I come bearing good news and bad news.

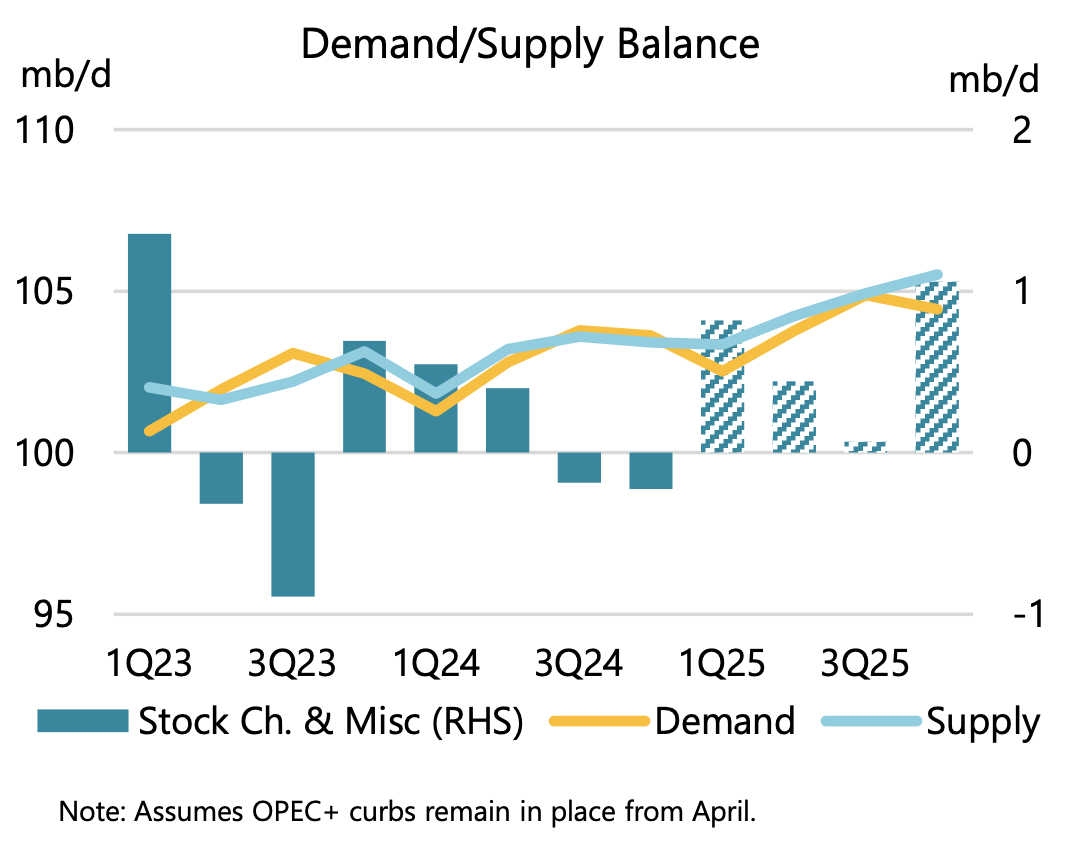

Good news: Oil market fundamentals are trending in the direction that we thought they would (Q1 balances to show a draw).

Bad news: No one gives a f&*! until something breaks.

The irony is that for oil specialists, the more granular the detail, the more you get pulled away from the broader sentiment in the market. Every generalist today is looking at the possibility of an incoming recession, while oil specialists are fixated on things like refining margins, high-frequency inventory, real-time US crude oil production, and things that actually move oil market fundamentals.

But the cold hard reality is that price is king, and given that's the case, no one is going to care until prices start to meaningfully move higher. And prices won't meaningfully move higher unless something breaks.

If you want an example of what I'm saying, all you have to do is read the latest IEA oil market report that came out today. In IEA's report, it specifically says:

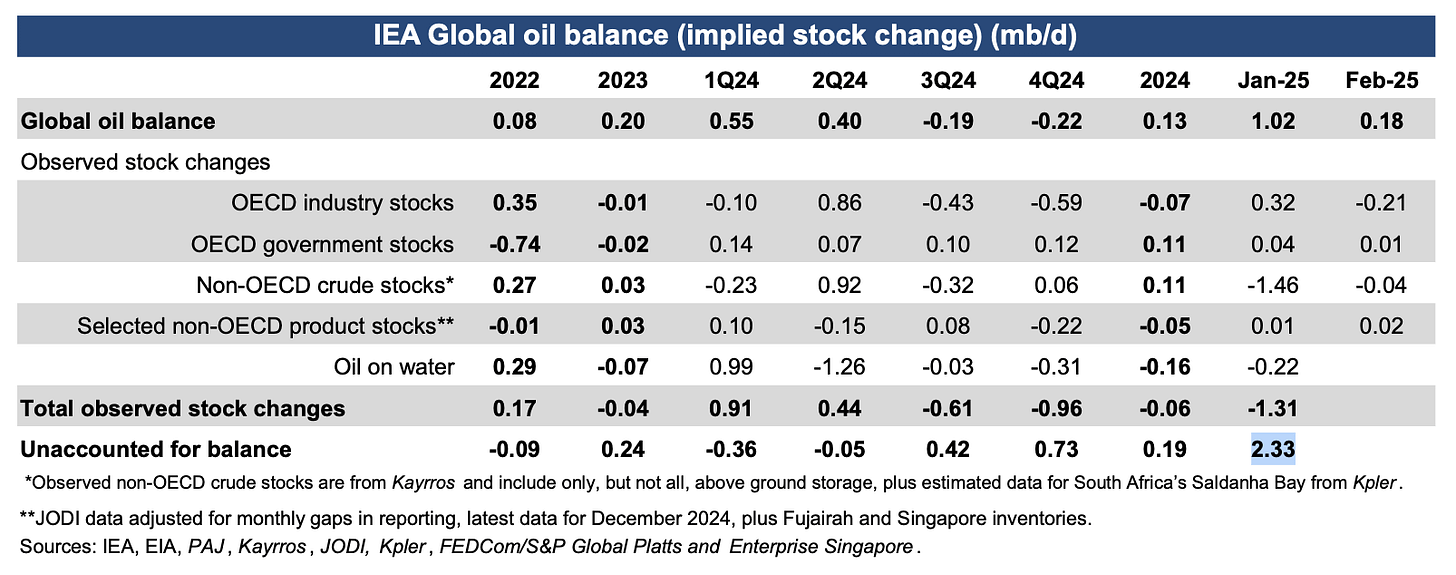

Global observed oil stocks fell by 40.5 mb in January, of which 26.1 mb were products. Non‑OECD crude stocks plunged by 45.3 mb, dominated by China where imports declined. Total OECD stocks rose by 11.2 mb, boosted by a 25 mb build in industry crude inventories. Oil on water fell by 6.7 mb. However, preliminary data for February show total global oil stocks rebounded, lifted by an increase in oil on water.

Oh... inventories declined in January? But wait a second, what's this?

Source: IEA

Global oil inventories are still expected to build by nearly ~1 million b/d?

Ah, it's because of "unaccounted for balances", which came in at a staggering +2.33 million b/d for January.

Source: IEA

The magic fairy dust that eliminates all deficits. I mean just look at 2024 balances where observed inventory changes showed a decline of 0.06 million b/d, but IEA penciled in a build of 0.13 million b/d (from +0.19 million b/d of unaccounted for balance).

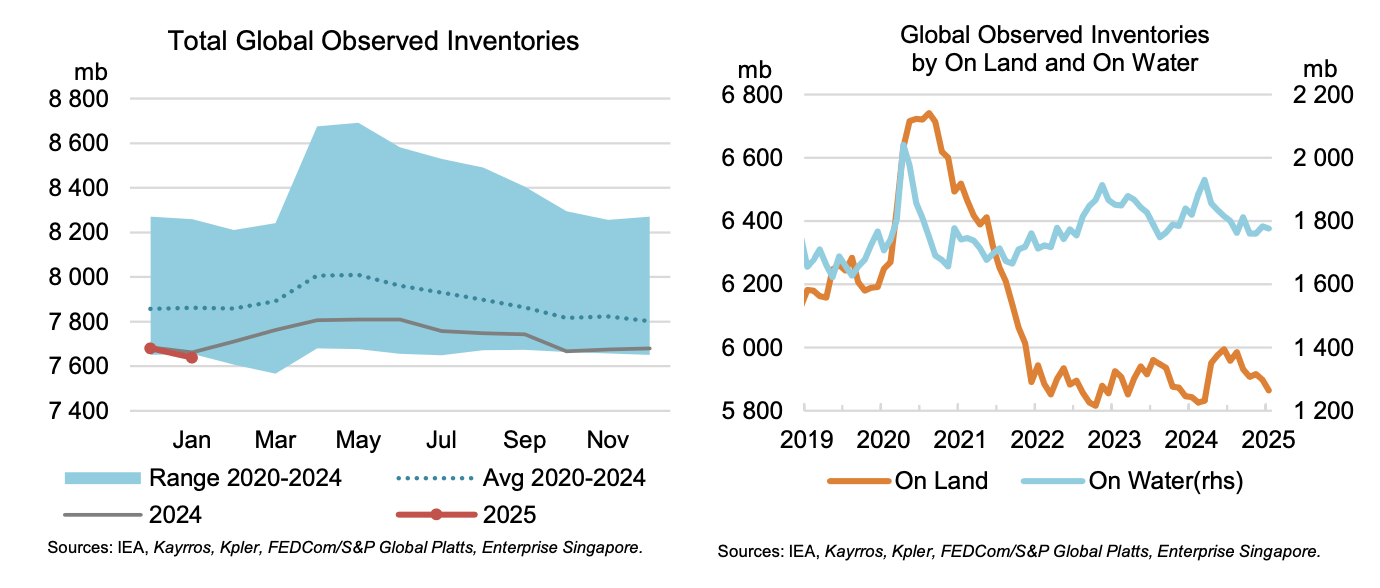

And because of the decline in inventories in January, global observed oil inventories are near the lows over the past 5 years.

So never mind the fact that pixie dust +2.33 million b/d came from thin air, what justifies the consensus's belief that Q1 will show a build?

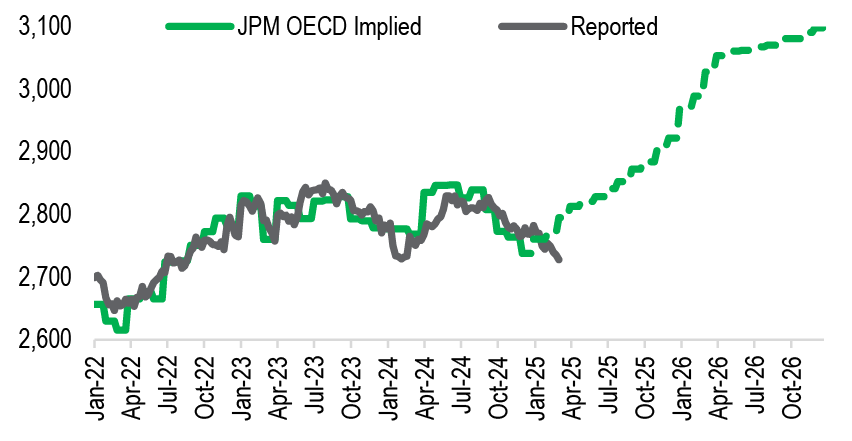

But the troubling thing is that it's not just the IEA that's on this crusade in calling for massive inventory builds, JPM, Citi, Morgan, and Goldman are all aligned on the same page.

Source: JPM

All you have to do is just look at the implied balance versus the reported for all the answers you need.

But this isn't my first rodeo in being so far against the consensus. At the end of 2023, we called for the material slowdown we will see in US crude oil production in 2024 just as everyone thought we would have another year of stellar growth. The reality ended up showing the slowest US crude oil production growth since the Permian revolution started in 2016.

And what's the reward?

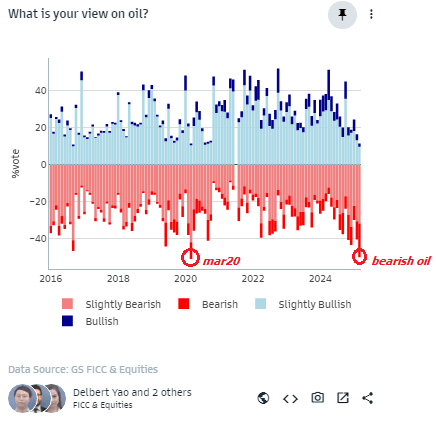

$66/bbl WTI + the most bearish consensus has been since COVID

Source: Goldman, BenniKim

Perhaps it's time for a job change.