Oil Data Looks Far Better Than Meets The Eye

Before I dive into the oil data, there are a few important things that need to be said.

First, I believe the sell-off you saw in oil over the past week is more related to 1) macro worries and 2) technical (gap fill) rather than something oil specific. It is important to point out, however, that the physical oil market has not been very strong either, which has disincentivized anyone looking to get long.

So when you couple the two things we said with a softening physical oil market, readers should not expect prices to move higher. In addition, oil market balances in April was showing a small deficit. And looking at US total liquids, we are flat for the month, which is in line with our expectations.

Going forward, there are two important catalysts on the horizon:

Improving oil demand data (more on this later).

OPEC+ production cut.

Now that the technical gap fill has taken place and oil has given back all of the gains it achieved from the surprise OPEC+ cut announcement, we can finally focus on fundamentals again.

I believe firmly this year's oil market balance comes down to just one variable - demand. I've said this for a long time now, but the supply side is known. There are no surprises lurking in the dark corners of the market that we don't know about. For those wondering about US oil production, we have this figure down to the T.

And as you can see in the latest data, US oil production is flat since December. We believe US oil production today is around ~12.5 million b/d.

As for the rest of the world, Canada, Brazil, and Norway are the only other countries with material enough production growth to sway balances. And there are no surprises lurking there either.

This then just comes down to OPEC+ and Russia. And for our oil market balance, we have Russia losing no production, and OPEC+ following through. Putting all of this together, the end result is a gradually increasing deficit starting in May.

Note: OPEC+ cut starts in May.

Now if we tie all of this back together, it's not the supply side we have to worry about. It's just demand, and for market participants, the incoming recession is one that has many of them guessing what demand will do.

But first, let's just entertain the idea that demand will be horrid.

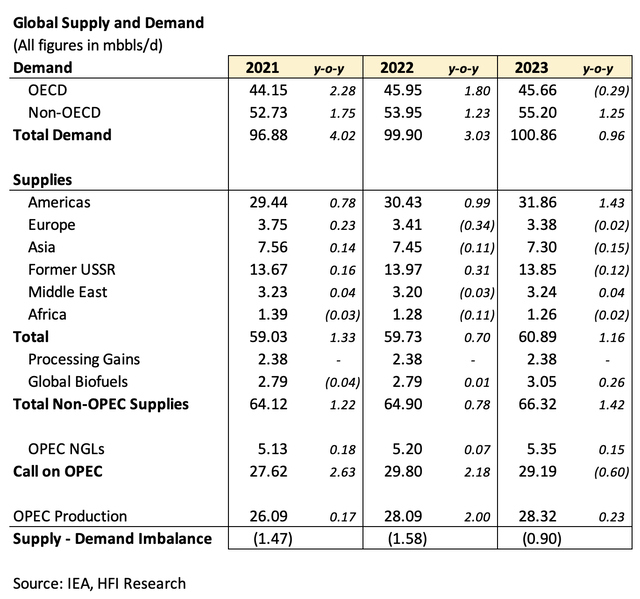

For 2023, we are assuming a decrease of 0.29 million b/d in OECD demand. And for non-OECD, we are assuming an increase of 1.25 million b/d y-o-y. The increase in non-OECD demand is all related to China's removal of its zero-COVID policy. The demand increase does not reflect any inherent economic growth.

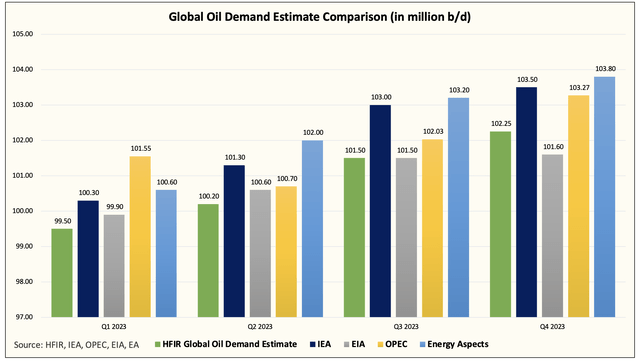

And looking at our global oil demand estimate versus peers, you can see we have the lowest average.

So even under a very dire demand outlook scenario, oil market balances from May to December will average over ~1 million b/d of draw.

But we are not done just yet. If you look at the latest US oil demand data, the decrease that we are assuming y-o-y for OECD seems unwarranted.

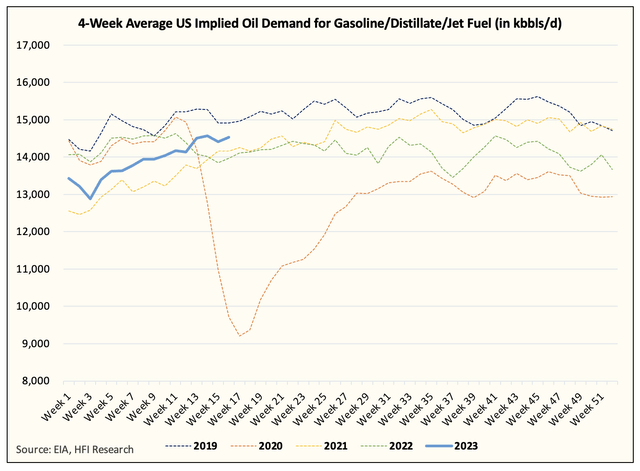

Here is the US total implied oil demand chart, which is currently above 2022 (NOTE: Q1 2022 demand data was acknowledged by EIA to be faulty to the upside).

And if you look at gasoline, distillate, and jet fuel, you can see that we are well above 2022.

As a result, I believe that our estimate assuming a decrease in OECD demand is overly conservative and likely to be wrong. Putting it in another way, we think OECD demand is likely to be higher than our estimate resulting in an even higher deficit than we have modeled.

The reverse of last year...

On April 12, I published a report titled, "It's Funny, Oil Market Has The Exact Opposite Setup Vs Last Year." In it, I wrote:

In essence, what I am trying to say is that the oil market is never what it seems. On the surface, something can be perceived bullishly like the Russia/Ukraine invasion, but it turned out to be bearish for the market. Similarly, the possibility of a recession on the horizon, which materially lowered oil prices, could be bullish as it stimulates demand once again. In addition, the perception also prompted OPEC+ to cut supplies, which is a bit like the opposite of the SPR release last year.

So what if the recession isn't as bad as we think it is? But supplies have been reduced regardless, and just like last year when the SPR was released on the expectation that Russia would lose production, what happens if demand isn't all that bad?

The oil market is a funny beast, and I feel like we live in a parallel universe. What happened last year is playing out in its exact opposite form this year. If my analysis on this is correct, I think there's a much higher chance oil prices surprise to the upside this year.

And with the latest US oil demand data, I can't help but feel that this is the exact opposite setup versus last year. US oil demand was materially disappointing to the downside by this time last year, but oil prices kept going upwards nonetheless. But this year, demand is starting to improve, the OPEC+ production cut is coming, and yet, everyone is afraid that recession will meaningfully drop demand.

I believe it's moments like this when readers have to really clear their heads of preconceived notions and focus on what's important. And what's important is that US oil demand is improving, and global oil market balances still show a draw despite very tepid demand assumptions.

Oil data looks far better than meets the eye. Focus on what's important.