Oil Inventories Start Q1 With Builds And What To Expect Going Forward

Going into the end of 2022, the oil market fully anticipated Q1 2023 to show builds. The question on everyone's mind was how much were the builds going to be.

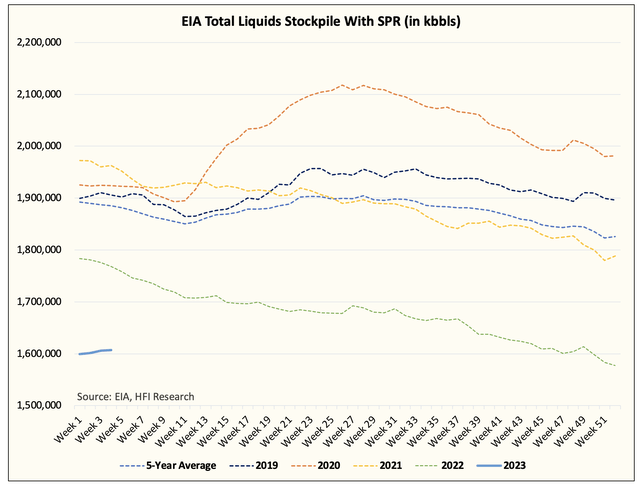

With January in the bag, US total liquids showed a build of 30.367 million bbls over the 4-week span covered in EIA's latest report. This translates into a daily surplus of 1.085 million b/d.

Now compare this to Q4 where we saw US total liquids drop by ~60 million bbls or -0.66 million b/d.

Looking ahead, we had expected the average build of Q1 to come in around ~0.5 million b/d. And if you look at the EIA data closely, the velocity of the builds has slowed in the last 2-weeks. Most of the builds we saw in January came in the first 2 reports, so February will be a crucial month in how we fare for the rest of Q1.