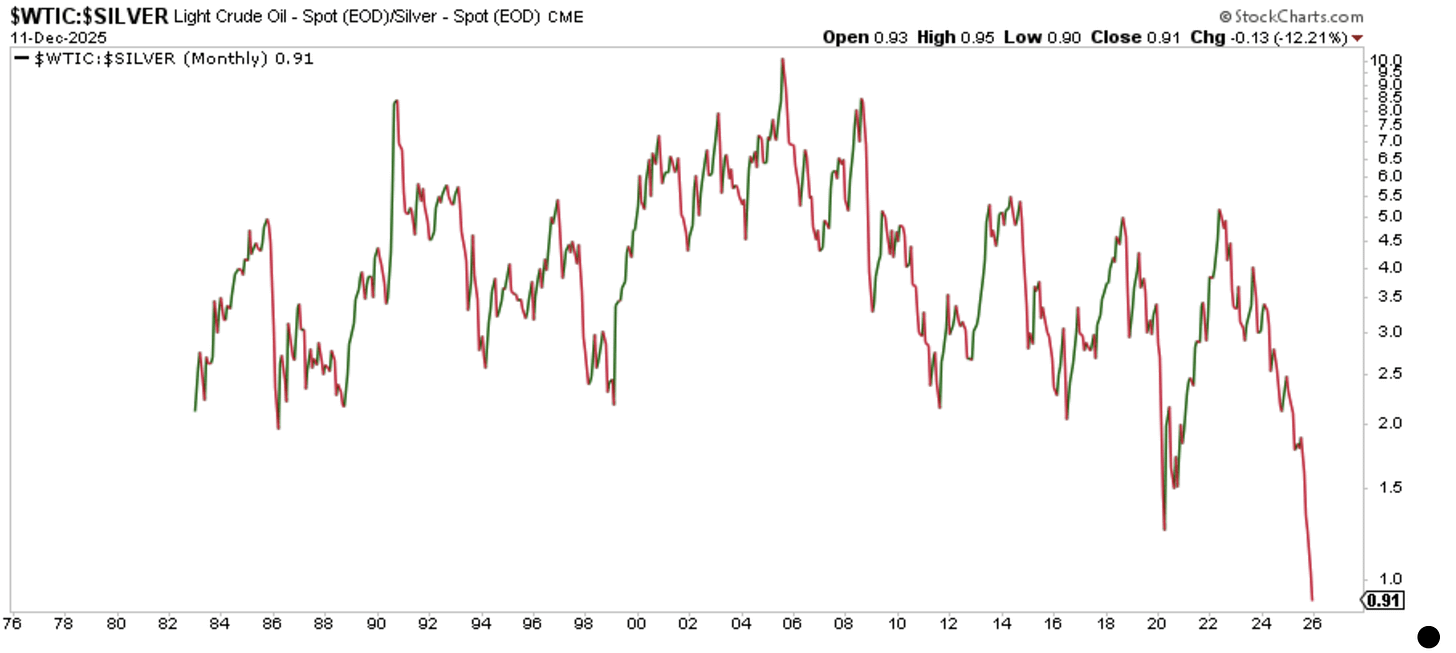

Something caught my eye this week. It was the WTI to silver chart:

A barrel of crude oil now costs less than an ounce of silver.

Take a step back and think about that for a second. Yes, silver has strong industrial demand channels, but the chart above is a silly illustration of how far things are today.

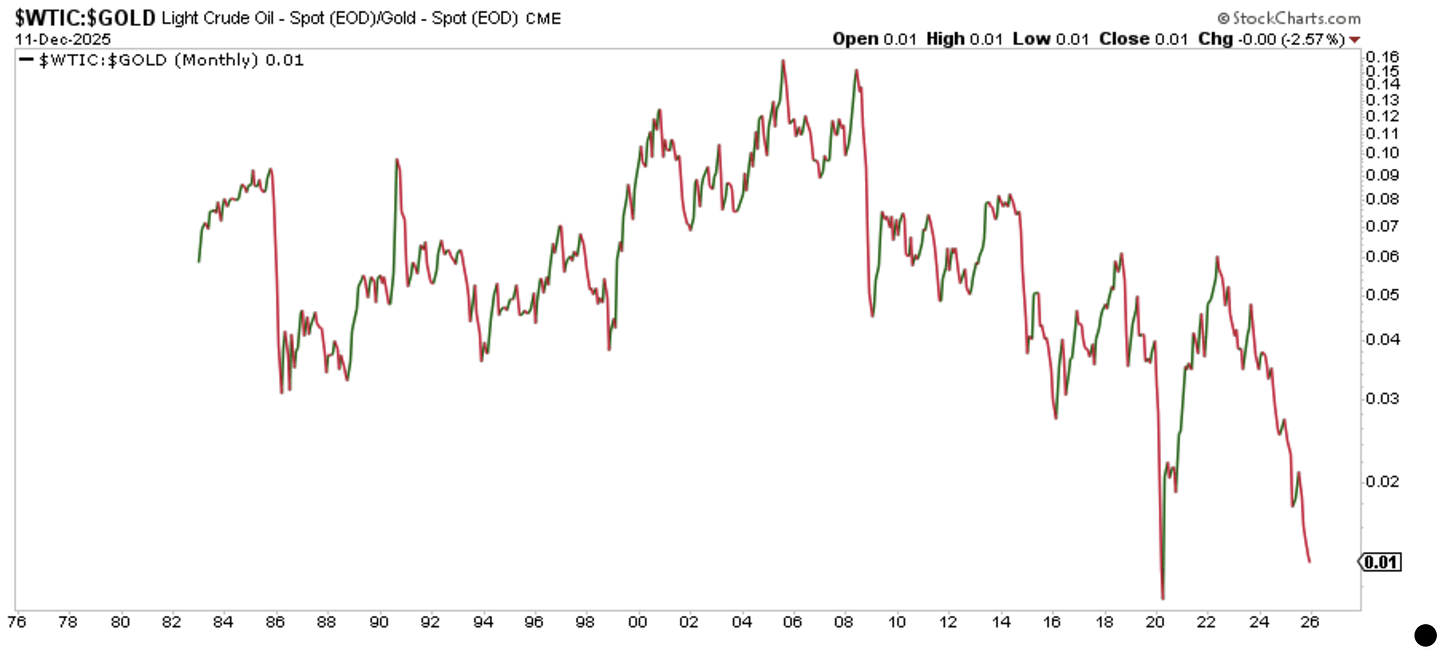

Now if you add gold to the mix...

You see something similar.

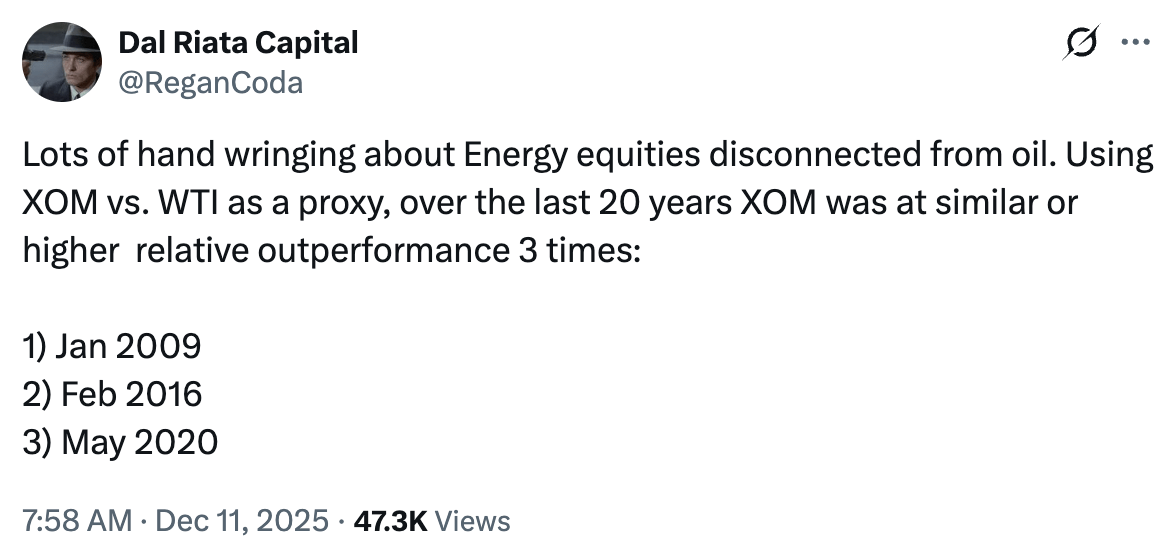

But it’s not just precious metals that are beating the pants off oil; energy stocks are also showing the same relative outperformance.

Dal Riata Capital on X posted an incredible tweet, which I will share below:

This prompted me to start looking at all of the relative outperformances, and here are some that caught my attention:

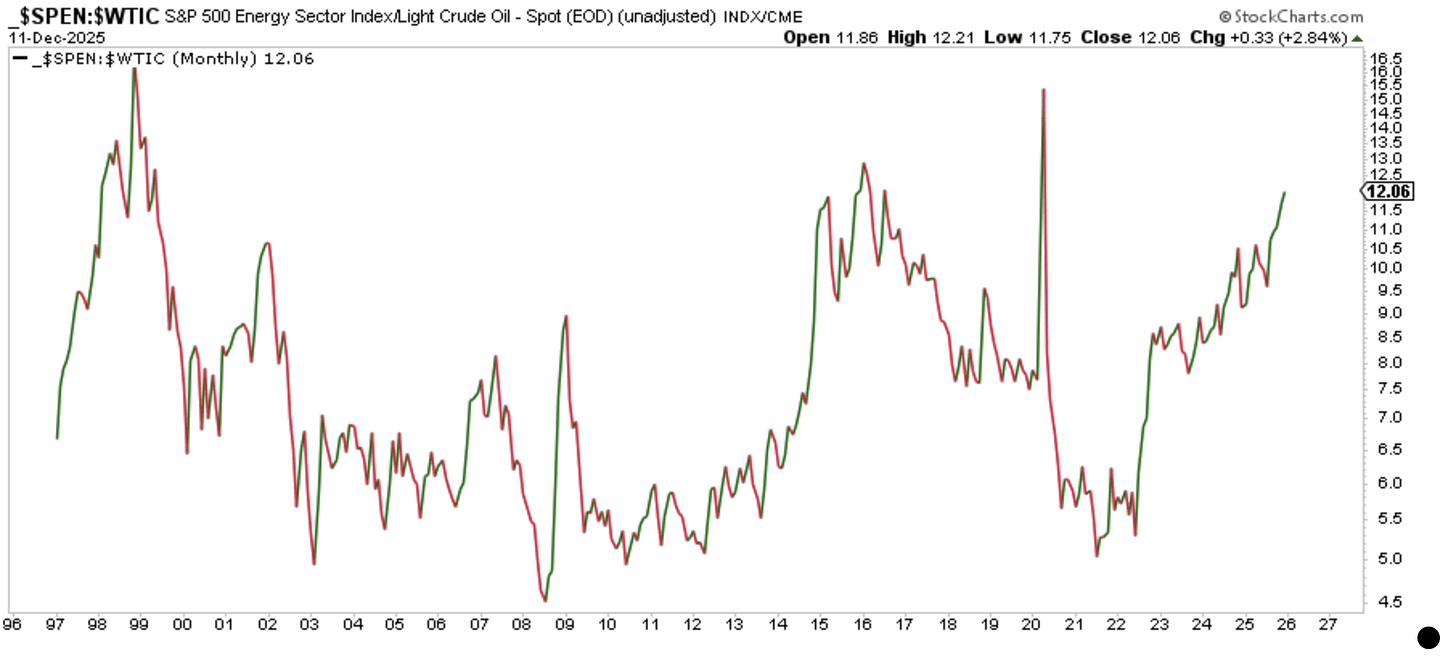

S&P Energy vs WTI

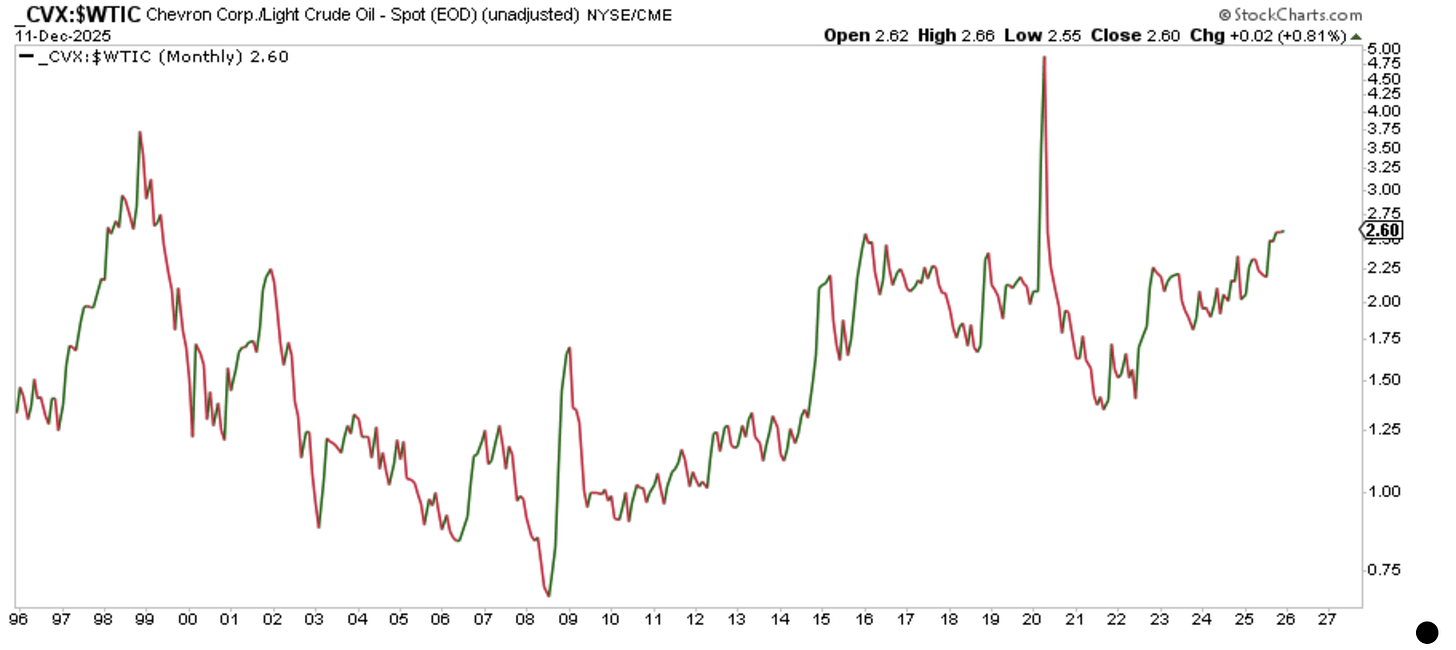

Chevron vs WTI

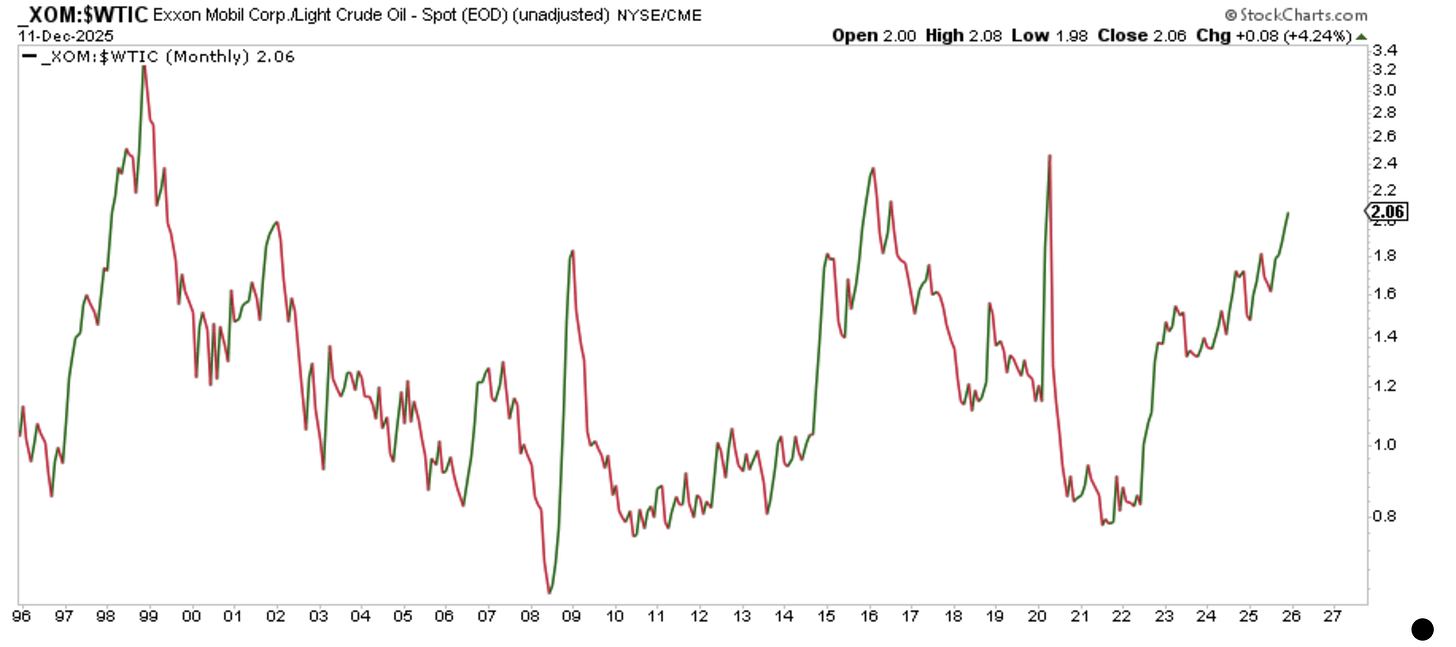

Exxon vs WTI

Now what you will notice is that the relative outperformance is rather substantial since 2022. This makes sense considering that WTI fell from $120+ to $58/bbl today. But simultaneously, we are seeing energy stocks outperform meaningfully on a relative basis. Some have suggested that such a strong outperformance is a sign that oil will reverse higher soon. And others have suggested that it could just be that energy stocks are overvalued.

Like all things in the markets, the observation that oil is cheap is valid, and the observation that energy stocks are expensive is also valid. We noted in our previous reports that some of the energy stocks now trade at low single-digit free cash flow yields. This is not a sign of “cheapness”, but the lack of weakness is also a sign that oil could be artificially depressed.

Interestingly enough, even with the broader energy complex outperforming oil, it has materially underperformed the S&P 500 since 2022.

Everything is relative at the end of the day.

Unsustainable

I don’t think anyone in their right mind would argue that WTI at $58/bbl is sustainable in the long run. Even the most bearish forecasters (cough cough, IEA) are projecting global oil demand to peak well past 2030. Meanwhile, we have the following catalysts on the horizon in 2026: