Oil Data Continues To Fly In The Face Of Skeptics

EIA's oil storage report today was bullish, but the market continues to find a million reasons to be skeptical about oil. Debt ceiling this, China demand that, Russian export this, and so on and so forth, but the reality is that the oil market data continues to trend favorably for the bulls. Most importantly, the demand weakness we saw in the US that started in April last year has turned into a strengthening trend.

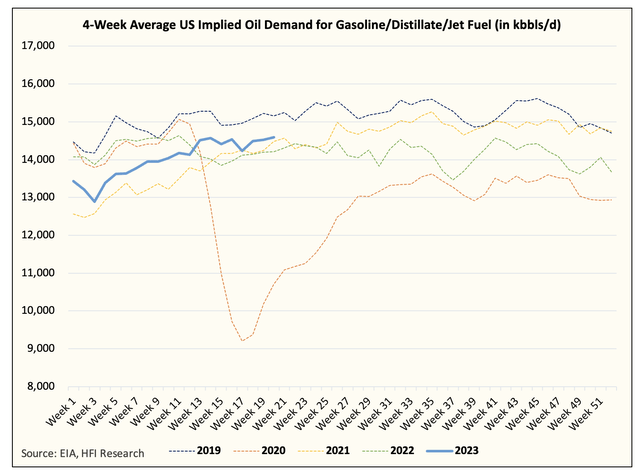

Looking at the chart above, you can see that the US implied oil demand on a 4-week basis is now above 2019. We are also materially higher than 2021 and 2022.

In the coming weeks, we expect implied oil demand to keep trending higher fueled by gasoline and jet fuel.

By the latter part of this summer, we expect gasoline, distillate, and jet fuel demand to be close to that of 2019. Combining this with the other demand variables, we expect US oil demand to hit an all-time high.

What about the incoming recession?

For us, we are trying to be as objective as we can. If you look at oil demand data, it's clear to us that the weakness we saw in demand in H2 2022 had recession written all over it. That period coincided with 1) Fed tightening and 2) elevated petroleum product prices. But following the weak data, we are starting to see demand improve again. So unless the data tells us otherwise, we think the oil data continues to fly in the skeptics believing things will get worse from here.

In our view, given the disappointing demand figures that started in April last year, refinery throughput this time around may not be enough to satisfy the demand on the horizon.

Looking at product storage, we are already below 2022. So if demand outpaces 2022 by a good margin, US petroleum product exports will drop, which will result in tighter global product balances and thus higher prices.

The good news is that 2+ million b/d of new refining capacity is coming online this year, so we won't see the same refining margin spike as we saw last year. But that doesn't mean margins can't go higher, which would then incentivize refineries to increase throughput. This will eventually result in more crude buying and a tighter physical market.

Now you couple higher throughput with the OPEC+ production cut, and we would strongly argue for much higher oil prices going forward.

Let the draws begin...

In our oil market balance, we had mid-May as the start of large inventory draws. It was nice to see EIA confirm this for once, and so for the oil bulls, the trend needs to continue. Looking at our balances, we expect June to show an oil market deficit of ~1 million b/d with the 2nd half of 2023 showing an average of ~1.25 million b/d.

On a total liquids basis, we expect US oil inventory balances to eliminate the surplus since the beginning of the year by mid-June. And by the end of July, we should see commercial total liquids below that of 2022.

Once this happens, skeptics will have no choice but to acknowledge that the oil market deficit is back and that the market is far too pessimistic about oil.

For now, let's let the data speak for itself.