Oil Is Stuck In No-Man's Land... For Now

For oil bulls that expected oil prices to keep moving higher, the latest price action must feel a little demoralizing. Even in the face of a relatively bullish EIA oil report, oil prices remain stuck in no-man's land. But this doesn't come as a surprise to those that follow fundamentals closely. April oil market balances were never going to scream shortage, and the consensus, rightfully so, remains worried over macro issues and a possible global economic slowdown.

So will a ~2 million bbl draw in total liquids change this view? Most definitely not, and while it is my job to persuade you that the market may be wrong in the way it's looking at oil, it is also my job to tell you reality as is. Oil is going to be stuck in no-man's land for a while longer.

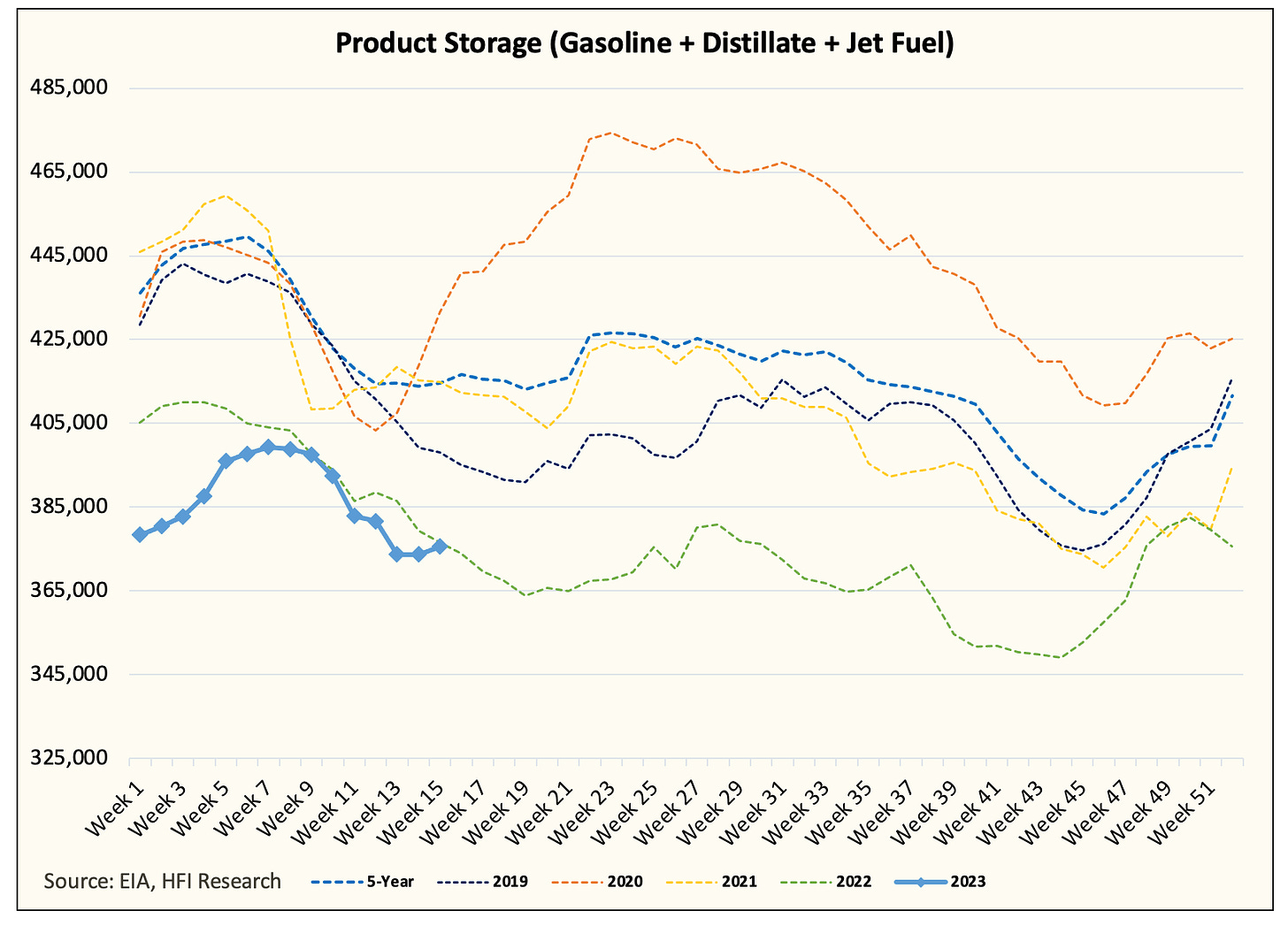

Looking at today's EIA oil report, the bearish variable was the build in product storage.

As we wrote in our US crude storage outlook report, the market only cares about product storage in the near term. A build in product storage translates into lower refining margin, which then translates into lower crude demand down the road. This is why despite the crude draw we saw in this report, oil prices are lower.

Now depending on which camp you are in (bull vs bear), we can argue both sides. Lower absolute product storage gives refineries room to increase throughput, so it's not bearish. But for bears, the build signals that higher refinery throughput would result in higher than expected seasonal builds in product, which would then translate to even lower refining margin, and thus, lower crude demand.

Both sides are correct in some ways, but more importantly, demand typically moves higher as we get through April. The bulls will be correct about the absolute inventory argument if demand increases. Similarly, if demand doesn't improve, then the bears will be correct about the higher relative builds.

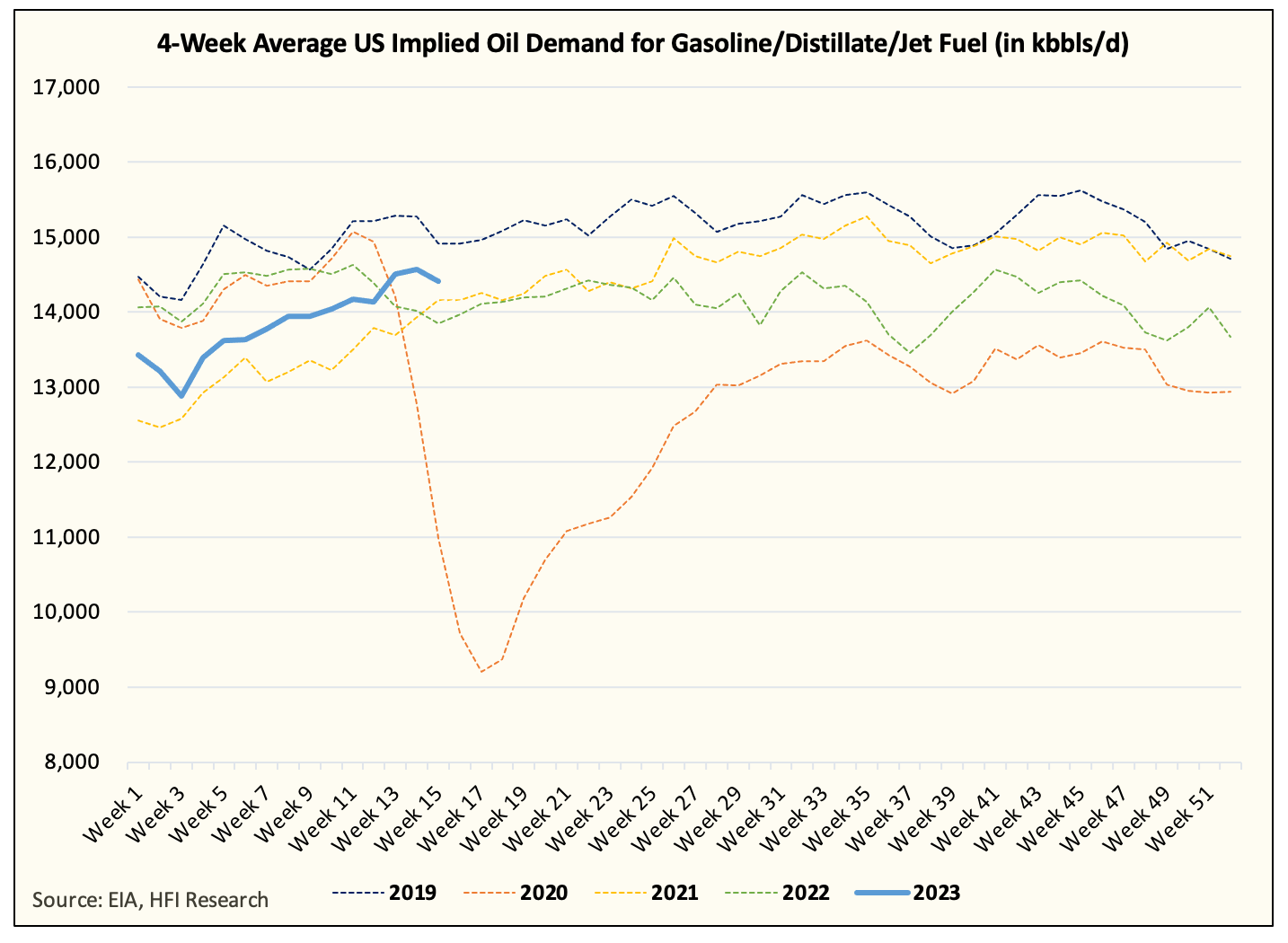

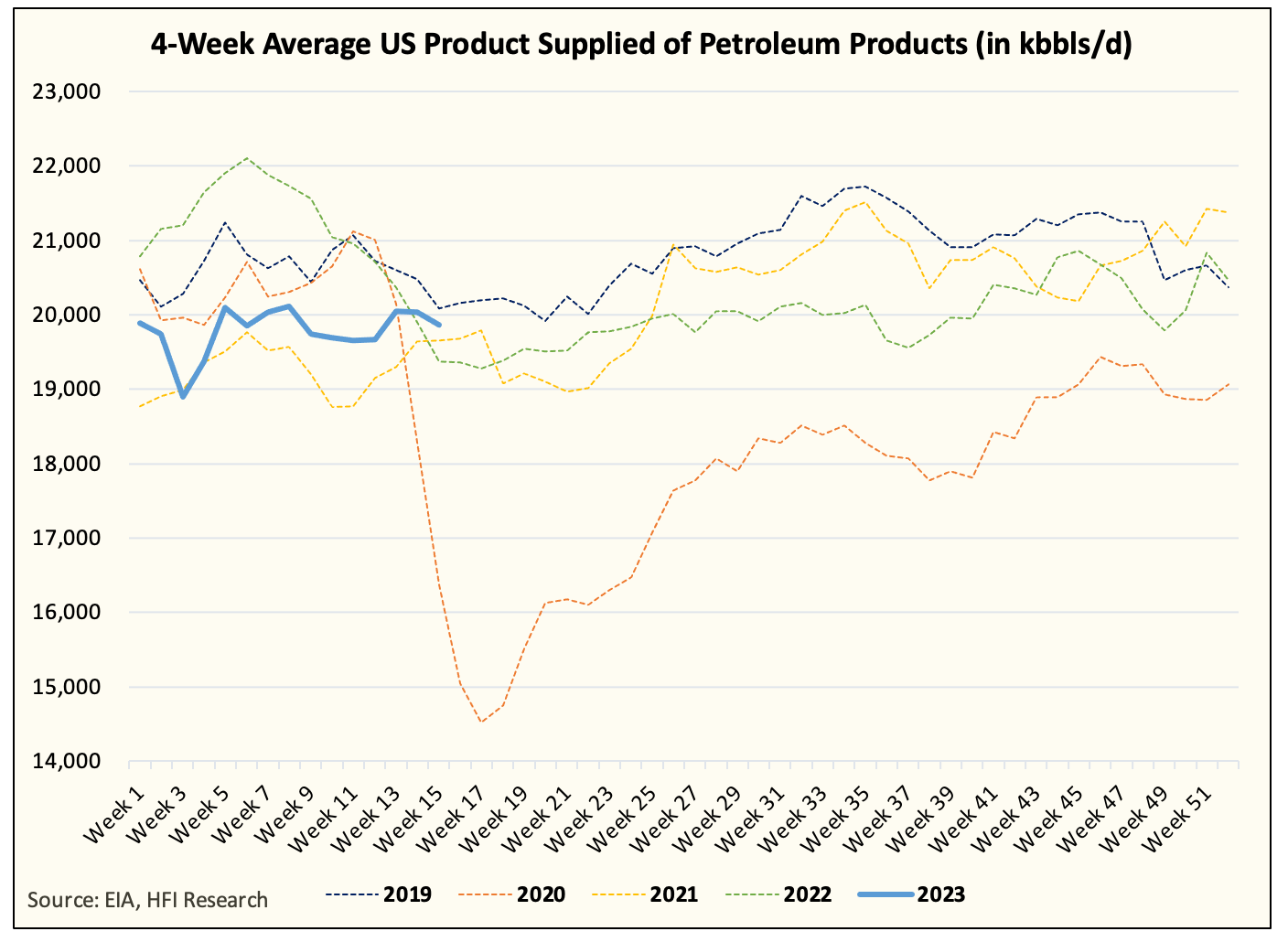

In my view, I think US oil demand this year is going to surprise to the upside. I think this report was a noisy one in that weather and seasonal elements disrupted what would have been a strong week. Looking at the velocity of the demand in gasoline and jet fuel, I think 2023 could see US oil demand hit an all-time high.

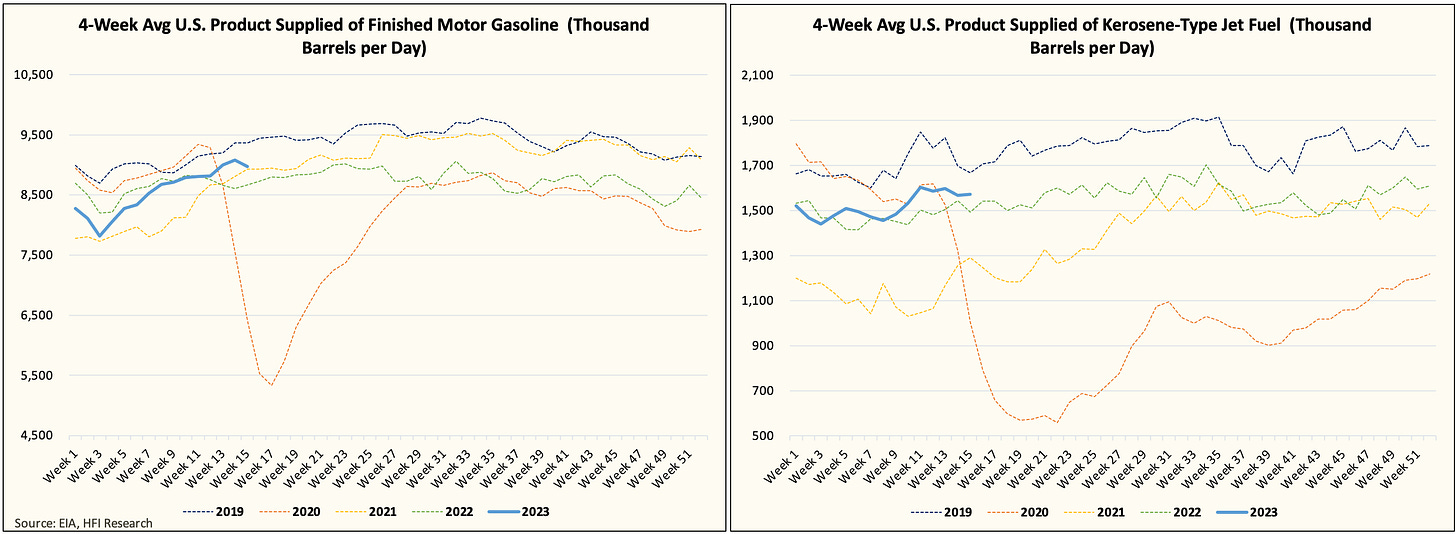

On the gasoline front, you can see that the velocity of change is already materially better than last year. Not to mention that gasoline prices are going to be significantly lower y-o-y.

And on the jet fuel front, international travel is picking up, and with bookings skyrocketing this summer, we expect jet fuel to at least get close to 2019.

Now if you circle this back to the total US implied oil demand, we think this year's demand is going to surpass 2023 because of gasoline and jet fuel.

Consider that even with one of the warmest winters on record, the US total implied oil demand is just a smidge below 2019. I think we can surpass the previous high.

Stuck in no-man's land for now...

But everything we wrote here takes time. It's not like the oil market will all of a sudden turn extremely bullish, and prices skyrocket to $100. April oil market balances will show a minor deficit, and nothing to materially move market sentiment. And for market participants, the additional OPEC+ cut won't kick in until May, so it's still a wait-and-see market.

All of this just adds up to the idea that we are going to be stuck in no-man's land for a while longer. But if our analysis is correct that US oil demand is going to surprise to the upside, then oil prices will break out of this no-man's land. We think even with macro worries ahead, the physical market can tighten to the extent where prices get back into the $90s.