Oil Data Is Turning But Not Turning Fast Enough

EIA's oil report this week was mildly bullish, and while the data is finally starting to turn for the better, the velocity of the turn is not enough.

One key reminder for readers, however, is that you should expect crude storage to continuously draw from here on out. Crude exports remain elevated while crude imports remain in line. Next week's preliminary forecast is for another mid-single-digit draw.

The oil market, as it stands today, is a glass-half-full vs half-empty situation.

If you are an oil bull, you can look at this market (like us) and point to the improving demand data, the incoming inventory draws, and the OPEC+ cut as bullish tailwinds.

If you are an oil bear, you can point to the physical market being loose, timespreads falling, and worries over demand in the incoming recession as reasons why you should remain bearish.

The reality is straightforward. Oil demand data is improving, and inventories are going to start to draw, but none of these things are happening as fast as the bulls want, and all of the bear forces remain in place.

So if you are an oil bear expecting prices to go down further from here, you would need oil demand to turn downward instead of upward. And if you are an oil bull, you need to see the next few weeks validate that 1) inventories are drawing, 2) OPEC+ cuts are materializing, and 3) demand is improving.

Look at the data...

Yes, I understand oil prices are down today on the heels of this EIA oil storage report, but I'm looking at the data. And this is what I see:

I see demand diverging from last year. And in relative terms, I firmly believe that by July, US implied oil demand along with the rest of the world should firmly be above 2022. Last year saw very elevated oil prices dampen demand over the summer months, that's not going to happen this year.

And there are important implications arising from this point. By the end of July, and if demand is indeed improving vs decreasing (last year), then product storage will remain low, and inventories will trend lower.

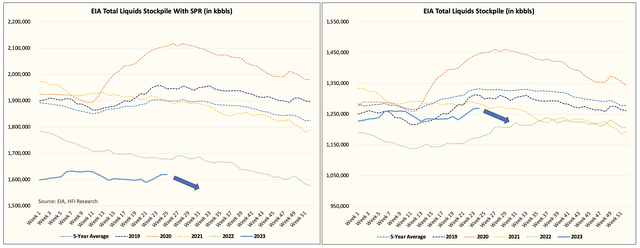

Another important point to note is that the SPR release will finish by the end of June. This has been a meaningful drag on crude storage balances. While I am not a fan of using US crude storage with SPR to show just how much we drained in storage, it is a matter of fact that the US SPR release has "clouded" the real inventory backdrop.

Commercial

With SPR

With all that said, there are more reasons why if the inventory draws don't materialize, then oil bulls have to admit that H2 2023 balances won't be tight.

What to expect?

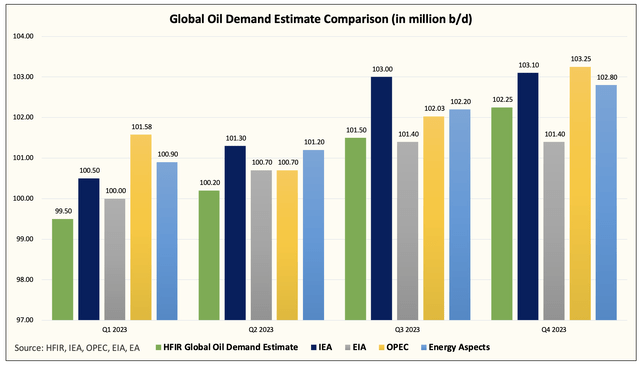

In our global oil supply & demand balance, we are assuming Iran producing close to ~3.3 million b/d now (separate article on this coming).

As you can see, we still expect H2 2023 balances to show draws with Q2 balances flipping to a small surplus. One key assumption for H2 2023 is that the Saudis maintain their voluntary production cut into year-end.

Now if you take our balance and assume that the Saudis don't unilaterally cut ~1 million b/d, then the deficit shifts to -0.21 million b/d and -0.56 million b/d, respectively. In essence, the oil market is firmly in the hands of the Saudis in H2 2023. If they want oil inventories to draw in size, then they should keep their cuts until year-end. If they feel prices are too high, then they can increase production.

Keep in mind, again, that we have very conservative demand assumptions.

So what should you expect? You should expect US oil inventories (total liquids) to start trending downward.

You are not in an oil bull market if the total liquids stockpile is building. We will know how right we are in a few weeks. You don't even need to wait that long to find out if H2 balances are correct or not.

Conclusion

Oil data is improving but it's not improving fast enough. The rubber meets the road for the oil market in a few weeks when the anticipated draws need to materialize. With Saudi unilaterally cutting ~1 million b/d in July, we should see 1) inventory draws starting and 2) the physical oil market tightening. If neither of these things happens, then we need to reassess immediately.

Let's see what's ahead.