a result, if Lower 48 gas production does not meaningfully surprise to the upside, the natural gas price spike happening later this year is all but inevitable.